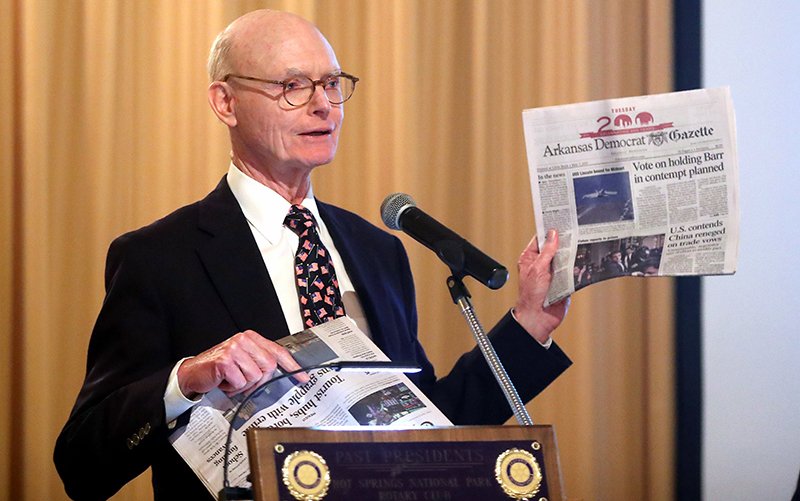

WEHCO Media, Inc. will receive $12.3 million in Paycheck Protection Program loans through the U.S. Small Business Administration, said Walter E. Hussman Jr., the company's chairman.

WEHCO Media is the parent company of the Arkansas Democrat-Gazette, Northwest Arkansas Democrat-Gazette, eight other daily newspapers and eight weekly newspapers. The company also has a cable television business.

WEHCO has about 1,300 employees, said Hussman. About 900 of them work at the company's newspapers.

The Paycheck Protection Program loans were created to help businesses keep their workforces employed during the covid-19 pandemic.

Hussman said WEHCO newspaper employees who recently volunteered to take furloughs, salary cuts or reductions in working hours will no longer need to do so.

Hussman and Nat Lea, president and chief executive officer of WEHCO, emailed the company's full-time newspaper employees April 13 asking for volunteers.

"We had over 90 individuals in our newspapers volunteer, close to 10%," they wrote in a letter sent to WEHCO newspaper employees late Monday.

"We asked for these volunteers due to hundreds of thousands of dollars of advertising canceled in the month of March," they wrote. "In April, all of our newspapers combined saw an even larger, 50% drop in our advertising revenues, something we have never experienced."

Advertising still represents more than half of the company's revenue, they wrote. So other cuts were going to be necessary.

"Had this not been approved, that 10% of our employees wouldn't have been enough," Hussman said late Monday. "If we had not been able to do this, we'd have fewer people out there covering the covid-19 crisis."

Hussman said each of WEHCO's 21 separate companies is receiving a loan through the program, and the total amount is $12.3 million. He said the loans are based on number of employees.

The Arkansas Democrat-Gazette will receive a $4.2 million loan. The Northwest Arkansas Democrat-Gazette will receive a $1.9 million loan. Besides being chairman of WEHCO, Hussman is publisher of the newspapers.

"Originally, we did not believe we could qualify for a federal Payroll Protection Program loan, where if maintaining our payroll, it would result in a forgiveness or grant," Hussman and Lea said in the email to newspaper employees. "However, last week, we learned our company could qualify. As a result, we applied, and our SBA loans have been approved and funded covering a full eight weeks of payroll."

"This will give us eight weeks for stores to reopen and advertising to return to more normal levels, and if so, it may eliminate the need for further cost reductions," they said.

According to the U.S. Treasury Department, "The Paycheck Protection Program authorizes up to $349 billion in forgivable loans to small businesses to pay their employees during the covid-19 crisis. ... The loan amounts will be forgiven as long as the loan proceeds are used to cover payroll costs, and most mortgage interest, rent and utility costs over the eight-week period after the loan is made; and employee and compensation levels are maintained. Payroll costs are capped at $100,000 on an annualized basis for each employee."

Hussman said Simmons Bank of Pine Bluff submitted the loan application for WEHCO.

Hussman said WEHCO's newspapers qualify for loans independently and "in the aggregate." Newspaper companies must have fewer than 1,000 employees to qualify, he said. Also, "wired telecommunications" companies qualify if they have fewer than 1,500 employees, said Hussman, so WEHCO's cable business is considerably smaller than that.

"There is still a lot of uncertainty, so we will have to see how much progress can be made by early July," Hussman and Lea wrote in the email to employees. "Another uncertainty is in borrowing with a federal program, something we have never done. In the event that we have to repay the loan and it is not forgiven, we will incur a significant loss for those two months. But with our statement of core values placing the interests of employees ahead of shareholders, we are willing to take that risk in order to maintain the wages, hours, and salaries of employees."

Metro on 05/05/2020