J.B. Hunt Transport Services Inc.'s revenue grew during the trucker's 2018 fourth quarter as net and operating incomes skidded, in part, from arbitration fees.

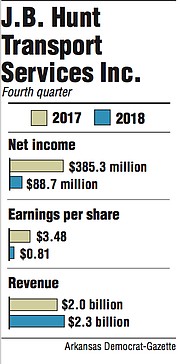

The Lowell-based transportation company reported a profit of $88.7 million, or 81 cents per share, a 77 percent drop from 2017, when the company reported a profit of $385.3 million, or $3.48 per share.

Revenue was $2.3 billion, up from $2 billion a year ago.

David Mee, J.B. Hunt's chief financial officer, said in Thursday's earnings call that "we felt it was a good quarter, but I wouldn't go as far as to say it was a great quarter."

Mee said rail service interruptions in the intermodal sector and demand that "did not accelerate throughout the quarter" were reflected in the quarter that ended Dec. 31.

Operating income fell 16 percent to $123 million compared with last year's quarter. Hunt's operating income grew year over year for the Dedicated Contract Services and Integrated Capacity Solutions business segments. Income from Hunt's Intermodal segment fell 65 percent to $32.4 million compared with last year's quarter.

The steep decline in net profits year over year stemmed, in part, from a tax law passed by Congress in the winter of 2017. The legislation created a windfall reflected in business earnings reports this time last year. As a result, net profits more than tripled in J.B. Hunt's fourth quarter that year compared with 2016, when income reached $117.6 million.

This, coupled with a one-time pretax charge claimed by intermodal partner BNSF Railway Co. during the period, led Stephens Inc. analyst Brad Delco to believe the company beat Wall Street expectations.

The Lowell-based freight and logistics firm recorded a pretax charge of $89.4 million in the fourth quarter after arbitration talks with BNSF, which give J.B. Hunt deliveries an edge over competitors. Arbitration, a form of dispute resolution, is used to settle disagreements outside court. They entered arbitration in January 2017 and hired a third party to take a closer look at joint revenue division results dating back to May 2016. After closed talks, Hunt recorded a total charge of $134 million, or 93 cents per share, for the 12 months that ended Dec. 31.

Hunt shares rose $2.97 to close Thursday at $99.92. Earnings were released after markets closed.

Aside from arbitration charges, rising fuel costs and shrinking loads that stem from a tight labor market continue to pressure the industry. Meanwhile, mandated electronic logging devices, which critics say restrict drivers to work a maximum of 11 hours a day, affecting their pay, have upset drivers as companies strive to retain talent in an ongoing driver shortage.

Annual results show net income fell during fiscal 2018 compared with a year earlier as revenue and operating income rose. J.B. Hunt's profit fell 28 percent to $489.5 million, or $4.43 per share, down from $686.3 million, or $6.18 per share, posted for the 12 months that ended Dec. 31, 2017.

Annual revenue, including surcharges, grew 20 percent to $8.61 billion from a year ago. The report shows more reported loads in the company's Intermodal, Dedicated and Integrated Capacity Solutions segments.

As shipping demand rises, so do the rates and wages to keep truckers working. J.B. Hunt spent $4.43 billion on salaries, wages and employee benefits in fiscal 2018, which is 21 percent higher than 2017's expenses.

In the era of online shopping and overnight shipping, transportation companies have snapped up final-mile carriers that deliver big or bulky products into neighborhoods. J.B. Hunt has entered multimillion-dollar deals to buy two -- Special Logistics Dedicated LLC and Cory 1st Choice Home Delivery -- since the summer of 2017. Executives said in the company's 2017 annual report they expected sector growth to continue as more shoppers use the Internet.

Business on 01/18/2019