Walmart Inc.’s executives on Thursday sounded cautiously optimistic and ready to pivot as needed to meet customer demand going into a year full of uncertainties.

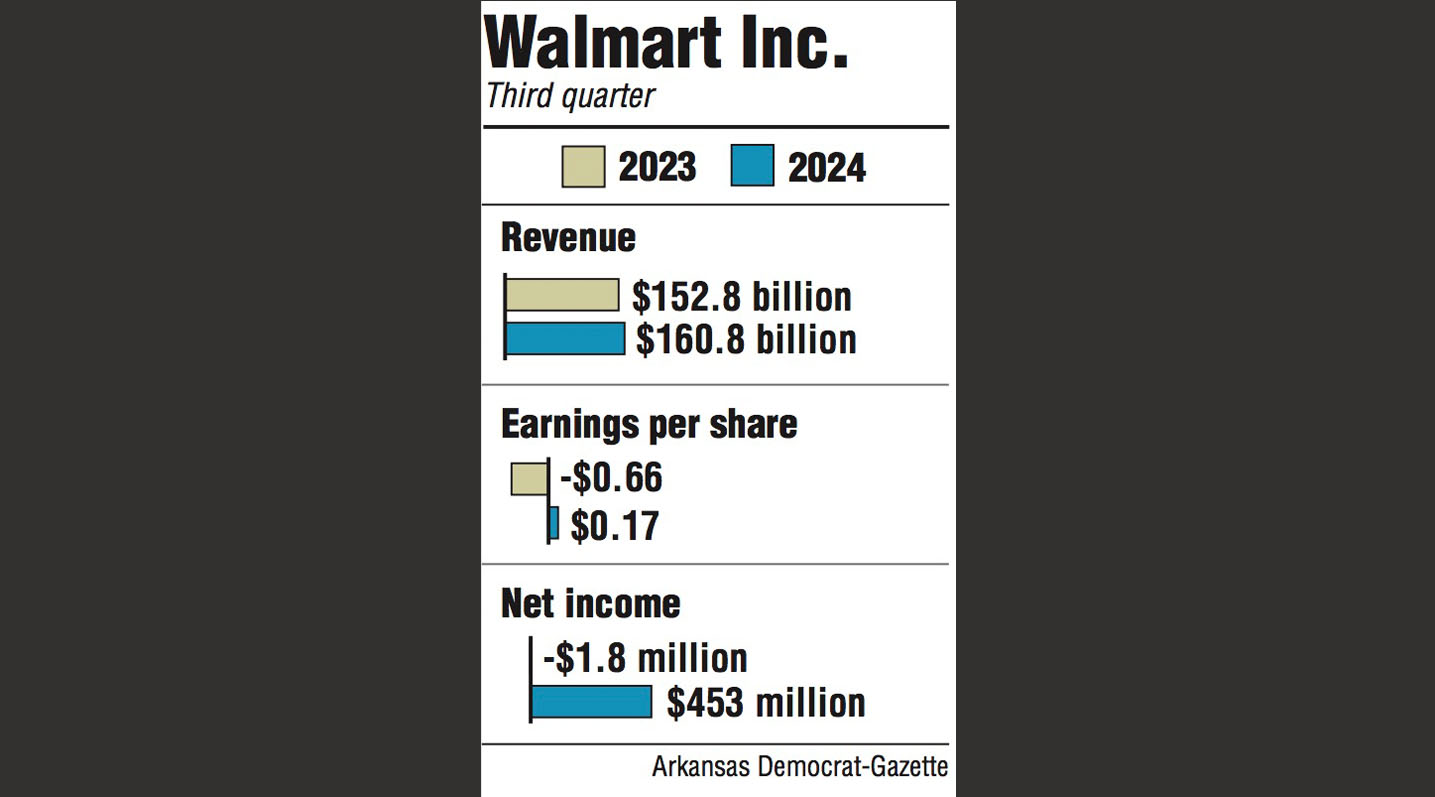

Despite a 5.2% gain in quarterly revenue, to $160.8 billion, they cited student loan debt repayment, possible deflation and political unrest overseas as a few of the headwinds the retailer might encounter in the fourth quarter and beyond.

Walmart posted net income of $453 million, or 17 cents per share, for the quarter that ended Oct. 31, compared with a net loss of $1.8 million, or 66 cents per share, in last year’s third quarter.

Walmart’s per-share earnings missed the average estimate of $1.52 from 29 analysts on Yahoo Finance. However, adjusting for losses on equity and other investments brings the earnings per share to $1.53.

Doug McMillon, Walmart’s president and chief executive officer, said in a conference call with retail analysts that the Bentonville-based retailer had strong revenue growth across segments for the quarter.

“Looking ahead, our inventory is in good shape” with discounts on toys, apparel, electronics and seasonal decorations, McMillon said. As the Christmas shopping season approaches, “the teams are focused, and our associates are ready to serve our customers and members whenever and however they want to be served.” Sales of general merchandise have languished while inflation has had consumers limit spending to necessities. But McMillon said prices of these goods, which include popular gift items such as toys, electronics and technology, are coming down.

