Fueled by a surge in sales and use tax collections, Arkansas' general revenue collections in February increased by $44 million, or 8.3%, over the same month a year ago to $572.4 million.

Last month's general revenues beat the state's forecast by $58.3 million, or 11.3%, the state Department of Finance and Administration reported Wednesday in its monthly revenue forecast.

February's total general revenue is the largest amount collected in any February, outdistancing the previous record of $528.5 million in February 2022, said Steve Wilkins, a tax analyst for the finance department.

Asked what the February revenue report shows about the state of Arkansas' economy, the state's chief economic forecaster, John Shelnutt, said Wednesday "it shows we are not slowing down at this point and we can't attribute this kind of gain to just inflation or retained savings from the [federal] stimulus programs.

"It's real growth in the economy that relates to what we are seeing in the labor markets," he said in an interview.

Larry Walther, secretary for the finance department, said Wednesday that revenue growth was above expectations again in February and that demonstrates continued economic growth in Arkansas.

"Additionally, tax refunds are on track with the forecast as we enter the busiest months for filing," he said in a written statement.

The state's individual and corporate income tax filing deadlines are April 18, according to finance department spokesman Scott Hardin.

Tax refunds and some special government expenditures are taken off the top of total general revenue collections, leaving a net amount that state agencies are allowed to spend up to the amount authorized by the state's Revenue Stabilization Act.

The state's net tax revenue in February dropped by $4.6 million, or 1.1%, over the same month a year ago to $402.1 million and exceeded the state's Nov. 10 forecast by $55 million, or 16%.

February is the eighth month of fiscal year 2023, which started July 1, 2022, and ends June 30.

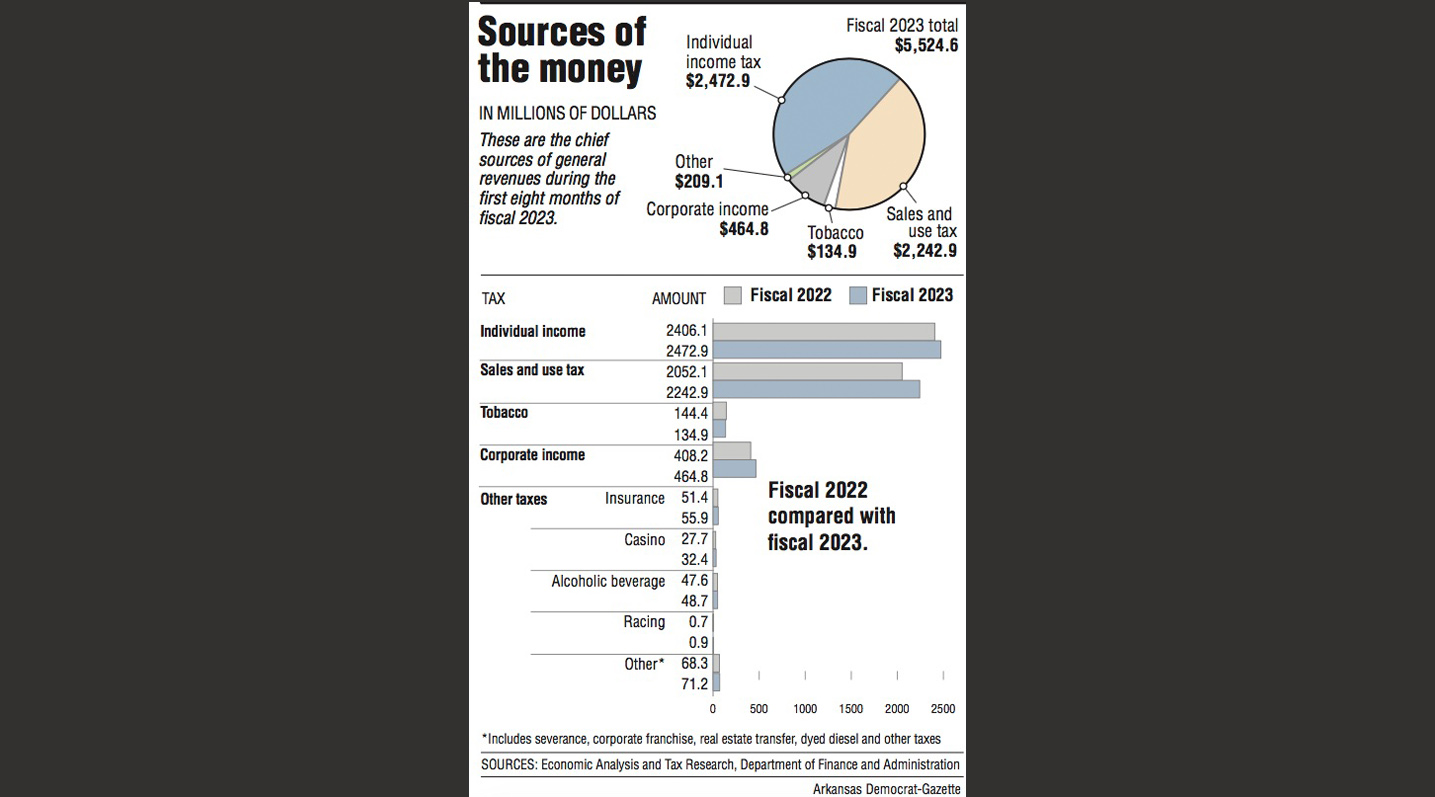

During the first eight months of fiscal 2023, the state's total general revenue increased by $318.2 million, or 6.1%, over the same period in fiscal 2022 to $5.5 billion and beat the state's forecast by $262.7 million, or 5%.

