Home sales in Arkansas dropped 3.4 percent in March, the Arkansas Realtors Association reported.

March's decline was the biggest drop in 44 months, since it also fell 3.4 percent in August 2014.

But the reason for the fall was attributed to the fact that March sales a year ago were so strong, Michael Pakko, chief economist at the Arkansas Economic Development Institute at the University of Arkansas at Little Rock, said Friday.

Home sales were up 16 percent in March 2017 from the previous year, Pakko said.

"So the monthly figures from March [this year] are deceptively weak because of the comparison to last year," Pakko said.

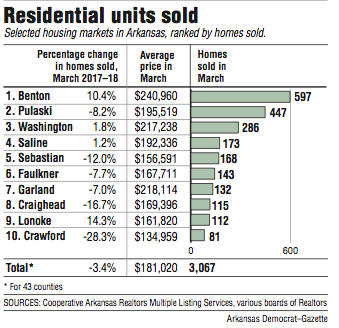

There were 3,067 homes sold in the state in March.

In Benton County, 597 homes were sold in March, 150 more than were sold in Pulaski County, the association said. Washington County had the third-most sales in March at 286.

The average home price in the state in March was $181,020, an increase of 7.2 percent compared with March last year.

Fewer homes are being built in Arkansas, said Mervin Jebaraj, director of the Center for Business and Economic Research at the University of Arkansas, Fayetteville.

"As a result, prices are climbing because there are a lot more people competing for the same number of houses," Jebaraj said.

The problem is national as well as in Arkansas, Jebaraj said.

In Northwest Arkansas, some cities are making small changes to their zoning laws, Jebaraj said.

"But it is not anything at the scale that needs to be done to address the need for more housing at affordable prices," Jebaraj said.

One need is to change zoning laws for areas near commercial thoroughfares so people can live closer to amenities like bars, restaurants and trails, Jebaraj said.

"Even in the more residential neighborhoods, consider the ones that are closer to the main streets need to be zoned to allow more houses per acre," Jebaraj said.

For the first quarter of 2018, home sales in Arkansas totaled 7,502, up 2.3 percent. There were 2,307 homes sold in February, up 9.1 percent.

"We're still seeing home sales rising as far as the trend goes," Pakko said.

Pakko said his forecast for home sales for this year depends on mortgage rates.

"My forecasting model has shown that there is still some demand overhang and that there is room for expansion in 2018 and we should expect another relatively strong year for growth," Pakko said. "Although that could show some signs of weakening later in the year."

Interest rates are trending upward, said Scott McElmurry, chief executive officer of Bank of Little Rock Mortgage, one of the larger mortgage lenders in the state.

The interest rates for conventional 30-year mortgages is about 4.5 percent to the upper 4 percent range, McElmurry said.

The rate for a conventional 15-year loan is in the low 4 percent range, he said.

For government-backed loans, the rate for a 30-year mortgage is in the mid-to-lower 4 percent range, McElmurry said.

The first quarter was about the same this year for Bank of Little Rock Mortgage as last year, McElmurry said.

From a national perspective, to have healthy home sales, markets need to have about six months of housing inventory, McElmurry said.

"Nationwide we're seeing that number under six months," McElmurry said. "In our markets, we're seeing inventory of five months and even below five months, which is concerning a little bit."

Owners seem to be recognizing that and may be starting to put their houses on the market, McElmurry said.

"That doesn't bode well for the housing market in general, unless that corrects itself from a national standpoint," he said.

Business on 05/05/2018