Arkansas lawmakers completed work on legislation last week that will let more than 250,000 low-income Arkansans use federal Medicaid funds to purchase private health insurance, becoming the first state in the country to adopt the method to provide health insurance for the poor.

Now the real work begins, state officials say.

Known at the Capitol as the “private option,” the concept was one of the most contentious issues of the legislative session, pitting Republican legislators against one another over whether the state should willingly participate in the 2010 federal healthcare law that has remained divisive among Arkansans.

After several late-night sessions, both chambers approved bills creating a framework for the program and giving the state Department of Human Services authority to spend about $400 million to purchase the plans. Gov.Mike Beebe will sign the bills at 10:30 a.m. Tuesday in the Governor’s Conference Room of the Capitol.

The private-option idea surfaced after the U.S. Supreme Court in June struck down part of the Patient Protection and Affordable Care Act and let states choose whether to extend Medicaid access to individuals who earn up to 138 percent of the federal poverty level, or $15,145 annually. The Affordable Care Act also calls for states to set up private-insurance marketplaces - called exchanges - from which people can choose insurance plans.

Beyond extending insurance to people who may not have had access, sponsors of the legislation expect the private option to offset mil-lions of dollars in Medicare rate cuts to hospitals that are part of the Affordable Care Act, and up to $38 million in federal penalties that would have been levied against businesses that employ more than 50 people but don’t offer insurance coverage.

Once the bills become law, the Department of Human Services will seek federal approval for the plan through waivers, a process that can take months, as the department and the Arkansas Insurance Department work together on how to absorb an extra quarter of a million people into a health-insurance marketplace that begins enrollment Oct. 1. The Insurance Department estimates an additional 211,000 Arkansans will purchase insurance on the exchange with the help of federal subsidies.

The bills specifically state that the private option will not become a reality unless the federal government gives Arkansas the exact waivers it wants, and gives the state permission to implement the program the exact way it wants. They also stipulate that the private option ends within 120 days if the federal government ever changes the amount it will pay toward the premiums. Under the Affordable Care Act, the federal government will pay 100 percent of health-care costs for eligible individuals until 2017, after which the state will pay incrementally more of the cost until the state’s share reaches 10 percent beginning in 2020.

Sen. Jonathan Dismang, R-Searcy, said those requirements helped secure legislative support for the measure and protect Arkansas’ interests.

The state worked with the federal government on each requirement, said Dismang, one of the legislation’s sponsors.

“I feel confident they’ll accept the amendments and the bill in its current form,” Dismang said. “The administration has been in pretty much constant contact. Every time there was a suggestion made, there was a phone call made. I think it’s likely that it will be accepted, but I also know that we were pushing the bounds as much as we possibly could inside what the Supreme Court allowed us to do. I don’t think we would be doing our jobs if we weren’t doing that.”

Some Republican legislators had asked for more time to weigh the decision and flesh out the plan, saying they are concerned about the potential level of control the federal government will have over the plan. They wanted written acceptance of Arkansas’ plan before approving authority for the state Department of Human Services to spend any money.

Kathleen Sebelius, the secretary of the U.S. Department of Health and Human Services, said in March that Arkansas could craft its private-option model, though the federal government has not signed off on a specific plan. Sebelius said last week that she’d review the precise details of the Arkansas model once it had been approved by lawmakers. She indicated that her department was following the day-to-day developments.

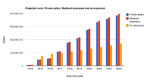

Requests for delay were denied, in large part, because of the short timeline to alert insurance companies and have plans in place when enrollment begins Oct. 1. Coverage on the exchange begins Source: Arkansas Insurance Department New Year’s Day.

“There’s a lot of work to do between now and Jan. 1, 2014. [Human Services] and Insurance Department and folks involved will be on full throttle, I’m sure, trying to make sure that the provisions in this bill are going to be able to be implemented in that time frame,” Dismang said.

Beebe said he doesn’t know when a waiver would be approved, but said the Department of Health and Human Services has shown a lot of interest in what Arkansas is doing.

“Their interest is so high that they were e-mailing our people … when it passed the House or when it didn’t pass the House and further e-mailing when it went through the Senate,” Beebe said. “I suspect they’ve got this on a front burner.”HUMAN SERVICES

The bills require the Human Services Department to seek a comprehensive waiver under Section 1115 of the Social Security Act. The waiver in essence exempts the private option from meeting certain requirements that accompany traditional Medicaid programs.

