LITTLE ROCK — BP Plc was a high bidder Wednesday on more than 40 leases to drill in the central Gulf of Mexico where two years ago its Macondo well exploded, causing the largest U.S. offshore oil spill.

Statoil ASA, based in Stavanger, Norway, bid $157 million for a single tract, a record in the region, Tommy Beaudreau, director of Interior Department’s Bureau of Ocean Energy Management, said Wednesday. Royal Dutch Shell Plc submitted the highest total bids at $406.6 million, the department said.

The auction in New Orleans raised $1.7 billion.

The Obama administration, pressured by Republicans to increase domestic oil production, auctioned tracts off the coasts of Alabama, Louisiana and Mississippi that it said may produce more than 1 billion barrels of oil. The previous auction in the central Gulf, about a month before the April 2010 BP disaster, raised $949.3 million for the U.S.

BP is acquiring leases in a region where the Londonbased company lost control of the Macondo well, destroying a $365 million drilling rig, killing 11 workers and spilling an estimated 4.9 million barrels of oil.

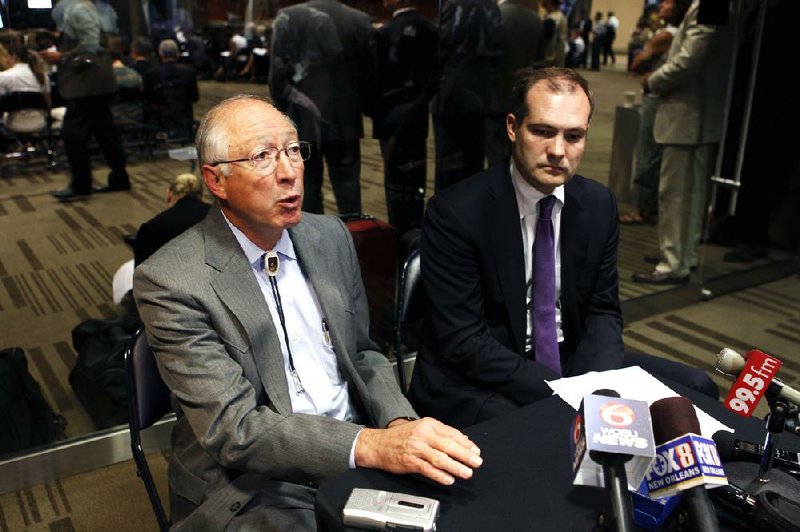

“Gulf of Mexico is back in business,” Interior Secretary Ken Salazar said as the sale began Wednesday in New Orleans. He said the companies can begin preparing for exploration immediately.

The administration is opening the central Gulf as Republicans in Congress demand accelerated domestic output to add jobs and reduce dependence on overseas sources. The BP oil spill prompted an overhaul of rules for deep-water drilling after a six-month halt in the Gulf to review safety.

Environmental groups including the New York-based Natural Resources Defense Council oppose the sale and say new drilling in the region may spark an environmentally disastrous accident similar to the BP blowout.

Production in the Gulf region increased 6.2 percent to 1.41 million barrels a day in March and represented more than a fifth of the U.S. crude production for the month, according to the Energy Department.

With oil trading about $80 a barrel on global markets, the Gulf of Mexico is the world’s most profitable place to produce oil because other nations set higher taxes on oil companies, said Fadel Gheit, an analyst at Oppenheimer & Co. in New York.

“Whether it’s the U.K., whether it’s Algeria, Nigeria, West Africa, Russia, anywhere you go, the effective tax rate is very high,” Gheit said in an interview. The Gulf “is welldeveloped, the whole area is basically very well-mapped, there are not too many surprises, the industry has all the services needed.”

After the BP disaster, the Interior Department revamped its oversight of drilling, dividing the leasing function from enforcement of safety rules and collection of production royalties. The department also added standards on well design, casing and cementing and introduced a requirement for a subsea oil-spill containment system.

A nonprofit group commissioned by the agency also recommended that U.S. inspectors be allowed to fly to rigs on company-leased helicopters and live for a time with workers, the National Research Council said in report released Tuesday.

Business, Pages 27 on 06/21/2012