Home BancShares Inc. opened the year with record quarterly earnings, reaching new highs for net income and earnings per share.

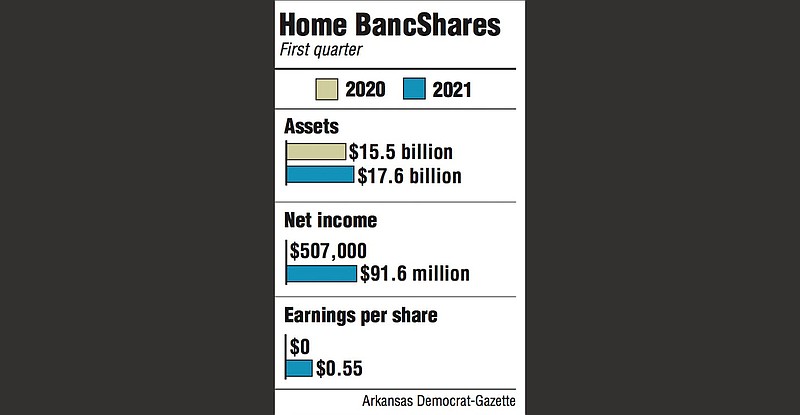

The Conway bank reported Thursday that net income jumped to $91.6 million for the first quarter ending March 31. The bank reported net income of $507,000 in the first quarter of 2020.

Earnings per share reached 55 cents, compared with no earnings per share last year. Earnings per share was 47 cents, adjusted for non-recurring gains, which beat analysts' consensus of 44 cents per share.

Total assets were $17.2 million in the first quarter, compared with $15.5 million over the same period last year.

In the first quarter of 2020, Home BancShares and financial institutions across the nation realized steep earnings declines as they adjusted to account for the looming coronavirus pandemic and new federal regulations. Last year, the bank set aside $77 million in reserves to cover potential loan losses.

Home BancShares Chairman and Chief Executive Officer John Allison boasted about the overall quarterly performance, calling it "the most powerful quarter in the company's nearly 22-year history."

The company said Thursday that it didn't record any credit loss expense in the first quarter, noting in a statement that "an additional provision for credit losses on loans was not necessary as the current level of the allowance for credit losses was considered adequate as of March 31."

Yet the bank's allowance for credit losses inched up slightly in the quarter to 2.25% of total loans, compared with 2.01% of total loans in the first three months of last year.

Stephens Inc. analyst Matt Olney called the results "excellent," noting the bank's net interest income performance and lower operating expenses.

Net interest income in the first quarter was $148 million, above analysts consensus forecast of $145.4 million. In 2020's first quarter, net interest income was $139.7 million. Net interest margin dropped to 4.02% from 4.22% in the first quarter of 2020.

Total operating expenses fell to $15.7 million from $17.9 million last year. Total deposits were $13.5 million, compared with $11.5 million a year ago.

"It was a great quarter," Allison told analysts in a conference call Thursday afternoon.

One area of concern during the quarter was organic loan growth as the bank recorded a decrease of $442.2 million in loans. Chief Lending Officer Kevin Hester told analysts that that should rebound this year. "I'm confident the second half of the year will result in organic loan growth," Hester added.

In another report after the call, Olney of Stephens Inc. was encouraged that the loan situation will improve. "Core loan balances remain pressured," he wrote, "but we're encouraged to hear commentary of a late quarter inflection with improving pipelines that could potentially stabilize balances in the near term."

Home BancShares is actively pursuing merger-and-acquisition (M&A) opportunities, Allison said. "We have a few out there" in the pipeline, he said, adding that the company is in talks now with another bank that was not disclosed.

The company is looking at acquisitions in the $2 billion to $3 billion range, Allison said. "I think we've got one we can get done and maybe another one," he said.

Home BancShares is set up nicely to pursue merger-and-acquisition activity, according to Olney, who wrote: "we consider HOMB to be a premier acquirer in the region given its M&A history and strong currency."

Meanwhile, the bank will continue its share buyback program and recently authorized another 20 million shares for repurchase. In the first quarter, the bank repurchased 330,000 shares for about $8.8 million at a weighted average price of $26.55.

For the first time in a year, there was little discussion of the pandemic and no comments indicating bank officials are concerned that it will continue as a problem this year.

There has been little change in loan modifications from quarter to quarter, Hester said, and the bank has about $270 million in modifications, representing 2.5% of its loan portfolio.

However, the hospitality industry is moving toward a turnaround, according to Hester. "Virtually all of our hotel operators have experienced a significant pickup in occupancy in March," he added.

Home BancShares has made more than 4,000 Paycheck Protection Program loans with a total value of more than $350 million to small businesses, Hester said.

The economic forecast is bright going forward, Allison said. "I don't foresee any losses as a result of covid," he told analysts in the call. Home BancShares did take a $2.5 million charge-off related to non-performing assets. Non-performing loans are less than 1% of total loans as of March 31.

"Business is picking up, and I think we're in for a powerful recovery," Allison said, adding that there is a lingering concern that inflation could slice into an economic rebound.

The company's stock, like many banking firms over the past few months, has been on a steady climb in 2021. Shares are up about 38% since the end of last year, closing Thursday at $26.91.