High prices and interest rates, along with an uncertain economy, still have nervous consumers at all income levels pinching pennies and looking for bargains on groceries and other necessities.

And they're still holding off on buying items they don't need right away, such as clothes, electronics and furniture.

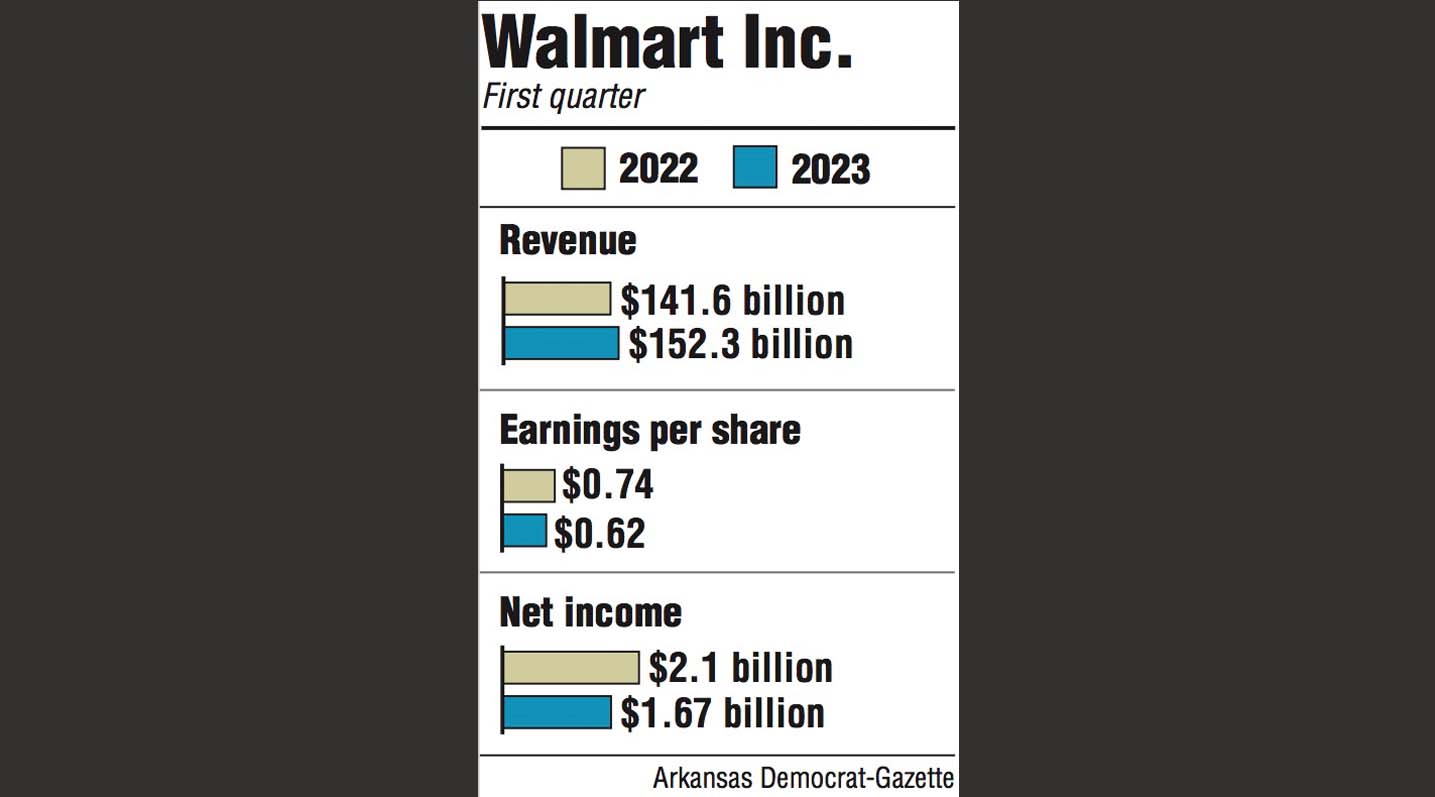

But even with these pressures, Walmart Inc. saw its revenue climb 7.6% between February and April, to $152.3 billion.

Before the markets opened Thursday, the Bentonville-based retailer posted first-quarter net income of $1.67 billion, or 62 cents per share, for the quarter that ended April 30, compared with $2.1 billion, or 74 cents per share, in the same period last year.

