America's Car-Mart posted a profit Tuesday for its fiscal third quarter that significantly beat analysts' estimates.

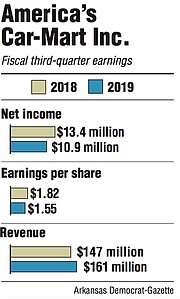

The Bentonville-based buy-here, pay-here used-car dealer reported a profit of $10.9 million, or $1.55 per share, for the quarter ending Jan. 31, compared with $13.4 million, or $1.82 per share, for the same quarter a year before. A consensus of four analysts predicted $1.03 per share, according to Yahoo Finance.

Revenue for the third quarter stood at $161 million, up from $147 million for the third quarter of fiscal 2018. The consensus of two analysts had predicted revenue at $164 million.

The news came after market close Tuesday. The company is to hold a conference call with analysts today.

Shares ended trading at $82.20 Tuesday, up 6 cents, or less than 1 percent, in trading on the Nasdaq stock exchange. Car-Mart shares have traded as low as $46.40 and as high as $100.75 over the past year.

In a statement, Jeff Williams, the used-car dealer's president and chief executive officer, said the company's success is a result of its focus on business basics, including customer service and investments in lot manager recruitment and training.

The company is opening dealerships in Conway and Bryant, as well as in Chattanooga, Tenn., and Tyler, Texas. Car-Mart runs 143 dealerships in Alabama, Arkansas, Georgia, Indiana, Iowa, Kentucky, Mississippi, Missouri, Oklahoma, Tennessee and Texas.

Vickie Judy, Car-Mart's chief financial officer, said in a statement that the company has repurchased 141,500 shares of its stock at the cost of $10.2 million and noted that Car-Mart will buy back shares opportunistically moving forward.

The average sale price per vehicle for the period was $11,146, up $484, or 4.5 percent from the same period in 2018. In the third quarter, the company sold 11,963 vehicles, up from 11,430 last year. On average, Car-Mart lots sold 27.9 vehicles per lot per month, up from 27.2 for the same quarter last year.

Net charge-offs stood at 6.2 percent, down from 7.4 percent for the third quarter of 2018. Charge-offs are an indication of debt that is unlikely to be collected. Car-Mart's customers often do not have access to traditional vehicle financing because of poor credit or no credit history. Accounts over 30 days past due were 3.2 percent, down from 4.1 percent for the same quarter last year.

Business on 02/20/2019