BEIJING -- U.S. Commerce Secretary Wilbur Ross said Monday that Washington is hoping for concrete progress during President Donald Trump's planned trip to China amid rising trade tensions.

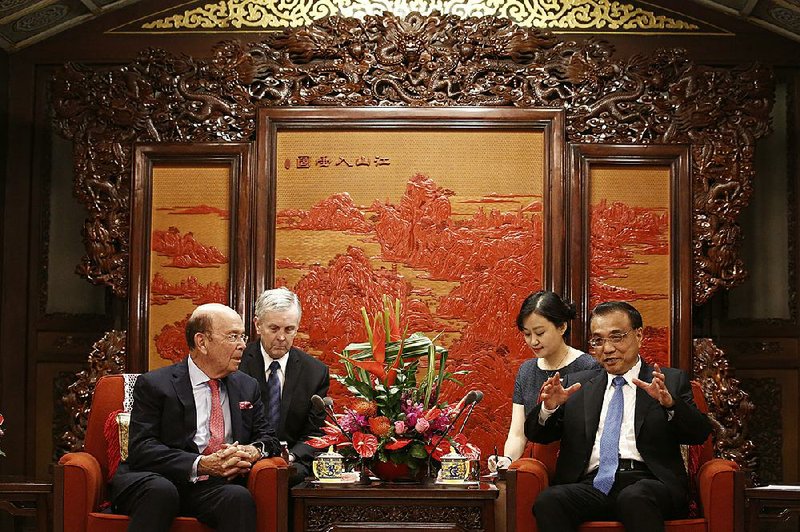

Ross met with Chinese Premier Li Keqiang, the country's top economic official, during a three-nation Asian tour. Trump is scheduled to visit Beijing later this year and meet President Xi Jinping, who visited the United States in April.

"We hope there will be some very good deliverables," Ross said at the start of a meeting at the Zhongnanhai compound where Chinese leaders live and work in central Beijing. That "would be the best single outcome for both countries," Ross said.

Ross gave no details, but Trump has criticized China's large trade surpluses with the United States and threatened to raise tariffs on steel. He has ordered an investigation into whether Beijing improperly pressures companies to hand over technology in exchange for market access.

[PRESIDENT TRUMP: Timeline, appointments, executive orders + guide to actions in first 200 days]

Chinese leaders have tried to head off punitive U.S. action by emphasizing the benefits of the world's biggest trading relationship.

"I think it is fair to say that our common interests far outweigh our differences," said Li. "This important trade and economic relations has benefited enormously our two peoples as well as the whole world."

Ross met Sunday with his Chinese counterpart, Zhong Shan.

He is scheduled to visit Hong Kong today and then travel to Thailand and Laos.

After decades of gains, China's share of global exports is now edging down. Whether that continues hinges a lot on how fast it can shift into higher-technology shipments.

China's portion of the global export pie has shrunk from a high of almost 17 percent reached in December 2015, International Monetary Fund data show. The pullback is driven mainly by the growth of shipments from commodity-exporting nations such as Brazil and Australia amid rising prices for staples like iron ore and bauxite, according to economists from Oxford Economics and TCW Group Inc.

Another factor is global demand tilting more to advanced machinery and cars, segments where China is just beginning to emerge as a competitor, said HSBC Holdings PLC.

Beijing's drive to create national champions, subsidize emerging industries and force technology transfers from foreign firms in the country has prompted U.S. Trade Representative Robert Lighthizer to say it's an unprecedented threat to the world trading system. Despite the smaller share of global exports, the "Made in China 2025" policy blueprint envisions global competitiveness by that year across 10 key industries from robots to medical devices.

"Declining export market share of late is more likely a blip, rather than the start of a lasting trend," said Frederic Neumann, co-head of Asian economics research at HSBC in Hong Kong. "As China's share in global gross domestic product continues to rise, it's likely that its share of global exports will expand as well, with products stretching from mass manufacturers to increasingly more sophisticated products as well."

A rebound in global car demand has lifted German and Japanese exports, while China runs a large semiconductor trade deficit, said Neumann. That will reverse as industrial policy pushes for more advanced manufacturing, taking market share from developed economies, he said.

Low-end industries such as textiles and furniture are feeling the most market-share pressure. That's in keeping with China's policy of shifting to higher value-added industries such as electric vehicles and robotics. A recent pollution crackdown has raised costs for industries such as dyeing companies and paper producers, pressuring their competitiveness.

Information for this article was contributed by The Associated Press and by Bloomberg News.

Business on 09/26/2017