Earnings per share came in far below analysts' average estimate of $1.32.

Steve Dennis, president and founder of SageBerry Consulting LLC, called Walmart's first-quarter results "particularly impressive."

The company "drove strong top-line performance despite growing economic uncertainties and generally weak outlooks from their competitors," Dennis said.

In contrast to rival Target Corp., which reported its first-quarter earnings on Wednesday, Dennis said Walmart showed strong growth in online orders, "reflecting escalating commitment to providing a more harm0nized experience across channels, with features like store pickup."

"As consumers continue to trade down due to inflationary pressures and focus more heavily on essentials," Dennis said, "Walmart's dominant and value-oriented position in groceries and basics positioned them to gain market share, even though they took a small hit to margins."

Doug McMillon, Walmart's president and chief executive officer, said in a conference call with analysts that the retailer had a strong quarter, with profit growing faster than sales.

McMillon also said the company has made more progress in returning its inventory to normal levels. Last year's inflation-related slowdown in sales plus a glut of merchandise ordered during the supply chain foul-up left Walmart, like many retailers, with too much inventory on hand.

But McMillon said Walmart is "in good shape" regarding inventory as the excess keeps coming down.

Higher sales in food and consumables has hurt gross profit, McMillon said, but expense management and progress with its newer businesses has helped Walmart grow profit ahead of sales at 17.3%.

"We're playing offense where we should and controlling what we can control," McMillon said.

Walmart's shares closed Thursday at $151.47 on the New York Stock Exchange, up $1.94, or 1.3%. Its shares have traded between $117.27 and $154.64 in the past year.

Carol Spieckerman, a retail consultant and president of Spieckerman Retail, said that while Walmart continues to see robust grocery sales, it's a low-margin category. And the expectation that grocery sales will lure shoppers to apparel, home and other more profitable categories "isn't panning out for now," she said.

Walmart's convenience options follow the same dynamic, Spieckerman said.

"Walmart has wisely invested in building a portfolio of convenience options that meet customers where they are, yet grocery is the popular choice in this case as well," Spieckerman said.

"Increases in food costs have left shoppers with less to spend, once again supporting a grocery-centric trend," she said.

Walmart's ability to draw higher-income shoppers "should pay off for the long haul once consumer confidence rebounds," Spieckerman said. "This is particularly true as Walmart continues to make significant upgrades to its online shopping experience."

Walmart's U.S. unit, by far its largest, posted net sales of $103.9 billion in the quarter, up 7.2% from last year's first quarter.

Sales at stores open at least a year, also called same-store sales, more than doubled to 7.4%. This figure excludes sales of fuel. The company also gained market share in grocery, especially among higher-income households.

Same-store sales are considered a key indicator of a retailer's health.

The unit's e-commerce business grew 27%, driven largely by store pickup and delivery, as well as advertising. Walmart Connect, its advertising business, shot up nearly 40%.

Walmart International's net sales rose 12.9%, to $26.8 billion in constant currency, led by China, Walmart de Mexico y Centroamerica and Flipkart in India.

E-commerce sales, helped by strong store fulfilment and advertising, jumped 25%.

At Sam's Club, Walmart's members-only warehouse division, net sales including fuel grew 4.5% to $20.5 billion. Same-store sales, excluding fuel, were up by 7%.

Curbside pickup led its 19% growth in e-commerce. And active advertisers on the unit's Members Access Platform jumped more than 50% over last year's first quarter.

Memberships reached another record high in the quarter, with greater numbers of millennials and the Gen Z population signing up. Membership income grew 6.3%.

Walmart also addressed its guidance for the second quarter and the fiscal year.

Chief Financial Officer John David Rainey said the retailer has raised its full-year guidance, and now expects net sales in constant currency to grow about 3.5%. Walmart expects its U.S. and international units to increase slightly faster than previously expected and Sam's Club to remain within February's guidance.

For the second quarter, the company expects adjusted earnings per share of $1.63 to $1.68.

Walmart will hold its annual shareholders business meeting on May 31 and its celebration for employees and shareholders on June 2.

A replay and transcript of Thursday's conference call with investors are available at Walmart's corporate website by logging into http://corporate.walmart.com/newsroom/financial-events and selecting the First Quarter Earnings Release event.