State general revenue last month dipped by $12.8 million from a year ago to $529.3 million, yet still exceeded the state's forecast by $11.3 million.

State government's two largest sources of state general revenue -- individual income taxes and sales and use taxes -- each declined slightly in December 2015 from December 2014, the state Department of Finance and Administration said Tuesday in its monthly revenue report.

Gov. Asa Hutchinson said that overall, state revenue continues to exceed the budget forecast and "this reflects our conservative approach to the budget."

"And even though sales tax collections for December are below expectations, I am confident in the overall financial condition of the state as we enter 2016," the Republican governor said in a written statement.

Individual income tax collections exceeded the state's forecast in December largely because self-employed people and investors paid more quarterly estimated taxes than projected in the month, said John Shelnutt, the state's chief economic forecaster.

But the state's sales and use tax collections fell short of the state's forecast for the month because of "a major decline" in the utility sales tax collections from residential and commercial customers, possibly due to cheaper fuel and warmer-than-usual weather, as well as a 1.8 percent decline in retail sales tax collections, Shelnutt said.

The state's sales tax collections for December 2015 reflect payments based on businesses' sales to consumers in November. The state's collections in January will show tax payments based on businesses' sales in December.

"In a few months, we'll be able to get a better look at the economy through the revenue numbers," Shelnutt said.

State officials want to see January's sales and use tax collections based on sales in December to get a better handle on retail sales from Christmas shopping, he said. Christmas sales tend to be over a longer period of time than in the past, due to gift cards and other factors, he said.

State officials "normally look for wage-type growth" in individual income tax withholdings, but payroll service companies have reduced their withholdings more than expected because of individual income tax rate cuts that became effective Jan. 1, 2015, Shelnutt said.

Arkansas' unemployment rate fell to 5 percent in November, matching the national rate, the U.S. Bureau of Labor Statistics reported last month. That was the first time since April 2008 that Arkansas' unemployment rate has been as low as 5 percent.

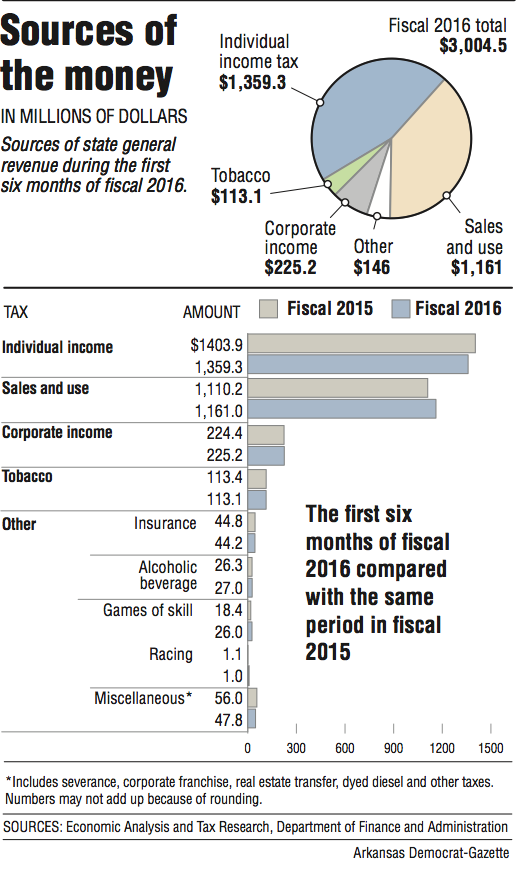

Halfway through fiscal 2016, state total general revenue increased by $6 million (0.2 percent) over the same period in fiscal 2015 to $3 billion, the finance department reported. That's $85.3 million (2.9 percent) above the state's forecast.

State tax refunds and several other government expenditures come off the top of total general revenue, leaving "net" general revenue that agencies are allowed to spend.

Net general revenue in December declined by $18.7 million (3.9 percent) below year-ago figures to $464.1 million, but exceeded the state's forecast by $7.7 million (1.7 percent).

Halfway through fiscal 2016, the net declined by $17.8 million (0.7 percent) below the same period in fiscal 2015 to $2.58 billion, yet exceeds the state's forecast by $66.9 million (2.7 percent).

Earlier this year, the Republican-controlled Legislature enacted a $5.18 billion general-revenue budget for fiscal 2016 -- a $127 million increase from 2015 -- as it approved tax cuts projected to reduce state general revenue by $26.5 million in fiscal 2016 and nearly $101 million in 2017.

According to the finance department, December 2015's general revenue included:

• A $2.3 million (1 percent) decline in individual income tax collections from December 2014 to $230.6 million, which exceeded the state's forecast by $11.3 million (5.2 percent). Reduced collections from withholding payments accounted for the decline from year-ago level, the department said. Individual income tax rate cuts enacted by the 2013 Legislature became effective Jan. 1, 2015. They are projected by the finance department to reduce state general revenue by $50 million in fiscal 2016.

• Withholding payments in December dropped by $12 million over a year ago to $188.9 million and exceeded the state's forecast by $700,000.

Estimated quarterly payments, made by self-employed individuals and investors, increased by $5.5 million over December 2014 to $30.7 million, and exceeded the state's forecast by $6.1 million. Payments for tax returns and extensions increased by $4.2 million from December 2014 to $11 million, and exceeded the state's forecast by $4.5 million.

• A $2 million (1.1 percent) decrease in sales and use tax collections from a year ago to $186.4 million, which fell $5.8 million (3 percent). The results largely reflect taxable sales activity in November, the department said.

• A $4.8 million (5.7 percent) dip in corporate income tax collections from a year ago to $80.5 million, which exceeded the state's forecast by $10.3 million (14.7 percent). Shelnutt said corporate income taxes are a highly volatile component of state general revenue.

• A $200,000 (1.1 percent) decrease in tobacco tax collections from December 2014 to $18.7 million, which exceeded the state's forecast by $900,000. Monthly changes in tobacco tax collections can be attributed to uneven patterns of tobacco stamp sales to wholesale purchasers.

When asked about the December revenue report, Richard Wilson, assistant director of research for the Bureau of Labor Statistics, replied in an email: "No surprises."

Wilson added that he'll make a projection about a state surplus for fiscal 2016 in early February, "after the Christmas money shows up" in January's revenue report.

Tim Leathers, deputy director for the finance department, said it's too early at this point to project whether the state will have a surplus in the fiscal year that ends June 30.

Metro on 01/06/2016