Dillard's Inc. on Thursday reported a 29 percent drop in profit for its 2016 first quarter, missing analysts' estimates.

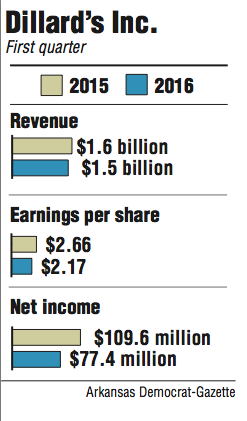

The Little Rock retailer said it had a profit of $77.4 million during its first quarter, down from $109.6 million during the same period a year ago.

Revenue fell to $1.54 billion for the first quarter, compared with $1.61 billion a year ago.

Dillard's reported earnings per share of $2.17 for the period ending April 30, compared with $2.66 per share during the first quarter in 2015.

Analysts expected the company to have earnings of $2.52 per share.

Dillard's shares fell $1.85, or 2.96 percent, to close Thursday at $60.64 on the New York Stock Exchange. The company reported its financial results after markets closed. The shares continued to fall in after-hours trading.

Dillard's said it bought back $58.4 million worth of shares under its $500 million share-repurchasing program.

"Retailers clearly are struggling," said Bob Williams, senior vice president and managing director of Simmons First Investment Group Inc. in Little Rock.

"I think the Internet has put quite a bit of margin pressure on the retailers, and you have companies like Amazon who can deliver in two days," he said.

Dillard's financial results came a day after Macy's Inc.'s earnings offered a gloomy outlook for the retail industry. Macy's financial results missed analysts' estimates and the company reduced its profit forecast for 2016.

"We are seeing continued weakness in consumer spending levels for apparel and related categories," said Terry Lundgren, Macy's Inc. chairman and chief executive officer, in a statement.

Macy's on Wednesday reported a profit of $116 million, or 37 cents per share, in its first quarter, down from $193 million, or 56 cents per share, during the same same period a year ago.

Macy's also lowered its 2016 forecast, saying it expects comparable store sales in 2016 to decline between 3 percent and 4 percent.

"Our management team is rising to the challenge and aggressively changing our playbook to gain market share and accelerate progress and results for the remainder of 2016 while also continuing to build for the longer term," Lundgren said.

"We are not counting on the consumer to spend more, so we are working harder to give customers more reasons to buy from us by delivering outstanding style, quality and value," he said.

Shares of Macy's tumbled as much as 14 percent during intraday trading on Wednesday after the company released its results. On Thursday, Macy's shares fell 0.54 percent to close at $31.21 on the New York Stock Exchange.

The company's results and following comments sparked concerns about the retail industry as a whole, bringing down shares of other companies such as Dillard's and Wal-Mart Stores Inc.

Gap Inc. also reported weak results this week. The company reported a 7 percent decline in sales in April.

On Thursday, Dillard's also reported a decline in sales.

The company said total merchandise sales, which exclude it's contracting business CDI Contractors, dropped 5 percent during the first quarter.

Dillard's sales in comparable stores also fell 5 percent. The company said sales were strongest in shoes, but weak in home and furniture, and ladies' accessories and lingerie.

"Our disappointing sales pressured our gross margin and net income performance, although inventory was relatively flat at the quarter end," said Chief Executive Officer William Dillard II in a prepared statement.

"While we controlled expenses, sales leverage was difficult to achieve," he said.

Business on 05/13/2016