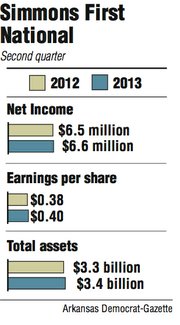

Simmons First National Corp.’s earnings rose slightly to $6.6 million in the second quarter, the Pine Bluff bank said Thursday.

Simmons’ net income was up from $6.5 million in the second quarter last year. Simmons earned 40 cents per share in the second quarter, matching expectations of three analysts who follow Simmons, according to a survey by Thomson Reuters.

The bank earned 38 cents a share in the same period last year.

Simmons shares were unchanged Thursday at $27.95 in trading on the Nasdaq exchange.

The bank has acquired four failed banks since 2010 in Missouri and Kansas. But Simmons is not limiting itself to those two states for acquisitions, said Matt Olney, an analyst with Stephens Inc.who owns no stock in the bank.

Simmons recently bid on one bank in east Tennessee, Olney said. That was Mountain National Bank in Sevierville, closed by federal regulators June 7 and acquired by another Tennessee bank. Simmons also made a bid on a bank in Lynchburg, Tenn., last year.

“Simmons is looking at failed-bank and live-bank opportunities,” Olney said.

George Makris Jr., Simmons’ chief executive officer elect, said the bank is in discussions with six different banks.

“Some are further down the road than others,” said Makris, who is scheduled to take over for CEO J. Thomas May when May retires at the end of the year.

May, also Simmons’ chairman, did not comment on Thursday’s conference call, the first time in years he has not addressed the analysts. May was diagnosed seven years ago with amyotrophic lateral sclerosis, commonly known as Lou Gehrig’s disease, which attacks the nerves in the brain and spinal cord and causes loss of muscle control.

Even though Simmons has made offers on two Tennessee banks, the bank continues focusing on banks within 350 miles of central Arkansas, Makris said.

Simmons has recently hired eight commercial lending officers and four mortgage lenders, Makris said.

Three are in the Kansas City, Mo., market and one each now work in St. Louis; central Arkansas; Sedalia and Springfield, Mo.; and Wichita, Kan., said David Bartlett, Simmons’ president.

The mortgage lenders are working in Kansas City; Salina, Kan.; and Springfield, Mo., Bartlett said.

“We’ve got expectations of loan production somewhere in the $50 million range for the remaining part of 2013,” Bartlett said.

Makris said the hiring of lenders will be ongoing.

“When we find the right fit, we’re going to make that move,” Makris said.

Simmons has 92 branches in 55 communities in Arkansas, Missouri and Kansas.

Business, Pages 23 on 07/19/2013