Bolstered by rising individual income tax and sales tax collections, state general revenue in August increased by 4.7 percent over the same month a year ago to a record of $490.3 million for the month.

Last month's collections increased by $22.1 million over those in August 2017 and exceeded the state's forecast by $8.5 million, or 1.8 percent, the state Department of Finance and Administration said Wednesday in its monthly revenue report.

The previous record for August was the $478.1 million collected in 2015, said Whitney McLaughlin, a tax analyst for the state Department of Finance and Administration.

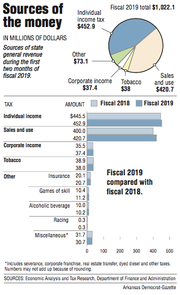

Individual income taxes and sales and use taxes are state government's two largest sources of state general revenue. Collections of both taxes increased in August by more than 5 percent over the same month a year ago.

Gov. Asa Hutchinson said the report "reflects continued, balanced growth of the state's economy with all major areas exceeding expectations.

"While it is still early in the new fiscal year, we are in a solid position entering September at $18 million above forecast," the Republican governor said in a written statement. He was referring to how much net general revenue exceeds the forecast for the first two months.

August is the second month of fiscal 2019, which started July 1.

Richard Wilson, an assistant director of research for the Bureau of Legislative Research, which works for state lawmakers, said August revenue "appears to be another solid month."

Midway through the fiscal year, individual income tax rates for people making less than $21,000 a year will be cut under a 2017 law projected by the state to reduce general revenue by about $50 million a year.

In addition, the state's sales tax on groceries is expected to be trimmed from 1.5 percent to 0.125 percent on Jan. 1 under a 2013 law that authorizes using the end of desegregation payments -- about $65 million a year -- to three Pulaski County school districts to cut the grocery tax, according to state officials.

During the first two months of fiscal 2019, total general revenue collections reached $1.022 billion, an increase of $29.8 million or 3 percent above the same period in fiscal 2019. It topped forecast by $15.7 million.

According to the finance department, August's general revenue included:

• An $11.5 million or 5.6 percent increase in individual income tax collections over year-ago figures to $216.9 million, which exceeded forecast by $4.7 million.

Individual withholdings are the largest category of individual income tax collections. They totaled $202.6 million in August, an $11.2 million increase over the same month a year ago and exceeded the state's forecast by $4.8 million.

The report reflects more people working and more people working longer hours, said John Shelnutt, the state's chief economic forecaster.

"If somebody wants to work, there is a job these days. It is really a good situation to be in," said finance department Director Larry Walther.

Arkansas' joblessness rate dipped to 3.7 percent in July after five straight months at 3.8 percent, the U.S. Bureau of Labor Statistics reported last month. The lowest unemployment rate in Arkansas was 3.6 percent from February through May last year.

The national unemployment rate in July was 3.9 percent, down from 4.0 percent in June.

• A $10.8 million or 5.4 percent increase in sales and use tax collections from a year ago to $211.2 million, which exceeded the forecast by $200,000.

Sales tax collections last month increased from both consumer and business spending with the exception of motor vehicle sales, said Shelnutt.

"With the economy doing well and nationally GDP growing strongly, very little unemployment and the federal stimulus [through tax cuts] flowing through household consumption, I think it could continue," he said.

• A $1.5 million or 28.7 percent increase in corporate income tax collections over the same month a year ago to $6.6 million, which exceeded the forecast by $1.9 million or 41.5 percent in an otherwise minor month for this category.

Tax refunds and some special government expenditures come off the top of total general revenue, leaving a net amount the state agencies are allowed to spend.

Net available general revenue in August increased by $28.1 million or 6.9 percent to $434.1 million and that exceeded the state's forecast by $9 million or 2.1 percent.

During July and August, the first two months of fiscal 2019, net general revenue totaled $903.4 million, an increase of $43 million or 5 percent over the same period in fiscal 2018, exceeding the forecast by $18 million.

For fiscal 2019, the general revenue budget is projected to be $5.63 billion, or $172.8 million more than the fiscal 2018 budget. The Revenue Stabilization Act that distributes general revenue to state-backed programs also would set aside $48 million of what the governor considers surplus money for a restricted reserve fund that he said would set the stage for future tax cuts and set aside $16 million to help match federal highway funds.

In 2015 and 2017, the Legislature enacted Hutchinson's plans to cut individual income tax rates for people who make less than $75,000 a year, reducing revenue an estimated $150 million a year.

Two weeks ago, Hutchinson signaled his support for a proposal developed by state finance department officials that would cut Arkansas' three individual income tax tables to a single table and gradually cut the top rate from 6.9 percent to 5.9 percent. The changes are projected to reduce revenue by nearly $192 million a year.

The proposal was presented to the Arkansas Tax Reform and Relief Legislative Task Force, which voted to have its consultant review it. Some Democrats and Republicans have questioned whether the state can afford this size of a tax cut without jeopardizing some state services.

Asked about what the August revenue report shows about the ability of the state to finance that tax cut, Hutchinson said Wednesday, "With regards to tax cuts, I've always said that we will absorb the costs through economic growth, our continued efficiency efforts, and task force recommendations."

In the Nov. 6 general election, Hutchinson of Rogers is seeking re-election to a second four-year term as governor. His foes are Democratic candidate Jared Henderson of Little Rock and Libertarian candidate Mark West of Batesville.

Metro on 09/06/2018