Bolstered by surging sales-and-use tax revenue, Arkansas' general tax collections in April set a state record for any month, increasing by $18.5 million over the same month a year ago to $842.8 million.

April's total general revenue increased by 2.2 percent over year-ago figures, but they fell $3.4 million, or 0.4 percent, short of forecast, the state Department of Finance and Administration reported Wednesday in its monthly forecast.

The previous record for a month's collection was $824.3 million in April 2017, said Whitney McLaughlin, a tax analyst for the finance department. Historically, the best month for tax collections is the one in which tax returns are due. April is now that month, though it was May in earlier years.

While the category of sales-and-use tax collections showed a 9.5 percent increase in April compared with a year ago, individual income-tax collections rose by just 0.1 percent, the finance department reported. The state's two largest sources of general revenue are individual income taxes and sales-and-use taxes.

"Employment and wage rate growth remain strong, and I am confident the state will end the budget year in excellent shape and well positioned for the future," Gov. Asa Hutchinson said.

"The fact that we are 10 months into the fiscal year and have over a $50 million surplus is good news," the Republican governor said in a written statement.

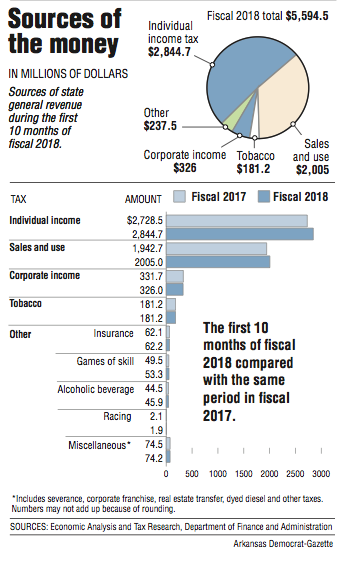

During the first 10 months of fiscal 2018, which ends June 30, general revenue collected by the state increased by $177.7 million, or 3.3 percent, over the same period in fiscal 2017, to $5.59 billion. The 10-month total exceeds the state's forecast by $29 million, or 0.5 percent.

Thus far in fiscal 2018, individual income tax collections have increased by $116.2 million, or 4.3 percent, over the same period in fiscal 2017 to $2.84 billion. That category total exceeded forecasts by $41 million, or 1.5 percent.

This is the second full fiscal year in which the governor's plan to cut individual income-tax rates for people with taxable incomes between $21,000 and $75,000 a year has been in effect. The tax cut became effective Jan. 1, 2016, and was projected to reduce revenue by about $100 million a year.

Hutchinson's plan to cut individual rates for people with up to $21,000 a year in taxable incomes will become effective Jan. 1. The state projects that plan will reduce revenue by about $25 million in fiscal 2019 and then about $50 million a year thereafter.

So far in fiscal 2018, sales-and-use tax collections have increased by $62.3 million, or 3.2 percent, over the same period in fiscal 2017 to $2 billion. The total narrowly exceeds the forecast by $1.1 million, or 0.1 percent.

Tax refunds and some special government expenditures, such as court-mandated desegregation payments, come off the top of total general revenue, leaving a net amount that state agencies are allowed to spend.

Net general revenue in April slipped by $3.8 million, or 0.6 percent, from a year ago to $657.1 million and fell $15.7 million, or 2.3 percent, below forecasts.

Individual income-tax refunds were higher than expected, by $19.1 million, in April and accounted for most of the shortfall in net revenue, the finance department said. These refunds totaled $119.1 million in April and were $20.9 million more than what was paid by the state a year ago.

That category of refunds was less than expected in January and February, but greater than expected in March and April, said Richard Wilson, assistant director for research for the Bureau of Legislative Research.

"Therefore, considering the refund season (January through May), balances are now about where they should be," Wilson said in a written statement.

Looking at the total so far in fiscal 2018, net general revenue was $151.8 million greater, or 3.4 percent, over the amount collected in the first 10 months of fiscal 2017, to $4.58 billion. So far, the net exceeds the state's forecast by $52.8 million, or 0.5 percent.

The general revenue budget in fiscal 2018 is projected to increase by $120.1 million over fiscal 2017 to $5.45 billion, according to the finance department.

In May a year ago, before fiscal 2017 ended, Hutchinson cut $43 million out of the general revenue budget for fiscal 2018. The governor also cut the budget for fiscal 2017 by $70 million, but restored $60 million on the last day of the fiscal year, after collections rebounded.

"We think we are in good shape," finance department Director Larry Walther said about the state's current position.

"Obviously, we'll be watching for the next two months, but we feel pretty good about where we are," he said. He said he doesn't know whether the state will end the fiscal year with a general revenue surplus of $50 million.

According to the finance department, April's general revenue includes:

• A $600,000, or 0.1 percent, increase in individual income-tax collections over the same month a year ago, to $522.6 million. That's $1.8 million below forecast.

Individual income-tax withholdings is the largest category of individual income tax collections.

Withholdings totaled $288.3 million in April, a $3 million increase over April a year ago and $9.7 million above forecasts.

"That was offset by the other categories of individual income [tax collections] from the filings, estimated payments and returns, and extensions," said John Shelnutt, the state's chief economic forecaster.

• An $18 million, or 9.5 percent, increase in sales-and-use tax collections over April a year ago, to $208.2 million, which exceeded forecasts by $8.3 million.

Sales-tax collections from motor vehicle sales rebounded in April to $27 million, an increase of $3 million, or 7 percent, over a year ago, after they declined in February and March from the same months in 2017, Shelnutt said.

The increased collections from motor vehicle sales "could be related to the $330 million we paid out in refunds in the past three months," he added.

Shelnutt said other categories of sales-tax collections were strong in April with the collections from "the large retail category" increasing by 3.5 percent, from food services increasing by nearly 4 percent, and from utilities increasing by double digits.

• An $800,000, or 1 percent, increase in corporate income-tax collections over April a year ago to $78.8 million, which fell $10.9 million, or 12.1 percent, below forecast.

Corporate income-tax collections are a volatile source of monthly tax collections, Walther said.

Shelnutt said the report shows the state's economy is stable and growing, "not a peak performance that you will see a major economic expansion, but close."

Asked when he foresees the next recession, he said, "We don't see one in our short-term view, which is about 2½ to three years out. We would set the record for the longest expansion next July," in 2019.

The current economic expansion started in June 2009 and has an average annual economic growth of 2.2 percent, Shelnutt said. The longest economic expansion lasted from March 1991 until March 2001 with average annual growth of 3.6 percent, he said.

A Section on 05/03/2018