So far in fiscal 2023, the state's net general revenue increased by $201.4 million, or 4.4%, over the same period in fiscal 2022 to $4.7 billion and outdistanced the state's forecast by 250.2 million, or 5.6%.

In the fiscal session last spring, the General Assembly and then-Gov. Asa Hutchinson authorized a general revenue budget of $6.02 billion for fiscal 2023 -- up by $175.1 million from fiscal year 2022's general revenue budget, with most of the increases for public schools and human service programs.

The finance department's Nov. 10 forecast projects a general revenue surplus of $598.1 million at the end of fiscal 2023.

Shelnutt said Wednesday that "we are tracking above that by $250 million, so I am not prepared to put a new number out there [for a projected general revenue surplus], but it seems unlikely that we are going to burn through $250 million above forecast, given the provisions that we have for high refund claims coming up and a very low growth in sales tax over the remaining months."

In the Aug. 9-11 special session, the Legislature and Hutchinson enacted a four-pronged tax cut package that the finance department projected would reduce state general revenue by $500.1 million in fiscal 2023, by $166.6 million more in fiscal 2024, by $69.5 million more in fiscal 2025, by $18.4 million more in fiscal 2026 and by $8.4 million more in fiscal 2027.

The tax cut package accelerated the reduction of the state's top individual income tax rate from 5.5% to 4.9%, retroactive to Jan. 1, 2022, and accelerated the cut in the state's top corporate income tax rate from 5.9% to 5.3%, effective Jan. 1, 2023.

The package also granted a temporary, nonrefundable income tax credit of $150 for individual taxpayers with net income up to $87,000 and of $300 for married taxpayers filing jointly with net income up to $174,0000, and adopts a federal depreciation schedule for businesses.

The special session in August was held after the state reported accumulating a record general revenue surplus of $1.628 billion in fiscal 2022 that ended June 30, 2022.

In fiscal 2021 that ended June 30, 2021, the state reported collecting a $945.7 million general revenue surplus.

Prior to fiscal 2021, the state's largest general revenue surplus was $409.3 million in fiscal 2007, when Republican Mike Huckabee was governor for the first part of the fiscal year and Democrat Mike Beebe was governor for the second part of fiscal 2007.

In November, Hutchinson proposed a $314 million increase in the state's general revenue budget to $6.33 billion in fiscal 2024, starting July 1, 2023, with $200 million of the increased general revenue earmarked for public schools to help boost teachers' salaries.

At that time, he said his proposed budget for fiscal 2024 would represent a 5.2% increase over the current budget of $6.02 billion, leaving a projected general revenue surplus of $254.9 million at the end of fiscal year 2024. Considering inflation was more than 8% last year, limiting the growth of the state's general revenue budget to 5.2% reflects conservative budgeting in these challenging times, he said.

During this year's regular session, legislative leaders and Gov. Sarah Huckabee Sanders haven't yet proposed a general revenue budget for fiscal 2024, which begins July 1, 2023, and ends June 30,2024.

Today is the 54th day of the regular session.

FEBRUARY'S COLLECTIONS

According to the finance department, February's general revenue collections included:

A $29.9 million, or 13.1%, increase in sales and use taxes over a year ago to $258.1 million, beating the state's forecast by $27 million, or 11.7%.

Most major reporting sectors of sales tax displayed high growth over the same month a year ago, reflecting continuing economic expansion in many sectors.

Sales tax collections in retail trade increased last month by 11.4% over the same month a year ago to $92.8 million, and sales tax collections from accommodation and food services, including restaurants, increased by 15.6% over the same month a year ago to $22.1 million.

Major vehicle sales tax collections increased by 11.6% over a year ago to $28.9 million.

A $2.1 million, or 0.8%, dip in individual income tax collections from a year ago to $262.7 million, exceeding the state's forecast by $13.9 million, or 5.6%.

Individual withholding tax revenue is the largest category of individual income tax collections.

Withholding tax revenue declined by $3 million, or 1.2%, compared to a year ago to $241.6 million, but exceeded the state's forecast by $5.6 million. The withholding tax revenue dipped because of the lower withholding rates tied to the recent tax reduction.

Collections from returns and extensions increased by $0.8 million over a year ago to $15 million, which outdistanced the state's forecast by $6.1 million.

Collections from estimated payments increased by $0.1 million from a year ago to $6.1 million, beating the state's forecast by $2.2 million.

A $14.1 million, or 199.9%, increase in corporate income tax collections over a year ago to $21.1 million, exceeding the state's forecast by $15.6 million, or 284.2%.

The increased collections reflect higher extension and return payments compared to a year ago.