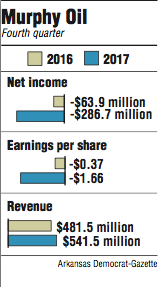

Murphy Oil Corp. on Wednesday reported a $286.7 million loss, or $1.66 per diluted share, for the fourth quarter of 2017.

The loss includes a $274 million "provisional tax expense" stemming from federal tax legislation approved by Congress and signed into law in late December.

For the year, Murphy recorded a net loss from continuing operations of $311 million, or $1.81 per diluted share.

A year ago, the company reported a $63.9 million loss for the fourth quarter of 2016.

Before taxes, the company netted $2 million in the fourth quarter of 2017 and $72 million for the year.

"Over the course of the year, we stabilized our production," Roger W. Jenkins, president and chief executive officer, said in a statement accompanying the earnings report. "Our constant focus on cost reductions, consistent cash balance, premium price-advantaged portfolio, and the ongoing financial strategy of spending within cash flow places our company in an excellent position moving forward."

Production in the fourth quarter averaged 168,000 barrels of oil equivalent per day, down from expectations because of the continued effects of Hurricane Harvey in Texas and in the Gulf of Mexico.

As of Dec. 31, the company had $2.8 billion of outstanding fixed-rate notes and about $1 billion in cash and cash equivalents.

The company's per-barrel expenses were $7.89, flat compared with the year before. Other general expenses were cut by 16 percent, the company said.

While basing the $274 million in provisional taxes on a "reasonable estimate," the company said it is continuing to assess the effects of Congress' tax overhaul. The $274 million estimate includes the effect of redeemed repatriation of foreign income and the re-measurement of deferred taxes and liabilities. Murphy's statutory tax rate was cut from 35 percent to 21 percent.

Other questions surrounding the legislation include the carry-forward of 2017 net operating losses, the change to federal tax rates and the possible limitations on the deductibility of interest paid.

The company will receive cash refunds of $30 million over the next four years relating to alternative minimum taxes paid earlier.

The company will hold a conference call at 10 a.m. today to discuss the report, at (833) 832-5124 with a reservation number of 6498569.

Business on 02/01/2018