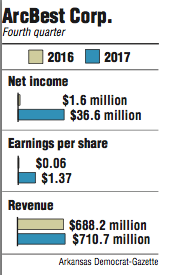

ArcBest Corp. reported net income of $36.6 million for the fourth quarter of 2017, an increase from $1.6 million a year ago that included a $24.5 million benefit from the new federal tax structure.

The Fort Smith company's earnings per share of $1.37 for the quarter also grew from 6 cents per share a year ago, and ArcBest reported $710.7 million in revenue.

Profits adjusted for one-time gains and costs during the fourth quarter were 42 cents per share -- $11.2 million in net income -- and beat analyst estimates of 36 cents for the quarter. Revenue was a 3.3 percent increase from a year ago but fell short of analyst expectations of $721.1 million.

ArcBest also announced its full-year performance Wednesday. Revenue of $2.8 billion was a 4.7 percent increase from $2.7 billion in 2016. Net income of $59.7 million increased from $18.7 million, and earnings per share grew to $2.25 after the company reported 71 cents in 2016.

Judy McReynolds, ArcBest's chief executive officer, said the fourth quarter wrapped up a year in which the trucking and logistics company made "significant" strides in its efforts to work more collaboratively across the organization to adapt to the changing market.

A company restructuring, which took effect Jan. 1, 2017, accounted for $10.3 million in costs that affected profits in the fourth quarter of 2016.

"Our customers have been asking for full logistics solutions from us and more manageable points of contact," McReynolds said. "By responding with a unified sales force, customer service and capacity sourcing, we more expertly answer their total supply chain needs and position the company for growth."

ArcBest also began implementing a new pricing structure last August that reflected the height, weight and length of packages. McReynolds said she's confident the changes, designed to account for the increase in e-commerce shipments that take up more space and weigh less than regular freight, represent "the right pricing foundation going forward."

"The intent of our pricing efforts was to improve our overall profitability," McReynolds said. "Though we have experienced some freight loss, we continued having success in securing new business that operated at better margins than the business that went away."

In the fourth quarter, the company's asset-based segment, ABF Freight, produced $18 million in operating income. It was an increase from $7.1 million a year ago. The division also reported revenue of $497 million, a 2.3 percent increase from $482.1 million in the fourth quarter of 2016.

The ArcBest Logistics and FleetNet segments of the company reported operating income of $5.2 million after a $900,000 loss in the same three-month period last year. Revenue increased 5.2 percent to $222.2 million, which the company attributed to strong revenue-per-shipment growth that was the result of higher customer demand and tighter capacity.

Brad Delco, a transportation analyst with Stephens Inc., said the company slightly missed operating income expectations for the quarter.

"Their costs went up without necessarily the same ability of passing on those costs to their customers," Delco said.

ArcBest's estimated $24.5 million tax benefit is the result of a reduction in deferred income tax liabilities. Chief Financial Officer David Cobb said the lower rates on deferred tax liabilities were recognized in 2017 but the benefit on those items will be realized over many years.

ArcBest also said capital expenditures for the year totaled $146 million, which was below previous expectations. The company expects 2018 capital expenditures to range between $155 million and $165 million, which includes equipment purchases of about $100 million for ABF Freight. The timing and amount will depend on the outcome of wage and benefit negotiations with the International Brotherhood of Teamsters, according to the company. The current contract for the company's union workers expires March 31, and McReynolds, the CEO, believes that progress has been made.

"As we have told the Teamsters, our goal is to reach an agreement that will ensure ABF's competitiveness in the marketplace for many years to come," McReynolds said.

Shares of ArcBest stock fell 30 cents to close Wednesday at $35.55.

Business on 02/01/2018