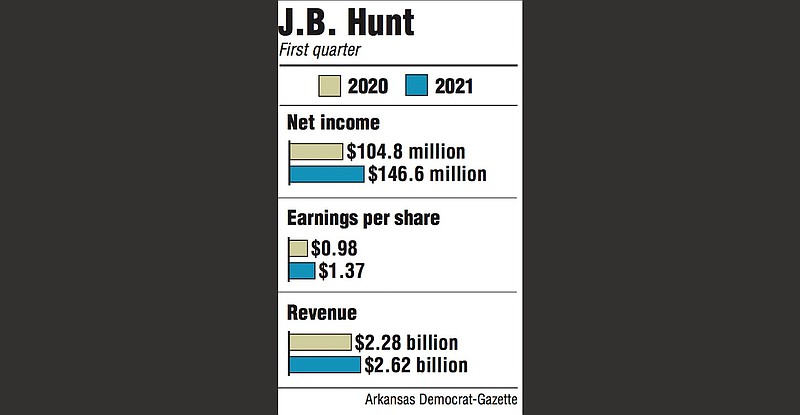

J.B. Hunt Transport Services Inc. on Thursday reported first quarter 2021 earnings of $146.6 million, up 40% from a year ago.

Revenue was $2.62 billion. The Lowell-based carrier exceeded analyst expectations for the quarter.

In a conference call Thursday after the stock market closed, J.B. Hunt executives said they were excited about the company's results and looked forward to growth opportunities in the year ahead.

"I am extremely proud of this team of leaders that not only navigated us though a challenging 2020, but hit the ground running in the first quarter," said John Roberts, J.B. Hunt's president and chief executive officer.

In an environment of elevated demand and a tight labor market, the quarter also had its challenges, including higher driver wages and recruiting costs and adverse weather that led to rail congestion in February.

Despite headwinds, J.B. Hunt reported strong profit and revenue growth with much of the upside coming from the company's Intermodal and Integrated Capacity Solutions segments.

The Intermodal, or rail freight, segment had a 3% decline in volumes compared with year-ago totals, the loss attributed to severe weather. Winter storms negatively affected volumes by 25,000 loads, and network disruptions continued to affect volumes in March. This was offset by a 5% increase in gross revenue per load, resulting in segment revenue of $1.18 billion. Operating income rose 5% to $107.5 million compared with the first quarter last year.

The Integrated Capacity Solutions, or asset-light brokerage, segment showed strong growth driven by a 58% increase in revenue per load because of higher spot and contract rates. Segment revenue was $525 million, up 56% from a year ago. Operating income increased to $7.3 million compared with a loss of $18.9 million in the same period last year.

According to a FactSet consensus, Wall Street analysts anticipated earnings per share of $1.17 or lower for J.B. Hunt's first quarter. However, the company outperformed, posting an earnings per share of $1.37.

Analyst Justin Long of Stephens Inc. said all five of J.B. Hunt's segments beat his estimates.

"This was a strong quarter across the board as very favorable freight market fundamentals offset the negative impact of the weather," he wrote in a research brief Thursday.

The Dedicated Contract Services, or fleet outsourcing, segment had higher utilization rates and less idle equipment in the quarter compared with last year, resulting in revenue of $580 million and operating income of $74.3 million.

The Final Mile Services segment benefited from the addition of customer contracts implemented over the past year, resulting in a 31% revenue increase of $202 million. Operating income was $8.5 million compared with a loss of $3.3 million in the first quarter of 2020.

The trucking segment had a 28% increase in revenue per loaded mile compared with the same period last year as contractual customer rates increased 14%. Segment revenue was $150 million, a 43% increase from a year ago. Operating income rose to $10.2 million from $1.8 million in the first quarter of 2020.

J.B. Hunt had total debt of $1.3 billion at the end of March, comparable to debt levels in December 2020. Cash and cash equivalents were $553 million.

Net capital expenditures were $86 million, a 33% decline from the first quarter last year.

J.B. Hunt shares rose 59 cents to close Thursday at $169.77.