Fort Smith based ArcBest reported record sales and profits and beat analyst's expectations on Friday, with each of its operating segments booking significant revenue growth when compared to last year.

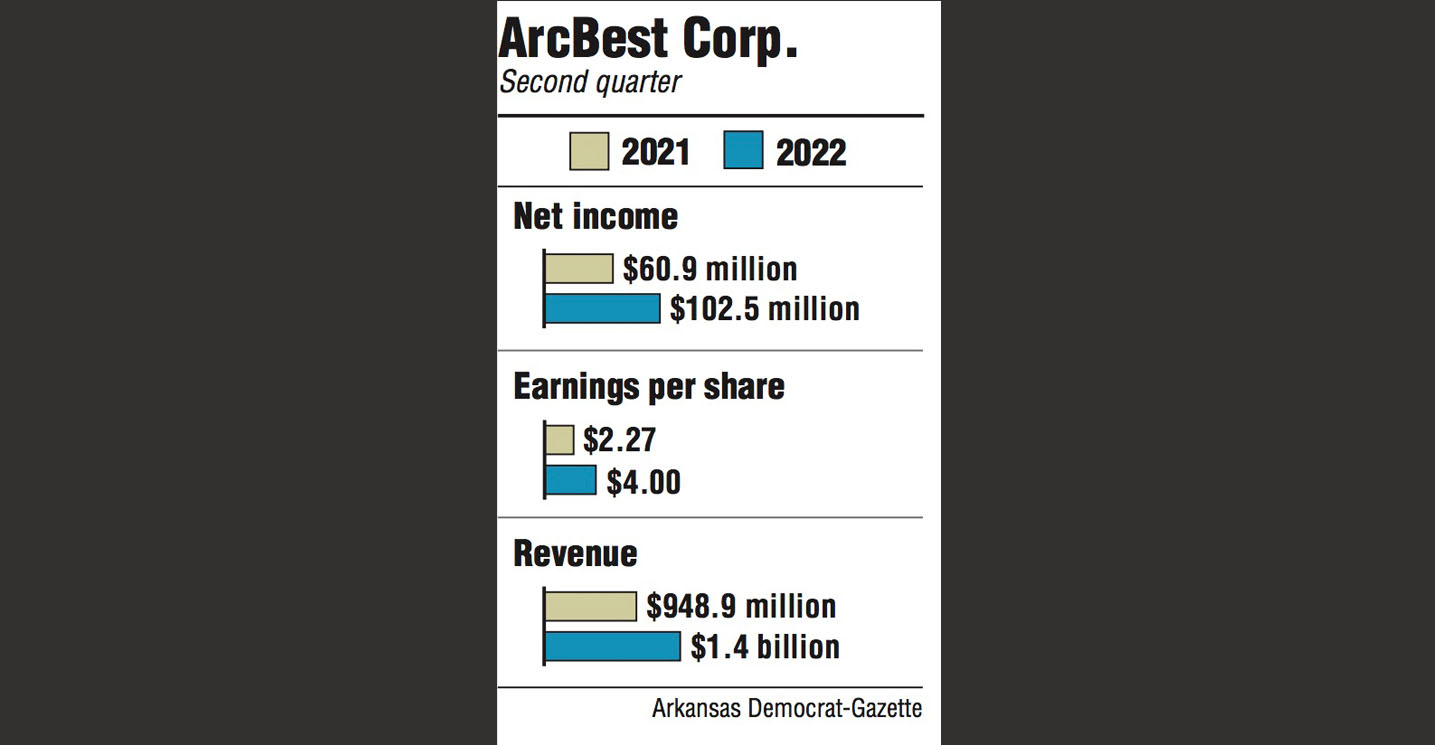

The trucking and logistics company reported net income of $102.5 million or $4 a share for the quarter ended June 30, up from $60.9 million or $2.27 per share for the year ago quarter. A consensus estimate of 10 analysts had expected earnings of $3.95 a share, according to Yahoo Finance.

Revenue for the period was $1.4 billion, up 47% from $948.9 million for the second quarter of 2021. An average estimate of seven analysts puts expected revenue of $1.37 billion.

ArcBest said in an earnings release its second quarter revenue and net income set company records.

ArcBest released its earnings before the markets opened Friday. ArcBest shares closed at $88.60, up 92 cents or 1% in trading Friday on the Nasdaq exchange. Shares have traded as low as $57.80 and as high as $125 over the past year.

Judy R. McReynolds, ArcBest's chairman, president and chief executive officer, during a conference call with analysts on Friday morning, said the company is seeing strong demand and its focus on strategic growth is paying off. She said as supply chains become more complex, ArcBest's customers are looking for more flexibility, something the company's "mode agnostic approach" can readily supply.

ArcBest's asset-based business, which consists of ABF Freight, posted revenue of $802.6 million compared to $652.8 million, a per-day increase of 22.9%. Operating income for the period was $116.7 million compared to $63.9 million for the year ago period. Billed revenue per hundredweight increased 17.7% pushed up by higher fuel surcharges. Revenue per hundredweight on less-than-truckload-rated business, excluding fuel surcharge, was up.

The company noted the segment's strong revenue gains were a product of healthy pricing environment, higher fuel surcharges and an increase in ABF Freight's average weight per shipment.

According to the U.S. Energy Information Administration, for the week ending July 25, the average price of on-highway diesel fuel was $5.27 a gallon, down 16 cents from a week earlier, but $1.93 per gallon higher than the same week a year ago.

The American Trucking Associations seasonally-adjusted For-Hire Truck Tonnage Index was up 2.7% in June after ticking up 0.3% in May, according to a release earlier this month. Compared with June 2021, the index was up 7.9% -- the tenth straight year-over-year gain and the largest since June 2018.

"June's jump tells me a couple of things: first, the transition in the freight market from spot back to contract continues. ATA's tonnage index is dominated by contract freight, so while the spot market has slowed as freight softens, contract carriers are backfilling those losses with loads from shippers reducing spot market exposure, ATA's Chief Economist Bob Costello said in a statement. "Essentially, the market is transitioning back to pre-pandemic shares of contract versus spot market.

"Second, and perhaps equally important, while economic growth is expected to be soft overall in the second quarter, the goods-economy wasn't as bad as feared," he said.

ArcBest's asset-light business, which covers logistics, transportation management and household goods moving services, booked revenue of $631.8 million compared to $330.3 million for the year-ago period, a per-day gain of 91.3%. Operating income was $29.1 million, up from $16.3 million for the same quarter last year.

The quarter includes the addition of truckload brokerage firm MoLo Solutions, which ArcBest acquired in the fourth quarter of 2021. The company credited higher revenue and shipment totals compared to the second quarter of 2021 on MoLo's additional business. It said the integration of MoLo was on schedule.