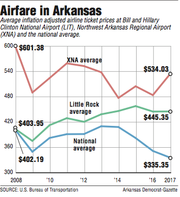

The average price for an airline ticket in the United States has fallen to $335.35, but airfares at Arkansas' two main commercial service airports aren't following suit.

The national average airfare is the lowest since the U.S. Bureau of Transportation Statistics began tracking airline ticket prices in 1993.

The state's largest airport, Bill and Hillary Clinton National Airport/Adams Field, had a $445.35 average ticket price, according to the bureau's latest survey, conducted in the third quarter of 2017. The average airfare at Arkansas' other major commercial airport, Northwest Arkansas Regional Airport, was $534.03.

Officials at both airports said they are frustrated by ticket prices and said they can do little more than try to attract budget airlines to give fliers in their markets lower-cost options. Short of that, they and industry analysts say, the airlines are charging what the market will bear.

"The pricing model for the airline is a proprietary system," said Ron Mathieu, executive director at Clinton National. "It is theirs and theirs alone. We have absolutely no input whatsoever to the pricing. In situations where you do try and talk to them about it -- and we have at times -- their response is that we charge what the market will bear.

"It's hard to argue with them," Mathieu said, "the passenger count is increasing."

A total of 2,029,309 passengers went through Clinton National last year, a 1.9 percent increase from the 1,991,504 passengers who caught flights from the airport in 2016.

ABILITY TO PAY

William Swelbar, a research engineer at the International Air Center for Air Transportation at the Massachusetts Institute of Technology and recognized expert in the airline industry, singled out Northwest Arkansas Regional and its heavy mix of business travelers to the headquarters of the world's biggest retailer, Wal-Mart Stores Inc., which is just up the road in Bentonville.

"When I look at [Northwest Arkansas Regional Airport], I also see a Huntsville, Ala., [Rocket City]," Swelbar said in an email. "Huntsville also suffers from high fares and can be largely attributed to the vibrancy of the market beginning on Sunday night when the vendors fly in for a week of work and on Friday night when the vendors fly back home.

"Markets are priced on an ability to pay, and in both cases the clientele doing business in the two cities have a unique ability to pay."

Kelly Johnson, who heads Northwest Arkansas Regional, said she and her staff are "thoroughly aware" of the high percentage of business travelers in their market and how it helps drive up the prices of airline tickets.

"We also understand completely to get those fares down, it's going to take some low-cost competition," she said. "We routinely go to ... airline speed dating conferences. If there's an airline that will meet with us, we will meet with them."

Frequent travelers such as John Wesley Hall, the longtime Little Rock defense attorney, agree that the economics of the industry work against airports the size of Clinton National and Northwest Regional.

As a defense attorney, many of his clients are in federal prisons, which he said typically are 12 miles or more outside small- and medium-size city airports that he must use.

"We at least have a decent number of flights on Delta, United and [American Airlines], and I welcome Frontier back to get to [Denver] and west," he said in an email, referring to Clinton National's airline options. "It's cheaper to fly coast to coast than from here to practically anywhere, but we're not alone in that because I've seen it's that way with any medium-sized city that I've flown to."

CONSOLIDATED AIRLINES

Higher ticket prices come as the industry has consolidated to four major airlines, known as the legacy carriers, and several budget airlines that have difficult times succeeding. GLO Airlines, a budget airline, filed for bankruptcy protection last year after providing service between New Orleans and Little Rock and several other Southern cities.

Swelbar discounts talk of consolidation and the lack of competition as major reasons for the high fares.

"Consolidation can be a factor, but the trend was in place before consolidation largely took hold," he said.

He points to the airlines consolidating their flights at the nation's major population centers, such as New York, Los Angeles, Chicago, Atlanta and Dallas.

"Air service is gravitating toward metro areas and states where economies are performing best," he said. "Arkansas is part of a region of the U.S. along with Texas and Oklahoma. Arkansas tends to lag in population growth, gross regional product, employment and income per capita.

"These are critical variables in the eyes of airlines looking for new market opportunities."

Both Clinton National and Northwest Arkansas Regional have had some success in attracting budget airline options to their markets. Both airports are served by Allegiant Air, which is a low-budget carrier that concentrates on leisure destinations.

Frontier, a budget airline, starts service between Little Rock and Denver on March 1. United Airlines also serves that route now.

"That will create some competition on that route again," Mathieu said. "I think you're going to see the average number go down a little bit."

A check of the airlines' websites shows that the cost of a round-trip ticket from Frontier is $156.60 versus $397 for a United flight on the same dates. United, though, has more frequent flights to and from Denver than Frontier has.

Passengers aren't likely to see competition spread quickly for other destinations, however, according to Mathieu.

For instance, Southwest Airlines is the second-biggest airline at Atlanta, trailing only Delta, yet Southwest chooses not to fly between Little Rock and Atlanta.

"It's difficult to create that competition on routes because the airlines have kind of decided they are going to create their areas," he said. "You've got four airlines that control 83 percent of the market in the United States. It's better for them not to fight."

Neither Clinton National nor Northwest Arkansas Regional are high-cost airports for the airlines.

Clinton National recently went five years without increasing landing fees or the terminal leases it charges the airlines. Northwest Arkansas Regional recently cut its terminal rates 25 percent and its landing fees 17 percent, thanks to debt refinancing. Johnson said she doesn't expect to see a drop in airline ticket prices as a result.

Still, she insists that travelers, if they plan ahead, can get competitively priced tickets at her airport.

"We don't want people to read this and automatically assume they can't get a reasonable fare when they can," Johnson said. "But if you're a last-minute booking business traveler, it's not going to be inexpensive. We know that, and we know the airlines know that."

And travelers such as Hall are willing to pay it.

"If we pay $100 more than the average for more flights and convenience, it's worth it to me because of the truism that 'time is money,' he said.

SundayMonday Business on 01/28/2018