SPRINGDALE -- Arkansas taxpayers can make a good case for reclaiming state grants to Ecclesia College obtained through kickbacks, a University of Arkansas School of Law professor said.

"In my opinion there is a very good legal basis," said Howard Brill, who previously served as the state's chief justice.

Grants stopped

The award of General Improvement Fund grants by individual lawmakers, such as those awarded to Ecclesia College, where found to be unconstitutional in a ruling issued by the Arkansas Supreme Court on Oct. 5.

Source: Staff report

Ecclesia's lawyer disagreed Wednesday.

"With respect, everything the college put on the grant applications is accurate," Travis Story of Fayetteville said. "The grants were spent for exactly the things the grants were issued for."

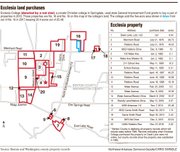

A total of $692,500 in state grants to Ecclesia from 2013 through 2014 were to pay for land to accommodate the college's growth, grant applications show. Ecclesia either bought or paid off the loans on 48.5 acres in 2013 through 2014 with the taxpayer money.

Only two of the 10 legislators who directed those grants to Ecclesia were involved in the kickback scheme, but they gave about two-thirds of the money the school received. The two lawmakers convicted of taking kickbacks from the college in exchange for grants from the state General Improvement Fund directed $550,000 to the school.

Five acres that Ecclesia bought with state grants have since been sold for more than twice as much per acre as the college paid for it, Benton County land records show.

Ecclesia bought 25.5 acres at 4095 Arkansas 112 in November 2013 for $500,000. That averages $19,608 an acre. The college sold 5.09 acres of the same property in August 2017 for $215,000, land records show. That averages $42,240 an acre. The college was able to sell 20 percent of the land in that tract for 43 percent of the purchase price.

The 20.4 acres Ecclesia still owns of that tract include about 640 feet of frontage along Arkansas 112 that begins about six-tenths of a mile south of the ramp to the recently opened U.S. 412 Northern Bypass, connecting Arkansas 112 to Interstate 49.

Much of Ecclesia's land is classified as tax exempt, Benton and Washington County land records show. The college owns 36.3 acres in Washington County and 202.2 acres in Benton County, according to land records. Of that 238.5 acres, 214 are exempt from property taxes, land records show.

Ecclesia is a work-study college in which students work to pay part of their tuition. It's a nonprofit religious institution, and its main office is in Springdale near Elm Springs.

The school awarded 42 degrees on May 5, the largest graduating class in its 40 years, according to its website. Ecclesia has about 160 full-time students, according to enrollment records, with another 100 students online.

GRANTS, FEES AND KICKBACKS

Oren Paris III, who was Ecclesia's president at the time, pleaded guilty April 4 to paying kickbacks in return for the state General Improvement Fund grants in 2013 and 2014. Paris resigned the day before his plea.

Those kickbacks went to then-state Rep. Micah Neal and then-Sen. Jon Woods, both of Springdale. Neal pleaded guilty to one count of conspiracy Jan. 4, 2017. Woods was convicted of 15 counts of corruption May 3, including counts arising from his dealings with Ecclesia.

Paris paid consulting fees to Randell Shelton Jr. of Kemp, Texas, a mutual friend of his and Woods. An undetermined portion of those fees was passed along to Woods and Neal as kickbacks. Shelton was convicted along with Woods in the same trial, where he was found guilty of 12 corruption charges all involving Ecclesia.

The college paid $267,420 to Shelton's company, Paradigm Strategic Consulting, according to finance records presented at the trial. Of that, $210,420 was removed by Shelton in large cash withdrawals, and $40,000 was wire-transferred to Woods. Another $9,235 was taken out by ATM withdrawals.

Ecclesia's governing board didn't know of Paris' agreement with and payments to Paradigm until October 2015, while the investigation that later indicted Paris was underway, according to court records.

None of the grant money went to Paradigm, Story said. All payments for the consulting on fundraising and planning came from another college account, he said.

Duane "Dak" Kees, U.S. attorney for the Western District of Arkansas, presided over the case against Paris, Woods and Shelton. He confirmed during court proceedings that the federal government has no method to recover any of the money, which was issued by the state.

The defendants were ordered to pay restitution for kickbacks paid and received, an amount yet to be determined. The U.S. District Court in Fayetteville hasn't imposed sentences in the case yet. Woods and Shelton will appeal their cases, their attorneys have said.

Paris' guilty plea is conditional, allowing him to pursue an appeal on the matter of whether the charge against him should be dismissed because of improper actions by an investigator in the case.

UNJUST ENRICHMENT

"There is a legal principle called 'unjust enrichment' that has a history in Arkansas law dating back to 1940," Brill said. The principle was never enacted by statute, but is a well-established concept in cases brought before Arkansas courts, he said.

Proving an unjust-enrichment case has three straightforward components, said Brill, who served by appointment as Arkansas chief justice from September 2015 to December 2016.

"First, there has to be some benefit, someone enriched by it. Second, there has to be something unjust about the way the one who benefits -- the college in this case -- received the money. There has to be fraud or some mistake such as a double payment," paying again for something already paid for. "Third, returning the money has to be equitable. You have to prove it would be more unfair to let the one who benefited keep the money than return it."

