WASHINGTON -- Federal Reserve Chairman Jerome Powell said Wednesday that the central bank has tools it can use to cushion the potential economic fallout from a trade war. But he told Congress the effort could be challenging if higher tariffs on foreign products push inflation up too sharply.

If the retaliatory tariffs imposed by other countries slowed the U.S. economy, Powell said the Fed could employ its normal tools, such as lowering interest rates.

"If we do have higher inflation, that could be very challenging for policy," Powell told members of the House Financial Services Committee.

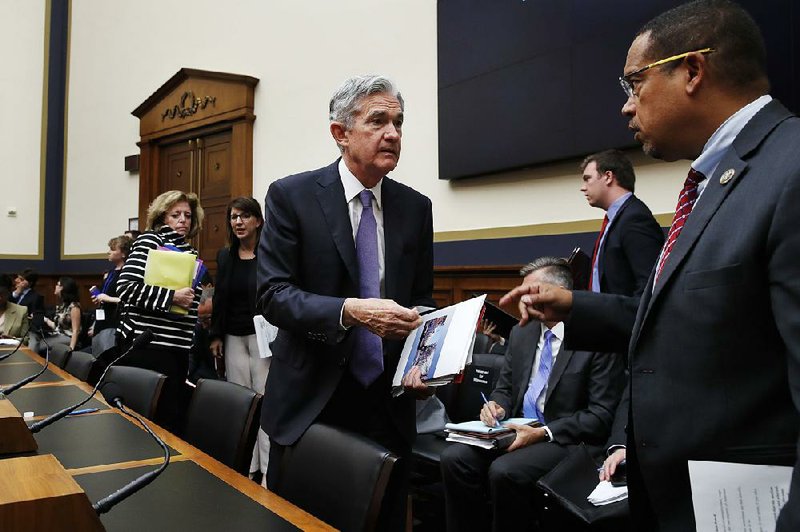

Testifying before Congress for a second day, Powell said Fed officials were hearing a "rising chorus of concern" from business contacts around the country about potential harm from President Donald Trump's tariffs.

The sentiment was echoed in the Fed's latest "beige book" report, which noted that manufacturers in all of the Fed's districts were expressing concerns about the tariffs. The report released Wednesday is based on anecdotes compiled from the Fed's 12 regional banks. It found that in many districts, manufacturers were seeing "higher prices and supply disruptions that they attributed to the new trade policies."

Asked about the findings in the Fed report, White House press secretary Sarah Huckabee Sanders said the overall economy is doing well and the tariffs are part of the president's hopes "to open up a number of markets and create a more level playing field across the globe."

The Fed's economic survey will inform discussions at the central bank's next rate-setting meeting on July 31-Aug. 1. The Fed has raised rates twice this year in response to strong growth, low unemployment and a slight rise in inflation.

The last rate increase occurred in June, and at that time, the Fed moved its projection for future rate increases this year from three up to four.

Many analysts believe the Fed will leave its benchmark rate unchanged in a range of 1.75 percent to 2 percent at the coming meeting but will raise rates again in September and December.

Powell's comments during his two days of testimony supported that view. He gave an upbeat assessment of the economy's prospects while citing rising trade tensions as a risk to the Fed's optimistic outlook.

During more than three hours of testimony before the House panel Wednesday, Powell heard widespread criticism from Democrats and Republicans about the adverse effects Trump's punitive tariffs are having on businesses and farmers in their districts.

Powell tried to avoid denouncing Trump's get-tough approach while still endorsing the benefits of free trade.

In response to one question, Powell said, "The bottom line is that a more protectionist economy is an economy that is less competitive, less productive. We know that. It is not a good thing if this is where it goes."

But Powell said the administration believes that its imposition of penalty tariffs against China and other countries will eventually end up forcing those countries to negotiate for lower tariffs.

"If this results in a more protectionist world, that would be bad for our economy and the world economy," Powell said. "That is not what the administration says it is trying to achieve."

He also said the Fed doesn't intend, unless there is a meaningful economic downturn, to change its plan for reducing the size of the central bank's balance sheet in response to the diminishing gap between short-term and long-term U.S. Treasury yields.

Some market participants and economists believe the shrinking of the balance sheet is contributing to that. Many also consider it a reliable harbinger of a coming recession when long-term yields fall below short-term yields.

A number of lawmakers praised Powell for his efforts to avoid economic jargon in explaining Fed policy and for his willingness to meet with individual lawmakers.

Powell, the first non-economist to head the Fed in nearly four decades, said his goal is to speak so that he can be understood not just by economists and Wall Street investors but also by the typical household.

He noted that he has already announced that he will double the number of news conference he holds each year from four to eight -- one after every Fed meeting starting next year

"We owe you, and the public in general, clear explanations of what we are doing and why we are doing it," Powell said in his testimony. "Monetary policy affects everyone and should be a mystery to no one."

Information for this article was contributed by Martin Crutsinger of The Associated Press; and by Reade Pickert, Christopher Condon, Rich Miller, Jeanna Smialek, Craig Torres and Matthew Boesler of Bloomberg News.

Business on 07/19/2018