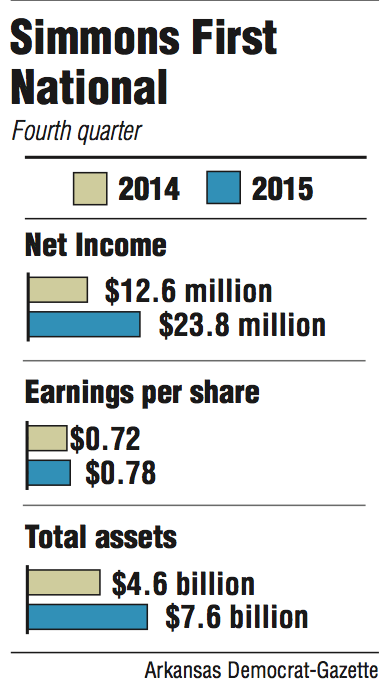

Pine Bluff-based Simmons First National Corp. earned $23.8 million in the fourth quarter last year, an almost 90 percent increase over the $12.6 million it made in the same period of 2014, the bank said Thursday.

Simmons earned 78 cents per share in the last three months of 2015, up from 72 cents a share in the fourth quarter of 2014. Excluding one-time expenses, Simmons made 86 cents a share in core operating earnings, which matched the estimates of five analysts surveyed by Thomson Reuters.

Simmons shares fell $2.76 to close Thursday at $44.12 a share in trading on the Nasdaq exchange. Simmons' stock has lost 14.1 percent since the end of 2015, due primarily to the drop in the stock market in the past three weeks. The S&P 500 is down 8.6 percent since Dec. 31.

For the year, Simmons earned $74.1 million. Simmons had $7.6 billion in assets at the end of 2015.

Simmons acquired Liberty Bancshares and Ozark Trust and Investment Corp., both of Springfield, Mo., and Community First Bancshares of Union City, Tenn., last year.

"It won't take many more acquisitions to push us over $10 billion in assets," said George Makris, chairman and chief executive officer of Simmons.

Simmons still is pursuing acquisitions, Makris said, and is looking at banks with more than $1 billion in assets in places where Simmons has no presence, Makris said.

"But we also have several markets where we'd like to increase our share," Makris said.

In those markets, Simmons would consider banks with assets of $300 million up to $750 million or more, Makris said.

Simmons' fee income in the fourth quarter was $28.9 million, less than the $31.1 million that analysts covering the bank expected, said Matt Olney, a Stephens Inc. bank analyst in Little Rock.

Simmons had core expenses of $64.5 million, less than the expectations of $64.8 million, said Olney, who owns no Simmons stock.

Simmons has branches in Arkansas, Kansas, Missouri and Tennessee.

The bank has about 160 branches in the four states, Makris said.

Simmons is seeing fewer and fewer face-to-face transactions, Makris said. To save money, the bank will continue to identify low-performing branches to close, he said.

Business on 01/22/2016