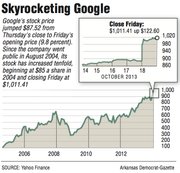

Shares of Google Inc. closed at $1,000 for the first time Friday amid optimism about new advertising for wireless devices and online video, joining a small club of U.S. stocks.

The world’s largest search engine company saw its stock gain 13.8 percent to a record $1,011.41 by the close of trading in New York. The stock, sold at $85 in a 2004 initialpublic offering, has risen every year since except for 2010 and 2008, when it slumped 56 percent during the recession.

The Internet company is benefiting from ads for new formats after expanding beyond delivering advertisements alongside search results on desktop computers. Google is expected to take 33 percent of the global online advertising market this year, up from 31 percent in 2012, according to EMarketer Inc.

“It’s not complicated,” said Martin Pyykkonen, an analyst at Wedge Partners Corp. in Greenwood Village, Colo. “This is a story that is a proven business model. The bottom line is this is a great growth stock.”

Google, based in Mountain View, Calif., already has one of the highest market capitalizations in the United States at about $330 billion, trailing only Apple Inc. and Exxon Mobil Corp. Among the few companies with a stock price above $1,000 are online-travel company Priceline.com Inc. and Seaboard Corp., a producer of turkeys and hogs with a market value of just $3 billion.

A majority of analysts are predicting further stock gains for Google, with 35 recommending to buy the shares and 13 advising to hold them, data compiled by Bloomberg show. None has a sell rating.Google is trading at a price-to-earnings ratio of 28, the data show, lower than Facebook Inc.’s 237 and Yahoo Inc.’s 29.

The stock jumped Friday after Google reported third-quarter sales and profit that beat estimates Thursday.

Third-quarter revenue, excluding sales passed on to partner sites, was $11.92 billion, exceeding the average projection of $11.64 billion, according to estimates compiled by Bloomberg. Profit excluding certain items was $10.74 a share, topping the average projection of $10.36. Net income jumped 36 percent to $2.97 billion from the year-earlier period.

“They continue to grow - for a company this size, very solid growth, still very profitable despite all the investments they’re making,” said Colin Sebastian, an analyst at Robert W. Baird & Co. who rates the stock the equivalent of a buy.

As the company navigates a shift to mobile promotions from pricier search-based ads on desktop computers, it is relying on a simple maxim: volume, not just price. Last quarter, the volume of clicks on advertisements climbed at the fastest pace this year, compensating for a drop in average-ad prices.

“As long as we continue to see that higher-than-expected volume coupled with the lower pricing, I’m OK with it,” said Josh Olson, an analyst at Edward Jones & Co. who rates the stock a buy. “It just signals they have good demand for that mobile business.”

Google also stepped up investments to boost capacity and introduce services that encourage marketers to direct more spending toward wireless devices.

The push to boost ad volumes - which rose 23 percent in the second quarter and 20 percent in the first - took its toll on Google’s gross profit margin, which shrank to 56.9percent, the lowest level this year, based on data compiled by Bloomberg.

The search provider has been working to address falling prices for advertising. This year, it introduced an advertising service called “enhanced campaigns,” encouraging marketers to funnel more of their spending to wireless devices.

Google is expanding its advertising in other ways, including working with rivals such as Facebook. Customers of its DoubleClick Bid Manager, which helps companies quickly buy ads across the Internet, will soon get access to the Facebook Exchange, Google said Friday. The feature, available to Google clients in the next few months, will let marketers target Facebook users based on their browsing.

The campaigns and other initiatives should help average ad prices recover in the next year or so, according to Victor Anthony, an analyst at Topeka Capital Markets Inc.

“The results clearly demonstrate that Google remains kind of the best of breed, best of class in the online advertising space, really within the Internet space itself,” Anthony said.

Revenue at Google’s sites,including the search page and YouTube, expanded 22 percent, faster than the 18 percent in the previous quarter.

“My goal was to ensure that Google maintains the passion and soul of the startup as we grow,” Chief Executive Officer Larry Page said in a call with analysts Thursday. “That’s why I worked so hard to increase the velocity and execution.”

Google is making other changes. Earlier this month, the search provider said it would update its marketing rules to allow users’ names and photos to be used in more promotions.

The company and Facebook are taking market share from Yahoo, which earlier this week reported a decline in revenue, while profit was bolstered by the Web portal’s stake in China’s Alibaba Group Holding Ltd.

Google is pushing for better results in other areas, including in hardware. Its Motorola mobile unit, which the company bought last year in its biggest acquisition ever, announced a flagship Moto X smartphone in August, an effort to boost sagging market share. Revenue in the division declined 34 percent to $1.18 billion.

Business, Pages 31 on 10/19/2013