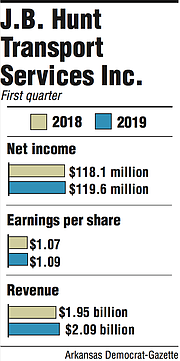

J.B. Hunt Transport Services Inc. on Monday reported net income of $119.6 million for the first quarter, up slightly from the same quarter a year ago.

The Lowell-based company reported per-share earnings of $1.09, compared with $1.07 a year ago, and revenue of $2.09 billion, up from $1.95 billion.

Both of those results fell short of expectations at Zacks Investment Research, where the average estimates of analysts were per-share earnings of $1.25 and revenue of $2.2 billion, according to The Associated Press. Analysts polled by the financial-data company FactSet had also expected earnings of $1.25 per share on revenue of $2.2 billion.

Gains from higher customer rates and new customers were offset by several factors, including higher costs related to rail transportation; lower productivity in the Midwest during a harsh winter season of storms, blizzards and flooding; and higher wages, salaries and benefits, the company said.

J.B. Intermodal reported first-quarter revenue of $1.09 billion, up 2 percent. Load volumes decreased across the board.

"Volumes were affected by the expected rail lane closures and persistent severe winter weather events impacting Chicago operations," the company said, adding that those events contributed to about half of the load losses.

The company's dedicated contract services segment reported $602 million in revenue, up 22 percent, and $50 million in operating income, up 24 percent from a year ago.

Revenue per truck increased 6 percent. A net 1,644 revenue-producing trucks were added to the fleet by the end of the quarter compared with a year ago.

The company's integrated capacity solutions segment reported first-quarter revenue of $301 million, up 2 percent, and operating income of $7 million, down 22 percent.

The trucking segment reported first-quarter revenue of $102 million, up 10 percent, and operating income of $7 million, up 41 percent.

"Benefits from the higher revenue per load and lower equipment ownership costs were partially offset by higher driver and independent contractor costs per mile and higher recruiting costs," the company said.

J.B. Hunt shares fell $1.18, or 1 percent, to close Monday at $105.50 before the earnings report was released. The shares fell further in after-hours trading, dropping more than 5 percent as of Monday evening. The shares had climbed 13 percent since the beginning of the year.

A replay of the company's Monday afternoon conference call with analysts will be posted at jbhunt.com.

Business on 04/16/2019