NEW YORK - The stock market rose Thursday after a pair of lackluster economic reports convinced traders that the U.S. central bank’s stimulus program will continue to help the economy.

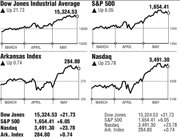

The Dow closed up 21.73 points, or 0.1 percent, at 15,324.53 points. The Nasdaq composite index rose 23.78 points, or 0.7 percent, to 3,491.30.

Three stocks rose for every two that fell on the New York Stock Exchange. Consolidated volume was average at 3.5 billion shares.

Unemployment claims rose and an initial estimate of first quarter economic growth was revised slightly lower Thursday. That suggests the U.S. economy may still need some time to recover from its funk and that the Fed will keep up its $85 billion in monthly bond purchases.

“The big worry that’s been hitting the market lately, that the Fed might step back prematurely, might be fading a little today on the idea that the economy does need a bit more support,” Jeff Kleintop, chief market strategist at LPL Financial, said.

A rise in the Standard & Poor’s 500 index was led by banking and insurance stocks, which gained 1.1 percent. Among individual bank stocks, Bank of America rose 35 cents, or 2.6 percent, to $13.87. The stock is trading at its highest in more than two years. JPMorgan gained 95 cents, or 1.7 percent, to $55.62.

The S&P 500 rose in early trading, climbing as much as 13.6 points, or 0.8 percent, by late afternoon. The index then gave up some of the gains in the last hour of trading to close just 6.05 points higher, or 0.4 percent, at 1,654.41.

Banks and other stocks that stand to benefit the most from an improving economy have surged this week, a change from earlier in the year when investors favored dividend-rich stocks like utilities. Now investors are selling dividend-rich stocks and buying so-called growth stocks. The S&P’s financial index is up 2.1 percent this week, and its utilities index is down 2.5 percent.

Stocks also got a boost from deal news.

NV Energy surged $4.34, or 23 percent, to $23.62, leading a broad advance in utility companies. Berkshire Hathaway’s MidAmerican Energy utility said Wednesday that it will buy the Nevada electric and natural-gas company for $5.6 billion. Clearwire, a wireless network operator, surged $1.02 , or 29 percent, to $4.50 after satellite TV operator Dish Network raised its bid for the company to $6.9 billion.

In economic news, the number of Americans seeking unemployment aid rose 10,000 last week to 354,000, a sign layoffs have increased, the Labor Department said Thursday.

The government also lowered its estimate for U.S. economic growth in the first three months of the year to 2.4 percent from 2.5 percent.

Trading has been choppy on Wall Street this week as investors wrestle with the question of whether the Fed will ease its economic stimulus. Minutes released last week from the Fed’s last policy meeting showed that some central bank officials favored slowing the purchases as early as next month, if the economy improves enough.

The Dow Jones industrial average rose 106 points Tuesday, then fell by the same amount Wednesday, leading some market watchers to ask whether the rally that has pushed the Dow and S&P 500 index to record levels may be fizzling out.

Stock investors have had a good year. The Dow is 16.9 percent higher and has set record closing highs on nine days in May. The S&P 500 index is up 16 percent and is on track to rise for a seventh straight month, its longest winning streak since 2009.

In commodities trading, oil rose 48 cents to $93.61 a barrel. Gold rose $20.20, or 1.5 percent, to $1,411.50 an ounce. The dollar fell against the euro and the Japanese yen.

In government bond trading, the yield on the 10-year note was unchanged at 2.12 percent.

Business, Pages 32 on 05/31/2013