Second-quarter 2017 did not treat P.A.M. Transportation Services well. Executives attribute the disappointing results to a struggling auto industry, to which P.A.M. devotes about half of its business, as well as low rates per mile.

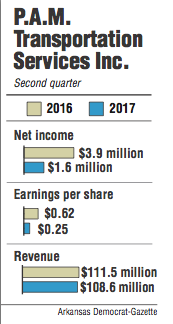

The company took in fewer dollars in the quarter, down to $108.6 million from $111.5 million in second quarter 2016. At the same time, the company had about $1 million more in operating expenses, which left the company with about $2.3 million less in profit this year compared with the same time last year. The profit in the quarter came out to about $1.6 million.

Earnings per share slid to 25 cents per share, down from 2016 when investors earned about 62 cents per share.

While the company delivered about 200 more loads this second quarter compared with 2016, P.A.M. earned less revenue per mile, falling from about $1.43 per mile to about $1.39 this quarter. Economists say this is because of an overcapacity in freight markets, so customers aren't feeling the pressure to pay shippers at higher rates.

Making matters worse, P.A.M. deals in the auto industry, a segment of the economy experiencing about a 3 percent decrease in sales.

"They got hit very heavily by their vulnerability to a single industry," said Bob Williams, senior vice president and managing director of Simmons First Investment Group. "There's not much you can do if you primarily operate in one industry."

Daniel Cushman, president of P.A.M., said the company expects that 2017 will eventually show improvements regarding overcapacity among truckers and weak prices for freight.

In the company's earnings release, Cushman cites the implementation of electronic logging devices as a difference-maker. He said the company believes that the devices will force some smaller shippers out of business, causing more truckers to leave the field.

P.A.M. has fewer company-owned trucks this year than last but has more contractors driving, and the company had a reduction in expenses from salaries, wages and benefits. In the second quarter of 2016, the company paid about $27.8 million, and this quarter about $25 million.

"There has to be some economic where it's cheaper to contract your help than put them on the clock full time and provide benefits," Williams said. "When there's excess capacity, then that becomes more expensive to you, and when things are more tight, you are willing to pay extra. It's ultimately indicative of supply and demand."

Expenses from rent and purchased transportation added up to about $3 million more this second quarter than in 2016.

Business on 07/29/2017