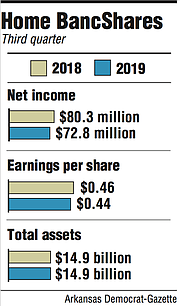

Home BancShares Inc. reported Thursday that third-quarter earnings were down slightly from a year ago, recording a $7.5 million drop in net income and an earnings per share drop of 2 cents to 44 cents per share compared with a year ago. Total assets remained steady at $14.9 billion for the quarter ending Sept. 30.

Conway-based Home Bancshares, parent of Centennial Bank, reported net income of $72.8 million compared with the $80.3 million recorded in the third quarter of 2018. Earnings per share of 44 cents were in line with forecasts from analysts who cover the bank.

"I'm pretty proud of the quarter," Chairman John Allison said on the company's earnings call.

Home Bancshares cited a net interest margin of 4.32%, up from 4.28% in the second quarter of this year. "I think this speaks to the discipline within this company and is a performance metric we are very proud of," said Tracy French, Centennial Bank president and chief executive officer.

Stephens Inc. analyst Matt Olney cited net interest margin as a positive achievement in the quarter. "We're pleased to see the [margin] remain relatively stable in the challenging interest rate environment," Olney wrote in a report issued after earnings were released Thursday morning.

The Federal Reserve lowered interest rates twice in the third quarter, most recently in September, and the target range for the federal funds rate is 1.75% to 2%. The federal funds rate refers to the interest rate that banks charge other banks for lending them money, and it affects the interest rates banks charge consumers on credit cards, mortgages and bank loans.

Home Bancshares closed Thursday at $18.66, down 0.8%. Share price is down about 10% from a year ago.

Allison was pleased with reporting tangible book value per share of $8.83 compared with $7.68 over the same quarter a year ago, a 15% increase.

"We made the strategic decision to participate in a stock repurchase program, although it is dilutive to tangible book [value]," Allison said. "If we had not bought back stock, our year-over-year increase in tangible book value would have been 20.2%."

This year, Home Bancshares said it has repurchased $75.4 million of its common stock. The repurchase, Olney noted, included about 300,000 fewer shares than analysts were expecting in the quarter. Allison said the bank likely will continue its share-buyback approach.

At the end of the third quarter, total loans were $10.77 billion. Total deposits were $11 billion. Nonperforming loans to total loans was 0.54% in the quarter, compared with 0.47% for the same period last year.

Little Rock banking attorney Garland Binns said Home BancShares is moving steadily ahead. "Net income and diluted earnings per share for Home Bancshares have been fairly consistent during the past year," Binns said.

Home Bancshares executives said they will continue to take a conservative approach in what they described as an uncertain loan market. "It is a time to be very, very cautious," Allison said. "We're not going to sell our future."

As interest rates decline, many institutions are making highly leveraged loans at lower interest rates -- creating greater risks to the bottom line. Home Bancshares will avoid that approach, Allison said, noting that the company will "hold steady" going forward and not chase unprofitable business.

"We're going to protect our assets," he added. "We're going to book the good loans and let the bad ones go away."

Home Bancshares has 77 branches in Arkansas, 76 in Florida, five in Alabama and one in New York City.

Business on 10/18/2019