There is no dispute the college received the money, satisfying the first requirement, Brill said. The second requirement is also clearly met since four people -- Neal, Paris, Woods and Shelton -- have been convicted of fraud.

"This money went to this college because of a kickback," Brill said. "It was the kickback that was the key operative element." Where the money for the kickback came from is not a factor, he said.

"The only question is in the third factor. All and all, is it better and more appropriate for the defendant to keep it?"

"I can see the college making a number of arguments," Brill said. "Perhaps the board of directors didn't know about the fraud. Maybe it was just one or two people who did. Perhaps the money went to help students, and that's good. But the taxpayers or the attorney general can respond that the money should have been given in a proper way."

"Ideally such a case would be brought to the the attorney general," Brill said. "And there should be an offer of 'Let's work out terms where you can repay it' without demanding everything back at once. If they can't work something out, then it would result in a circuit court" case.

Neither the attorney general nor anyone else has contacted Ecclesia to discuss repayment of the grants for any reason, Story said.

Attorney General Leslie Rutledge "is reviewing the situation," according to a June 8 statement from her office.

A spokesman for Mike Lee, the Democratic nominee for attorney general, said Monday that the campaign was researching the matter but had no statement. Libertarian nominee Kerry Hicks didn't respond to requests for comment.

If the attorney general doesn't act, any Arkansas taxpayer can file a suit.

There is also the possibility of an "illegal exaction" suit by a taxpayer, Brill said. Often those suits are filed over improperly imposed taxes, but the law there can be applied to government expenditures, he said.

LAND RICH, CASH POOR

Testimony in the Woods and Shelton corruption trial that ended May 3 painted a picture of a school that was struggling to meet its payroll but was rich in assets such as land.

Ecclesia spent its state grants to buy one tract and to reimburse itself for property it had already bought, according to records from the Northwest Arkansas Economic Development District, which administered the grants.

The college already owned 202 acres -- 155 acres in Benton County and 47 acres in Washington County -- when it made the first grant request in 2013, according to property records.

The acreage the school sold that was part of the 25.5 acres at 4095 Arkansas 112 was purchased for $500,000 from Darrell and Carol Patton on Nov. 7, 2013.

Rogelio Trujillo purchased the 5.09 acres for $215,000 on Aug. 10. The land Trujillo purchased from Ecclesia wraps around the rear and east side of property he owned at 8930 Carrie Smith Road, land records show.

Ecclesia requested the grant money for the property at 4095 Arkansas 112 to buy land with a student residence hall and shop facility adjacent to the college. The property includes a 2,556-square-foot home, a shop and a barn. The school purchased the land more than a year before it requested the grant money.

Several of Paris' grant requests for the properties said they were "critically needed space" for incoming resident students. Houses on some of the purchased land would be renovated into student housing, while more would be built on the sites, the grant applications said.

Ecclesia managers testifying in Woods and Shelton's trial said on the witness stand that those plans were upended by the corruption investigation and subsequent indictments.

At the trial, Shelton said he was hired as a consultant to raise money for ambitious expansion plans, and those plans were derailed by the investigation. Seth Duell, formerly a professional fundraiser for the college, testified at trial that Ecclesia was having to draw from a line of credit to pay its bills by the time he was hired in February 2015.

The county appraised property on Arkansas 112 at $352,850 when it sold in 2013 and $267,150 in 2016. The property is now listed as exempt, meaning it has no listed appraised value and the school pays no taxes on it.

TAX EXEMPTIONS

What can be exempted from state property taxes is listed in Article 16, Section 5 of the state constitution and includes "churches used as such; school buildings and apparatus; and buildings and grounds and materials used exclusively for public charity."

Some of Ecclesia's land doesn't have buildings on it and some of the lots that do have buildings, such as homes, are leased to tenants.

Spokesmen for the county assessor's offices in Benton and Washington counties both said tracts with a college-related building on them are deemed exempt. Land with buildings leased by the college to tenants for noncollege use are not considered exempt by either county, spokesmen said.

Washington County doesn't exempt from taxes any land that sits vacant, said Dan Cypert, chief deputy assessor. Benton County allows an exemption in cases where the vacant land is contiguous with the main campus, said Benton County Assessor Roderick Grieve.

The counties have no method for checking whether the vacant land is leased for some commercial use such as pasture, both counties' officials said.

Ecclesia purchased a pair of small lots in 2013 without state grants, adding another 3.5 acres. The properties sit at the intersection of Carrie Smith Road and Grimsley Road. The smaller property, 1.15 acres at 8532 Carrie Smith Road, has a 2,239-square-foot home and cost the school $230,000. The 2.43-acre parcel is adjacent to the home's north and east sides.

Shelton listed his address as 8532 Carrie Smith Road in 2015 and 2016, Benton County records show. That also was listed as the business address of a shingle recycling company Paris and Shelton partnered in. The address now is the listed business address of a car detail and cleaning service called Attention to Detail.

Metro on 07/01/2018