NEW YORK - After flitting between tiny gains and losses most of Friday, the stock market closed mostly lower, a peaceful end to the most volatile month in nearly two years.

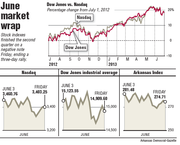

The S&P 500 stock index closed down 6.92 points, or 0.4 percent, to 1,606.28. The Dow Jones industrial average fell 114.89 points, or 0.8 percent, to 14,909.60. The Nasdaq composite index rose 1.39 points, or 0.04 percent, to 3,403.25.

Rising and falling stocks were evenly matched on the New York Stock Exchange. Consolidated volume was heavier than usual at 4.4 billion shares.

“It’s a dull Friday,” said Gary Flam, a stock manager at Bel Air Investment Advisors. A bull market, he said, is “rarely a straight march up.”

The Standard & Poor’s 500 index ended its bumpy ride in June down 1.5 percent, the first monthly loss since October. The index still had its best first half of a year since 1998.

Investors seemed unsure how to react to recent statements by Federal Reserve officials about when the central bank might end its support for the economy. Mixed economic news Friday added to investor uncertainty after big stock gains.

On Friday, an index of consumer confidence was up, but a gauge of business activity in the Chicago area plunged.

“Investors don’t know what to make of the news,” said John Toohey, vice president of stock investments at USAA Investment Management. “I wouldn’t be surprised to see more ups and downs.”

Stocks have jumped around in June. By contrast, the first five months of the year weremostly calm, marked by small but steady gains as investors bought on news of higher home prices, record corporate earnings and an improving jobs market.

By May 21, the S&P 500 had climbed to a record 1,669, up 18 percent for the year. Fed Chairman Ben Bernanke spoke the next day, and prices began gyrating.

Investors have long known that the central bank would eventually pull back from its bond purchases, which are designed to lower interest rates and get people to borrow and spend more. Last week, Bernanke got more specific about the timing. He said the Fed could start purchasing fewer bonds later this year and stop buying them completely by the middle of next year if the economy continued to strengthen.

Investors dumped stocks, but then had second thoughts this week as other Fed officials stressed that the central bank wouldn’t pull back on its support soon. The Dow gained 365 points over the previous three days this week.

Bonds have also been on a bumpy ride in recent weeks, mostly down.

The prospect of fewer purchases by the Fed sent investors fleeing from all sorts of bonds - municipals, U.S. Treasury securities, corporate bonds, foreign government debt and high-yield bonds. Investors pulled a record $23 billion from bond mutual funds in the five trading days ended Wednesday, according to Bank of America Merrill Lynch.

Bond yields, which move inthe opposite direction of bond prices, have rocketed.

The yield on the 10-year Treasury note rose to 2.49 percent from 2.47 percent late Thursday. Last month, the yield was as low as 1.63 percent. Treasury yields help set borrowing costs for a large range of consumer and business loans.

In U.S. economic news Friday, the University of Michigan said its index of consumer sentiment dipped to 84.1 in June from 84.5 the previous month. But that was still relatively high. May’s reading was the highest since July 2007.

Meanwhile, the Chicago Business Barometer sank to 51.6 from a 14-month high of 58.7 in May. That was well below the level of 55 that economists polled by FactSet were expecting.

Business, Pages 26 on 06/29/2013