Bank OZK of Little Rock on Thursday announced robust fourth-quarter earnings, with net income and earnings per share both climbing by 19% for the period that ended Dec. 31. OZK also reported that those key metrics were down by more than 30% for the full year.

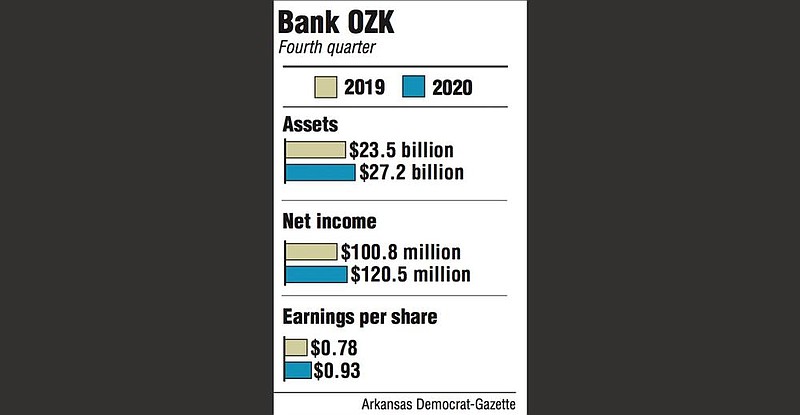

Net income for the fourth quarter was $120.5 million, a 19.5% increase from $100.8 million reported in the fourth quarter of 2019.

At the same time, earnings per share reached 93 cents, a 19.2% increase from 78 cents last year. The bank blew past analysts' consensus of 80 cents per share for this year's fourth quarter, according to information from Zacks Investment Research.

For the full year, net income was $291.9 million, plummeting 31.5% from $425.9 million for 2019. Earnings per share in 2020 were $2.26, down 31.5% from $3.30 in 2019.

"We are pleased to report one of our best quarters ever, highlighted by record quarterly net interest income, our second highest quarterly net income in company history, excellent asset quality and an efficiency ratio among the best in the industry," George Gleason, chairman and chief executive, said in a news release. "It was a strong finish to a challenging year."

Earnings were released after the stock market closed Thursday.

Bank OZK has scheduled a conference call with analysts at 10 a.m. today to discuss the financial results. The number for the call is (844) 818-5110 and it also is available on the web at ir.ozk.com.

Last year, Bank OZK and other financial institutions began increasing reserves to meet new regulatory requirements and to shore up against the economic turbulence generated by the spreading coronavirus.

"Net income and diluted earnings per share for the full year of 2020 reflected the substantial reserve build during the first two quarters of 2020 related to the actual and expected economic impacts of the covid-19 pandemic," the bank said in management comments released in conjunction with the earnings report Thursday.

The current expected credit losses methodology includes factors such as unemployment rates and business and economic conditions to determine how much money banks have to set aside to cover potential losses. The persistent economic troubles and high unemployment rates in 2020 -- compared with those of 2019 -- forced banks to increase reserves that otherwise would have boosted their bottom lines.

In 2020, Bank OZK's provisions for credit losses reached $203.6 million, ballooning from $26.2 million in 2019.

Bank OZK set a quarterly record for net interest income, which increased 10.5% to $237.6 million. Net interest income was $215 million in the 2019 fourth quarter.

For the full year, net interest income was up slightly to $888.6 million, compared with $884.2 million in 2019.

Little Rock banking analyst Garland Bins said Bank OZK recorded an outstanding performance for the year.

"[It] was an exceptionally good year for Bank OZK considering the covid-19 environment," Bins said. "The fourth quarter reflected a solid year for Bank OZK with good earnings, a strong capital base and a continuation of controlling overhead costs.

Net interest margin dropped to 3.88% in the quarter, compared with 4.15% a year ago. The bank attributed the decline to Federal Reserve interest-rate cuts and an increase in liquidity.

"The Fed's substantial and rapid cuts in the Fed funds target rate in the first quarter of 2020 caused our loan yields to drop much more rapidly than we were initially able to adjust our deposit rates," the management comments said. "In addition, throughout 2020, we held increased amounts of liquidity in the form of cash balances and very short-term securities, and this additional liquidity has had a negative impact on our net interest margin."

The bank had total assets of $27.2 billion, increasing from $23.5 billion in 2019. Total loans also increased, rising 9.6% in the quarter to $19.2 billion from $17.5 billion last year.

Overall, the bank's executive team said it was pleased with the performance.

"Our team came through really well in 2020, and we ended the year well positioned for 2021," it said in the management comments.

The annualized return on average assets was 1.79% for the fourth quarter compared with 1.74% for the last quarter of 2019.

OZK's stock price is up 10.7% since the beginning of the year; the S&P 500 has gained only 2.6% by comparison, according to Zacks. The bank's shares closed Thursday at $34.08, down 54 cents.

Bank OZK has 250 offices in 10 states: Arkansas, Georgia, Florida, North Carolina, Texas, Alabama, South Carolina, New York, California and Mississippi.