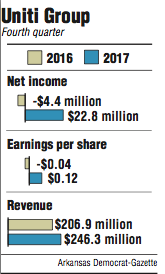

Uniti Group earned $22.8 million in the fourth quarter, the equivalent of 12 cents a share, the Little Rock real estate investment trust said Thursday.

The performance beat the expectations of 1-cent earnings per share projected by 10 analysts surveyed by Thomson Reuters who follow Uniti.

Uniti shares fell 5 cents to close Thursday at $15.30 in trading on the Nasdaq exchange. Uniti released its fourth-quarter and 2017 earnings after the market closed.

Uniti had $916 million in revenue in 2017 and a net loss of 13 cents per share for the year.

Uniti deployed more than $1 billion of capital last year with three acquisitions, said Kenneth Gunderman, Uniti's chief executive officer.

Uniti announced a sale and lease-back transaction Thursday with U.S. TelePacific Holding Corp., a 19-year-old privately held telephone communications firm based in Los Angeles. It does business in California, Nevada, Texas and Massachusetts, Gunderman said.

"They were interested in selling their fiber network to unlock the value of the excess fiber capacity and improve their leverage," Gunderman said in a conference call Thursday.

Uniti acquired 45,100 strand miles of fiber-optic line for $95 million and entered into a 15-year lease transaction for continued use of TelePacific's fiber network, Gunderman said. The lease will pay Uniti $8.8 million in annual rent plus a 1.5 percent escalator, Gunderman said.

"We view [U.S. TelePacific Holding Corp.] as a strong, creditworthy tenant," Gunderman said.

The deal demonstrates the momentum Uniti's leasing segment is gaining, Gunderman said.

"We expect Uniti Leasing will be an important contributor to our future growth as shared communication infrastructure is increasingly accepted within our industry," Gunderman said in a prepared statement.

On Wednesday, Moody's Investor Service downgraded Uniti's corporate family bond credit rating from B2 to B3 after Moody's downgrade of Windstream Holding, also from B2 to B3. Both Uniti's and Windstream's outlooks remained negative.

Uniti was a spinoff from Windstream in 2015.

Uniti's downgrade "reflects its reliance upon Windstream for approximately 70 percent of its revenues," Moody's said.

Uniti's rating will remain linked with Windstream unless or until it can diversify its revenue stream such that Windstream represents meaningfully less than half of Uniti's total revenue, Moody's said.

Windstream's downgrade was based on its "sustained weak operating trends and a challenging debt maturity profile," Moody's said.

"Windstream faces large debt maturities of over $1 billion each in 2020 and 2021 and strong negative market sentiment that poses very high refinancing risk," Moody's said.

Business on 03/02/2018