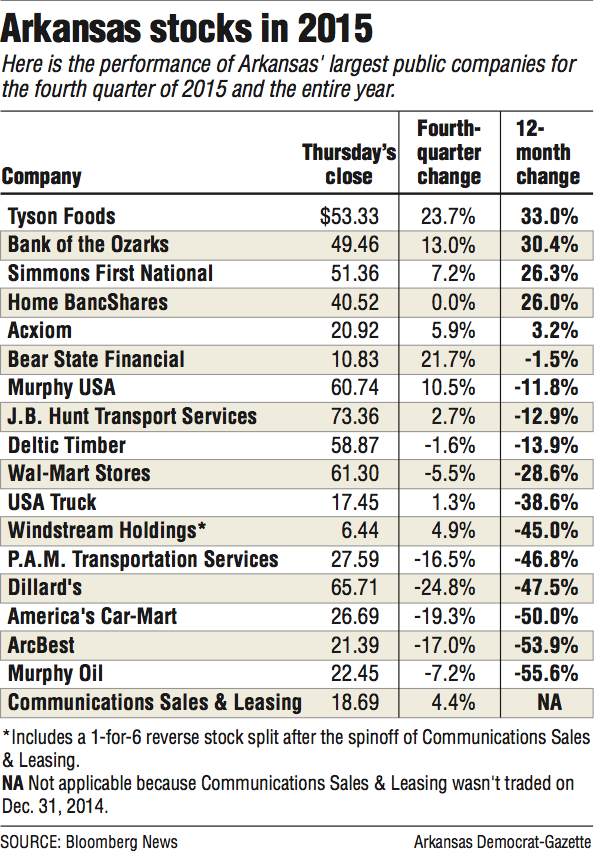

In a year when merely a positive return on investment was good, Tyson Foods' stock rose 33 percent, outperforming the other publicly traded companies on the Arkansas Index in 2015.

Only five stocks on the index rose for the year.

The index itself dropped more than 22 percent for the year. The Dow Jones industrial average and the S&P 500 index also fell in 2015.

Tyson Foods' domination of the domestic protein marketplace paid off for shareholders, said Bob Williams, senior vice president and managing director of Simmons First Investment Group Inc. in Little Rock.

Tyson Foods is the top beef and chicken producer in the United States and is third in pork production, Williams said.

In 2014, Tyson Foods paid about $8.5 billion for Hillshire Brands, which includes Ball Park hot dogs and Hillshire Farm and Jimmy Dean products.

"Synergies and savings from the merger of the Hillshire and Tyson management, as well as production and distribution channels, are flowing to the bottom line and investors liked what they saw," Williams said. "Tyson continues to expand its further-processed product lines in an effort to reduce its exposure to commodity price swings and improve profit margins."

The stocks of the three largest publicly traded banks posted gains of more than 26 percent each for the year.

Shares of Bank of the Ozarks in Little Rock, Pine Bluff-based Simmons First National Bank and Conway-based Home BancShares excelled for several reasons, said Matt Olney, a research analyst in Little Rock for Stephens Inc. Olney owns no stock in the banks.

One reason is that the banks grew through acquisitions in 2015, Olney said.

Bank of the Ozarks added Bank of the Carolinas of Mocksville, N.C., and announced the purchase of Community & Southern Bank of Atlanta and C1 Bank of Tampa, Fla., in 2015.

Home BancShares, which owns Centennial Bank, closed in 2015 on a $289 million portfolio it acquired from Doral Bank in Puerto Rico and on the acquisition of Florida Business BancGroup in Tampa.

And in 2015, Simmons closed on the purchases of Community First Bancshares in Tennessee and Liberty Bancshares in Springfield, Mo.

"Overall, it seems like banks were pretty flat [in 2015]," Olney said.

Bank of the Ozarks, Home BancShares and Simmons also did well simply because they had no exposure to energy businesses, Olney said.

"Banks that had energy exposure did worse [in 2015,] and banks that didn't did better," Olney said. "The fact that [the Arkansas banks] were not located in Texas and didn't have any direct, material energy exposure was also good for their stock prices. There are so many unknowns in energy right now. It's just unclear what the losses will be."

A third benefit for the banks was strong loan growth, even without counting loan growth from acquisitions, Olney said.

"They each put up steady loan growth, although at different levels," Olney said. "Ozarks was probably the highest, but Home [BancShares] had good loan growth and so did Simmons."

All three banks will be getting closer in 2016 to the $10 billion asset threshold that requires banks to undergo added scrutiny from governmental regulators, Olney said.

Bank of the Ozarks will grow from about $9.3 billion in assets to more than $16 billion in assets when its purchases of Community & Southern Bank and C1 Bank close in 2016, Olney said.

If Home BancShares doesn't pass $10 billion in 2016, it will in 2017, Olney said. Home BancShares now has about $8.5 billion in assets.

Simmons, which has about $7.5 billion in assets, should exceed $10 billion in assets sometime in the next few years, Olney said.

The worst-performing stock for 2015 was Murphy Oil, which lost more than 55 percent of its value in the past 12 months.

"With the rout in the oil markets, it's no surprise that Murphy was the worst-performing issue," Williams said.

Murphy Oil has taken a conservative stance to plummeting oil prices by cutting capital and operating expenditures in order to preserve cash and maintain its dividend, Williams said.

"The trend in oil prices remains full of uncertainty until the industry fundamentals improve," Williams said.

ArcBest, the Fort Smith-based transportation company, had the second-worst performance of the year, also losing more than half its value.

"While total shipments increased year over year, on average ArcBest saw smaller shipment sizes," Williams said. "Management has increased the dividend and extended a stock buyback program in an effort to reflect greater value to shareholders."

Business on 01/01/2016