Voters in Harrison will head to the polls Nov. 12 to decide whether to approve two sales tax increases to fund a proposed $39.9 million recreational and aquatic center.

"It's long overdue," said Mayor Jerry Jackson. "It provides economic development, recruitment of professional people and health care people, and most importantly quality of life, wellness and health of the community."

Jackson said Harrison officials studied 10 similar projects, including one in Batesville.

"It's done wonders for that whole town, in wellness, in economic development, in recruitment of doctors," he said.

Jackson said small cities have trouble recruiting doctors but that recreational facilities help with that.

Jackson said the center would have "something for everyone," regardless of age.

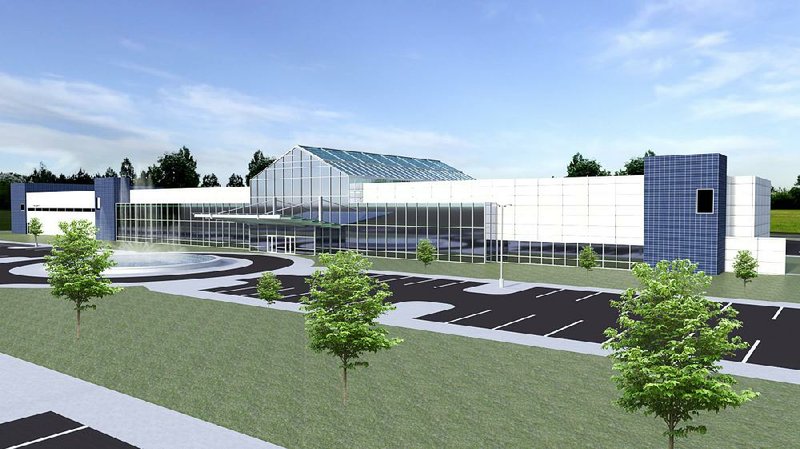

The proposed facility was designed by ETC Engineers & Architects Inc. of Little Rock.

It would include three indoor swimming pools (competition, therapeutic and play pools), in addition to outdoor pools and a splash pad, according to a brochure from Doug Harvey of ETC.

The center would have an indoor track, conference rooms, basketball courts, a fitness room and banquet facilities, according to the brochure.

Jackson said there would be space for concerts that could accommodate a crowd of 3,000.

He said the proposal includes a 3.5-mile trail from Lake Harrison to the complex.

"There will be a monthly fee, and we haven't set that yet," Jackson said. "It's going to be minimal for individuals and families, and there will also be a [lower] fee for low-income [residents]."

Jackson said a 0.75% sales tax would pay for construction of the facility. That tax would sunset when the bonds are paid off, he said.

Another 0.25% sales tax would be permanent and would pay for maintenance and operation of the facility, said the mayor. He said that tax would raise about $1.2 million per year.

"We want this facility 20 years from now to appear brand new," Jackson said. "That quarter-percent will pay for that."

If the 0.75% tax passed and the other one failed, then the election would be voided because there would be no money to maintain the community center, said Jackson.

If the 0.25% tax passed and the other one failed, then that tax would be put in place and the revenue from it would go to the city's Parks and Recreation Department, he said.

The city found a site on Gipson Road and has 40 acres there under contract for $545,000, the mayor said.

Metro on 09/02/2019