SPRINGDALE -- Tyson Foods Inc. posted upbeat third quarter earnings on Monday, just not as upbeat as executives wanted.

The Springdale-based company reported increased sales, net income and earnings per share for the three months ending June 30, compared with the same quarter a year ago. However, Tom Hayes, Tyson's president and chief executive officer, and Stewart Glendinning, executive vice president and chief financial officer, seemed disappointed.

"We are growing, but not as fast as we could be, and not as fast as we want to be," Hayes told analysts, shareholders and reporters during Tyson's third quarter earnings call.

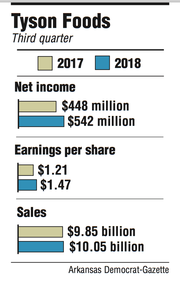

Despite market challenges, profits climbed to $542 million for the quarter, up from $448 million posted in the same period a year ago. Tyson's earnings increased to $1.47 per share for the quarter from $1.21 per share, about a 21 percent increase year-over-year. The company's earnings edged above Wall Street expectations by one cent per share, according to a group of analysts with Yahoo Finance.

Tyson shares rose $1.89, or 3.3 percent, to close Monday at $59.64. Shares have traded as high as $84.65 the last 52 weeks and as low as $56.79.

"Generally speaking, things look pretty good," said Alan Ellstrand, associate dean of the Walton College of Business at the University of Arkansas. "Probably one of the things that made [Tyson] happiest is the prepared foods segment."

Total sales for the period rose to $10.05 billion from $9.85 billion posted for the same quarter in 2017. Amid headwinds that stemmed from trade uncertainties and increased input costs, officials attributed third quarter growth to positive results from Tyson's beef and prepared foods segments. Both segments reported a positive 2.7 percent increase in volume, which led to increased incomes compared to the same quarter's results last year.

The margin in Tyson's beef segment climbed to 8 percent from a reported 3.7 percent a year ago, the report said. As the margins of Tyson's prepared foods segment, which encompasses further processed foods like Tyson's Any'tizers products, rose to 11.4 percent from the 9 percent posted the same time last year.

Meanwhile, the company's chicken and pork segments fell short of expectations. Uncertainty in trade policies and increased tariffs led to increased commodity market volatility that spurred an industrywide glut of U.S. meats, Hayes said. This oversupply has softened Tyson's domestic and export sales prices of pork and chicken and eaten into its third quarter earnings. Pork and chicken margins fell year-over-year from 10.3 percent to 5.6 percent, and 10.2 percent to 6.4 percent, respectively.

During the call, Hayes and Glendinning anticipated these market and trade factors to continue into Tyson's fourth quarter but assured the company was more "insulated" than its competitors.

"You know, we see the livestock supplies will be plentiful, so we need the exports to come through," Hayes said about Tyson's pork and chicken segments. "There's competing proteins at low prices ... and we are concerned about the ability for use to drive that demand up. That's probably the area where we are a bit cautious."

New U.S. tariffs on aluminum and steel imports announced earlier this year caused China to retaliate with tariffs on a litany of U.S. goods, including pork, beef and soybeans -- a key component of livestock feed. Key trading partners, Canada and Mexico, have implemented tariffs of their own on U.S. goods in response to the administration's tax on foreign metals. Specifically, Hayes said the "trade noise" has affected Tyson's partnership with Mexico.

"Despite the current trade issues, bulk protein demand continues to grow," he said. "Our products are moving in the export markets, albeit at lower values. We're working to strengthen our existing relationships in certain markets and build inroads into new markets."

Tyson adjusted its fiscal 2018 outlook last week in anticipation of Monday's earnings release. The company lowered its earnings guidance to $5.70 to $6 per share from a previously expected $6.55 to $6.70 per share. Tyson's shares dropped more than 7 percent on the New York Stock Exchange on the day of the announcement.

Trade headwinds aren't all of Tyson's concerns. During the call, Glendenning said the company is facing food inflation and increased feed and freight costs.

So far, Hayes said the company is on track to spend $270 million more on transportation costs this year, compared with fiscal 2017.

Tyson plans to sell its pizza crust business in the fourth quarter and expects the recent acquisitions of American Proteins, a rendering company, and Tecumseh Poultry, a producer of organic chickens, to bolster its outlook, officials said.

Glendenning said investors can expect a capital expenditure jump from $1.2 to 1.3 billion in fiscal 2018 to $1.6 billion in fiscal 2019. He attributed the growth to two large projects.

"One is the new chicken plant in Humboldt, Tenn.," Glendenning said in the call.

"The other one is a project we have underway to redo our distribution network, and those are some pretty heavy investments which have a powerful payback and are important as we move forward."

Business on 08/07/2018