“That allows us to roll back prices,” he said, which is important to families during the Christmas shopping season.

Walmart’s U.S. business may be managing through a period of deflation, or falling prices, in coming months, McMillon said. And while that would put pressure on the retailer to sell more units of goods, “we welcome it because it’s better for our customers.” Carol Spieckerman, a retail consultant and president of Spieckerman Retail, said Walmart likes to win, “and disproportionate increases in low-margin groceries and stagnation in more profitable general merchandise are ongoing frustrations” for them.

On a brighter note, Spieckerman said, “as inflation eases in general merchandise, Walmart can play a more aggressive pricing game over the holidays.” “Overall sales dollars may fall with deflation, yet Walmart may benefit from the perception boost across its business,” Spieckerman said. “Walmart may be in for a positive holiday surprise.” After days of big gains and hitting a record high of $169.94 on Wednesday, Walmart’s shares dropped 8.1%, or $13.74 on Thursday to close at $156.04 on the New York Stock Exchange. Its shares have traded between $136.09 and $169.94 in the past year.

Walmart released its earnings report before the U.S. markets opened.

“Given Walmart’s results, Wall Street’s initial reaction seems extreme,” Spieckerman said.

Brian Yarbrough, a retail analyst with financial services firm Edward Jones, said Walmart had a solid quarter. But expectations were high in the run-up to the earnings report, he said, and Walmart’s adjusted earnings came in just slightly above those expectations.

“When your stock is priced for perfection, these are the kinds of results you’re going to see,” Yarbrough said.

All retailers are nervous heading into this year’s Christmas shopping season, he said.

“During covid, everyone was buying goods, but now it’s travel and entertainment,” Yarbrough said. The economy has gone from pandemic mode to inflation, he said, plus student loan repayments have begun again and any savings from covid funds have dried up.

“There’s just a lot of headwinds for the consumer,” Yarbrough said. And retailers are watching the financial health of consumers and planning cautiously, he said.

Spieckerman has a different view.

“The tone of Walmart’s report was subdued, yet I don’t attribute that to worry or extreme caution,” Spieckerman said. “Walmart is clearly playing a long game, investing now in technologies and upgrades that will pay off over time.” In third-quarter results by unit, Walmart’s U.S. division, by far its largest, posted net sales of $109.4 billion, up 4.4% from the same period a year ago. Grocery and the health and wellness category led those sales, while general merchandise sales declined “modestly,” the company said.

Sales at stores open at least a year, excluding fuel, increased 4.9%. These sales, also called same-store sales or comp sales, are considered a key indicator of a retailer’s health.

Comp sales were also led by grocery and health and wellness.

At Walmart Connect, the retailer’s advertising business, sales rose 26%. And the unit’s e-commerce net sales grew 24%, driven by strength in pickup and delivery.

“Once again, Walmart touted its diversification into high-margin, non-product solutions and services as a major focus,” Spieckerman said. “The 26% growth in its ad arm, Walmart Connect, and continued growth in marketplace seller onboarding attest to the momentum.” “The bottom line is that Walmart is no longer just a place that sells products,” Spieckerman said. “Walmart’s confidence in its long-term prospects stems from the business model shifts and investments it is making right now.” “As Walmart looks at its business through new lenses, hand-wringing over seasonal results and short-term category misfires will naturally lessen,” Spieckerman said.

Walmart International’s net sales jumped 10.8% to $28 billion. In constant currency, the division’s net sales gained 5.4% to $26.7 billion. Investopedia defines constant currency as an exchange rate used to eliminate the effect of fluctuations when calculating financial performance numbers for financial statements.

The unit’s e-commerce sales declined 3%. Both overall and e-commerce sales growth took a hit from the timing of Flipkart’s Big Billion Days event, which moved from the third quarter last year to the fourth quarter this year.

Walmart de Mexico y Centroamerica led in international sales. The business known as Walmex reported net sales in constant currency rose 9.4% to $10.6 billion.

Walmex’s comp sales grew 8%, driven by sales at its popular Bodega format and Sam’s Club.

Walmex’s e-commerce sales climbed 16%.

Canada came in second in international sales growth, posting net sales of $5.8 billion in constant currency, up 5.3%. China’s net sales in constant currency jumped 25.3% to $4.5 billion.

At Sam’s Club, Walmart’s warehouse club division, net same-store sales including fuel inched up 2.8%, while those excluding fuel rose 3.2%.

Home delivery and curbside pickup helped Sam’s Club’s e-commerce net sales grow 16%. Its membership income increased 7.2% as the number of members reached a new high.

John David Rainey, Walmart’s chief financial officer, said shareholders bought back 700,000 shares of company stock at an average price of $159.77 a share, for a total of $111 million.

A replay and transcript of Thursday’s presentation and conference call with investors are available at Walmart’s corporate website by logging into https://corporate.walmart.com/news/events/fy2024-q3-earnings-release and selecting Watch the Replay.