FORT SMITH — Voters rejected Tuesday a proposal to levy a temporary 1 percent sales tax for the U.S. Marshals Museum to pay for completion of the U.S. Marshals Service’s national museum on the banks of the Arkansas River.

Complete but unofficial results were:

For 3,670

Against 6,726

“We are disappointed that tonight’s outcome was not favorable,” museum Foundation President Jim Dunn said in a prepared statement. “We are heartened by the many expressions of support by even those who opposed our effort. We have overcome many obstacles to get this far and we ask that all the citizens of Fort Smith unite and help complete the museum as soon as possible.”

Fort Smith attorney Joey McCutchen, a leader among opponents of the tax, also said Fort Smith residents should unite to help complete the museum. McCutchen said the people of Fort Smith and Arkansas have done their part to donate money for the museum, and that it is up to the museum to do its part and raise the money through donations.

“I think the people of Fort Smith have sent a loud and clear message that we need to focus on our priorities,” he said. “We support the museum, but we do not support it being paid for with public funds.”

Museum officials have said if the sales tax failed they would continue raising the $15.3 million needed to design and build the exhibit experience in the museum along with the start-up cost and working capital. The museum raised about $35 million in donations and in-kind donations over nearly 10 years.

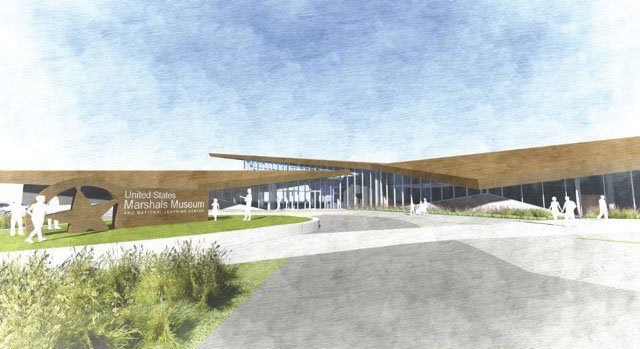

Construction is underway on the $19.1 million, 50,000-square-foot museum building.

City directors set Tuesday’s election by ordinance in December when museum officials requested that directors ask voters to pass a non-renewable 1 percent sales tax for nine months that would raise $15.5 million to $16 million. They asked for the tax because a large donation last summer that was a matching challenge had fallen through.

The tax met resistance from the start. Director George Catsavis voted against the museum tax ordinances, saying he did not like the idea of a special election. He argued that typically low turnout in special elections favored those who support the issue. The election should have been held during the Nov. 6 general election when more voters go to the polls, he said.

Catsavis and other opponents said Fort Smith residents are overtaxed. He said resident bear a high sales tax rate of 9.75 percent and have endured three consecutive years of sewer rate increases to pay for sewer system improvements mandated by a federal consent decree.

Many opponents of the tax said it is unfair to use public tax money for a private museum, one that some speculated would have trouble keeping its doors open without a future infusion of public tax money.

Opponents also said the public facilities board was an end run around the Arkansas Constitution that allowed Fort Smith directors to attempt to provide public tax money for the private museum. They questioned what the responsibility of the board would be if the museum closed, who would serve on the board and how board members would be chosen.

Included in the directors’ ordinances was the formation of a public facilities board, which is established by Arkansas law, that would purchase and own the museum and grounds and lease it back to the museum, which would operate the museum.

The public facilities board’s ownership of the property was necessary so public tax money could be used by a private non-profit corporation for a public purpose.

Debate over the tax was fierce. Signs for and against the tax sprang up in yards all over town and were even strapped to trailers and towed around town. Columns arguing for and against the tax appeared in the local newspapers, and letters to the editor regularly popped up on editorial pages.

Opponents and proponents held public meetings regarding the tax. Marshals Museum officials held three community meetings over six weeks that were attended by a total of about 100 people. Opponents of the tax held two public meetings sponsored by Citizens Against Unfair Taxation that drew a total of about 150.

The museum and its 1,000-items collection will feature five galleries: Defining Marshals; Campfire Stories Under the Stars; Frontier Marshals; A Changing Nation; and Modern Marshals; and the Samuel M. Sicard Hall of Honor honoring marshals killed in the line of duty and the National Learning Center.

Museum officials and supporters said the tax money would have been well spent. They estimate the museum will draw more than 125,000 visitors to Fort Smith annually and will have an annual $13 million to $22 million impact on the local economy.