ArcBest Corp., a Fort Smith-based trucking and logistics company, said Thursday that its second quarter was the most profitable in six years on an earnings-per-share basis, but it still missed analyst estimates significantly and its stock sagged.

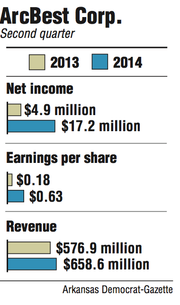

The company, formerly known as Arkansas Best, reported net income of $17.2 million, or 63 cents per share, for the quarter ended June 30, compared with $4.9 million, or 18 cents a share, for the same period in 2013. On a per-share basis, it was the company's most profitable quarter since 2008. Without pension-settlement charges, the company would have booked profits of 65 cents per share for the second quarter.

Despite the improvement, ArcBest missed the average earnings estimate of 14 analysts of 72 cents a share.

ArcBest shares ended the day at $31.73, down $10.56, or nearly 25 percent, in trading on the Nasdaq exchange. Shares have traded as low as $19.40 and as high as $45.68 over the past year.

John Barnes, a managing director for RBC Capital Markets, said the stock hit for ArcBest came as a result of the earnings miss and the company saying that while it's gaining new business, it's also had to hire more workers whose inexperience is hampering productivity in some areas. He said that information has investors thinking it will take a few more quarters for ArcBest to fully hit its stride.

Judy McReynolds, ArcBest's president and chief executive officer, said in an earnings call Thursday that second-quarter results improved significantly over the same period last year because of its new labor agreement, which went into effect in November, and better pricing in the ABF Freight segment. She also noted the company's emerging business segment continues to gain ground.

The cost of long-term incentive plans that are tied to ArcBest's share price as it compares to similar companies, and accounting requirements tied to company's two-tiered stock, reduced net income by a combined 10 cents a share in the second quarter. The impact for these items was 2 cents a share for the same quarter last year.

Revenue for the second quarter stood at $658.6 million, compared with $576.9 million a year ago, a 14 percent increase. The average revenue estimate from a group of nine analysts was $642.6 million.

The company's ABF Freight segment saw revenue of $492.9 million, up 10 percent from $446.8 million last year. Operating income for the quarter was $22.8 million, up from $5.5 million. The new labor deal helped costs as a percentage of revenue to improve to 95.4 percent compared with 98.8 percent in the second quarter of 2013.

ABF Freight was helped by a consolidation of 30 terminals that began in July 2013 and was completed in March. Profit margins and productivity were hampered somewhat by new dockworkers brought on to handle shipment growth. McReynolds said the company expects improved productivity levels in the coming months as these workers complete training and gain experience.

The emerging business segment saw combined revenue increase 28 percent to $178.1 million. The businesses, including Panther, ABF Logistics, FleetNet and ABF Moving, made up 27 percent of the company's total revenue in the second quarter, up from 24 percent last year.

Panther's revenue led the group with $81.4 million, up from $60.4 million in the second quarter of 2013, a 35 percent gain. Panther has increased market share over the past year. McReynolds said market conditions play to Panther's strength as a premium service provider.

Business on 08/01/2014