The waivers are designed to give states flexibility to try experimental, pilot or demonstration projects. They are generally approved for five year periods and can be renewed.

Arkansas has four Section 1115 waivers, including the waiver that allowed the creation of AR Kids B coverage. (ArKids B is a Medicaid program for children from families not poor enough to qualify for regular Medicaid.)

Department of Human Services spokesman Amy Webb said applying for and receiving a waiver takes time, but it must be completed by Jan. 1 when coverage begins.

Webb said the state will go forward with planning and enrolling eligible Arkansans with the expectation that the waiver will be granted.

“We don’t anticipate not getting the waiver … but we still have to go through the formal process,” Webb said.

She said the Human Services Department is drafting the waiver application, but she did not know when it will be complete.

“We needed the final legislative language to be able to complete the draft,” she said.

Once the draft application is complete, Human Services must hold two public meetings - one of which can be online. Webb said once the meetings occur, the department must wait 20 days before submitting the application to the Centers for Medicare and Medicaid Services, a subagency of the federal Health and Human Services Department.

Once the Centers for Medicare and Medicaid Services receives the application, it will set terms and conditions that would apply to the waiver and then negotiate with the state, she said.

Bill co-sponsor Rep. John Burris, R-Harrison, said before the waiver application is even submitted, he’d like a detailed, specific affirmation from the federal government that the program laid out in the bills is acceptable to pursue.

“We need an acknowledgment from [Health and Human Services officials] that they are supportive of every goal that we outlined as definitive,” Burris said. “I think they can make that statement and then we can start the process of going through the work of writing the waivers and the policy and everything else that’s associated with that.”

INSURANCE DEPARTMENT

The state’s exchange planning director, Cindy Crone, said that for the most part, exchange planning doesn’t have to change to meet the increased capacity produced by the private option.

The 250,000 newly eligible people would select midlevel or “silver” insurance plans on the exchange that the Arkansas Insurance Department and a steering committee have spent the last two years planning. They could choose a more expensive plan, but would have to pay the difference.

Plans are ranked based on how much of the service cost the consumer, or in this case the federal government, would pay. For a silver plan, the insurance company pays between 68 percent and 72 percent of the cost of a procedure. The consumer, or the government, pays the other 28 percent to 32 percent ofthe cost.

Gold, platinum and bronze level plans also will be sold.

Crone said the state will need to implement an electronic system to help people determine how much federal help they can receive.

The federal government would pay 100 percent of the premium for those making up to 138 percent of the federal poverty level. People who make between 138 percent and 400 percent of the federal poverty level (which in 2012 was up to $43,320 for an individual) would be eligible for a federal subsidy. People making above 400 percent of the federal poverty level can choose to buy insurance on the exchange.

The more than 400 people the department will hire to help people enroll, called “navigators” or counselors, also will need to know the eligibility specifics of the private option, she said.

Once the state has federal permission, the Insurance Department can notify insurance carriers of the new requirements, Crone said. The department plans to do that in early May.

Some supporters said adding a quarter-million people to the exchange will make Arkansas’ insurance market more attractive to insurance companies. Increased competition among insurance companies is expected to drive down premium costs.

The private option more than doubles the number of people expected to buy insurance on the exchange. Some worried that the only companies interested in selling plans would be Arkansas Blue Cross Blue Shield and QualChoice of Arkansas, the two largest insurers in the state. But additional companies have signaled they are likely to compete, Crone said

“The increased population should help stabilize the market and risk pool by bringing in 250,000 newly eligible and mostly healthy individuals into the market -and ones with a steady payment source,” Crone said.

Crone said the expanded population has already been a determining factor for some of the eight medical-insurance companies and four dental-insurance companies who have expressed interest in selling plans on Arkansas’ exchange.

Crone said interested medical-insurance companies are Arkansas Blue Cross Blue Shield, Coventry, Health Advantage, NovaSys/Centene/ Celtic, Preferred Risk Insurance Services, QualChoice of Arkansas, UnitedHealthcare and US Life and Health of Chicago.

Interested dental companies are Best Life and Health, Blue Cross Blue Shield, Delta Dental and Dentega.

Front Section, Pages 1 on 04/21/2013