P.A.M. Transportation Services Inc. on Friday reported an increase in second-quarter profit on increased revenue.

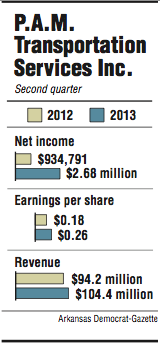

The Tontitown-based trucking company reported a profit of $2.68 million, or 26 cents per share, for the quarter that ended June 30, compared with a profit of $934,791, or 18 cents per share, for the same period in 2012. One analyst had estimated profits of 10 cents per share.

Revenue, including fuel surcharges, was $104.4 million for the quarter, a nearly 11 percent increase compared with $94.2 million for the same period last year. The analyst predicted $103.3 million in revenue.

“Revenue, excluding revenue from fuel surcharges, grew by approximately $7 million and represented a 9.4 percent increase from second quarter 2012 revenue,” Daniel H. Cushman, president, said in a release Friday.

P.A.M. shares rose 57 cents, or 5 percent, to close Friday at $11.30 in trading on the Nasdaq exchange. Shares have traded as low as $8.81 and as high as $11.74 over the past year.

Cushman pointed to fleet growth of 3.1 percent, improved tractor utilization, a reduction in the empty miles ratio and a 2.3 percent increase in the company’s rate-per-total-mile charge as contributions to the solid quarter. He said demand was strong and steady. He said the company lost some valuable “project lanes” that returned to intermodal shippers, but new business replaced the revenue lost.

The American Trucking Associations’ seasonably adjusted For-Hire Truck Tonnage Index edged 0.1 percent higher in June. The association calculates the tonnage index based on surveys from its membership.

June 2013 is the highest level on record, the association reported. The index surged 5.9 percent, when compared with June 2012. Year to date, compared with the same period in 2012, the tonnage index is up 4.7 percent.

“While housing starts were down in June, tonnage was buoyed by other areas like auto production which was very strong in June and durable-goods output, which increased 0.5 percent during the month according to the Federal Reserve,” Bob Costello, the chief economist for the association, said in a release.

Driver retention and recruiting was a challenge during the quarter, Cushman said, with P.A.M. and other trucking companies competing over a shrinking pool of qualified drivers. Hiring in the construction and manufacturing sectors has also increased, he said, and are attractive options for truck drivers.

According to the trucking association’s Trucking Activity Report released earlier in the month, quarterly turnover at large truckload fleets - those with at least $30 million annual revenue - rose in the first quarter to an annualized rate of 97 percent from 90 percent in the fourth quarter of 2012. At smaller truckload fleets, the rate rose to 82 percent in the first quarter from 76 percent in the previous quarter. The rate matches the 2012 annual average, but is below the most recent high of 94 percent in the third quarter of last year.

Cushman said fuel costs were down about $700,000 in the quarter compared with last year. He said the cost of diesel was down across the U.S. compared with last year and the company’s trucks were more fuel-efficient as older trucks are replaced with newer, more fuel-efficient models.

Business, Pages 25 on 07/27/2013