Several state treasurer’s office employees teared up this week when Gov. Mike Beebe stopped by and offered them his support after their boss’s arrest and subsequent resignation.

“I don’t know whether it was thankfulness for somebody kind of putting their arm around them or whether it was just the whole issue foaming up and causing an emotional reaction,” Beebe told reporters Friday. “Several appeared very emotional.

“I just told them that I know that they have been through a tough time and that I was there for them and they were professionals and that they needed to do their job and know I am available if they need me in the interim until a new treasurer is named and that all they had to do was call on me,” he said.

Beebe said he met briefly Wednesday with almost all of the treasurer’s office employees in a conference room in the Victory Building east of the state Capitol in Little Rock. The treasurer has offices in both the Victory Building and the state Capitol.

The governor “made everybody feel better, and I thought it was first class all the way,” said the treasurer’s investment manager, Hunter Johnson.

The treasurer’s office has27 employees, said chief deputy treasurer Debbie Rogers, who has worked in the treasurer’s office for more than 28 years. She is a sister of former state Treasurer Jimmie Lou Fisher, who served in the post from 1981-2003.

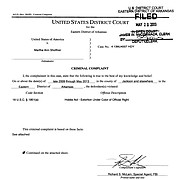

Martha Shoffner resigned as treasurer Tuesday amid bipartisan calls for her exit - a day after a complaint was filed in federal court. The complaint alleged that since 2009, she had accepted cash payments of at least $6,000 from an unnamed bond broker in return for directing the lion’s share of state bond business to him. The complaint also said an FBI informant secretly recorded her taking $6,000 in cash hidden in a pie box.

Shoffner plans to plead innocent to the charges, according to her attorney, Chuck Banks of Little Rock.

Bond broker Steele Stephens resigned Tuesday from his job with St. Bernard Financial Services without citing a reason for his departure, said Robert Keenan, chief executive officer for the Russellville-based company.

The treasurer’s office purchased $1.69 billion in bonds from Stephens from May 2008-May 2009 when he worked for Apple Tree Investments and since June 2009 while he worked at St. Bernard Financial Services - almost double what the office purchased from any other broker - the Legislative Audit Division reported in December. St. Bernard has been paid more than $2.3 million in commissions on bond transactions involving the state treasurer’s office during the past few years, a legislative auditor estimated.

On Wednesday, Rogers said the treasurer’s office is permanently suspending doing additional business with St. Bernard Financial Services.

Rogers said Friday that the charges filed against Shoffner and Shoffner’s resignation have triggered “a range of emotions, mad, sad, happy” in her.

“I hope and pray that I don’t [get caught up in the legal proceedings against Shoffner], but at this point I don’t see that I will,” she said.

Rogers said her main goal has been making sure that the office’s employees carry out their responsibilities to the best of their abilities, managing more than $3 billion in state investments.

“We don’t know what the future is going to hold and what the new treasurer will want, but we certainly are all here and will be available for what the new treasurer would want from us,” she said.

Beebe said “logistics” prevent him from naming Shoffner’s replacement until Wednesday; his prospective appointee is on a trip elsewhere.

He said he has no plans to change his mind about his appointee.

State Bank Commissioner Candace Franks said she has not expressed an interest in being appointed state treasurer.

“I love what I do. I have a wonderful job,” she said.

Franks’ predecessor - Robert “Bunny” Adcock of Conway - has said he would accept an appointment as state treasurer, but he didn’t get an offer from Beebe to do that.

The treasurer’s chief investment officer, Autumn Sanson, said Friday that she appreciated that Beebe talked to the office’s employees.

“It just boosts morale, lets us know that he is thinking about us and that he keeps us in mind with the potential person that he is wanting to put in office,” said Sanson, who has worked in the state treasurer’s office since January 2001 under the administrations of Fisher, Gus Wingfield and Shoffner.

Sanson, at one point last fall, had said she feared for her job in that office.

During a legislative hearing in September, Shoffner had said she couldn’t recall why her office sold bonds from its investment portfolio before their maturity dates and purchased similar bonds from the same brokers - transactions that auditors said resulted in the state losing out on earnings of several hundred thousand dollars.

Sanson testified at that hearing that she had advised Shoffner against selling the bonds before they matured, a claim Shoffner quickly denied. At one point, Sanson asked lawmakers for protection under the state’s whistle-blower law because she feared for her job.

During a legislative hearing in December, Shoffner said that her office “didn’t consciously show preference” to St. Bernard Financial Services. But Sanson told lawmakers that Shoffner instructed her to do more business with that firm.

Asked about her reaction to the charges filed against Shoffner and Shoffner’s resignation, Sanson said Friday that “personally I am disappointed with what happened, but it’s probably been a relief to me.

“I am disappointed that it had to come to this, and I am not implying that the Legislature didn’t do [its job],” she said.

The Legislative Joint Auditing Committee “did all that they possibly could to try to figure out what was going on,” Sanson said.

“I still don’t think it was right that we were sending so much [business to St. Bernard Financial Services], and it was obviously a red flag,”she said.

Rogers said the treasurer’s office’s investments through St. Bernard decreased by $180 million from September to December of 2012 as a result of the Legislative Audit Division and Legislative Joint Auditing Committee’s concerns about the amount of bond business given to St. Bernard.

The treasurer’s office purchased $310 million of its $1.899 billion in existing bond investments through St. Bernard Financial Services, according to figures released by the treasurer’s office this week.

In contrast, the office had purchased $518 million of its $1.68 billion in bond investments through St. Bernard Financial Services as of late October 2011, according to the office’s records.

Rogers said the treasurer’s office made its last bond purchase through St. Bernard Financial Services on Dec. 20.

“That was my position on it, that we absolutely stop,”said Sanson. She said Shoffner didn’t say much to her about that.

The last bond purchase through St. Bernard on Dec. 20 was six days after the Legislative Joint Auditing Committee decided to ask law enforcement agencies to review the state treasurer’s office decisions.

Auditors found that eight of the bond transactions involving St. Bernard Financial Services Inc. of Russellville resulted in the state losing out on earnings of $783,835. Keenan disagreed with the auditors’ calculations.

Now, “we go through every offer we get and then we pick the most competitive [one],” said Johnson, the investment manager who has worked in the treasurer’s office since Dec. 10 and previously was an investment officer and treasury manager of Red River Bank in Alexandria, La.

“We haven’t been having any problem.”

Front Section, Pages 1 on 05/25/2013