Tyson Foods, Inc., on Monday reported increased sales across all business segments compared with fourth-quarter results a year ago, largely because of low grain costs and strengthened beef and pork demand, company officials said.

The Springdale-based company also announced it purchased one of the nation's leading Philly cheesesteak producers, Original Philly Holdings, Inc., which Tyson said would strengthen its prepared foods business next year.

The Philadelphia-based company has two business units: one produces raw products, while the other prepares fully-cooked foods. Original Philly Holdings has two plants that employ about 250 people.

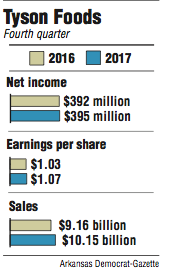

For the fourth quarter, Tyson Foods reported $10.14 billion in sales, up from $9.16 billion a year ago. Net income rose less than one percent to $395 million, up from $392 million, a year ago. Earnings per share increased by 4 percent to $1.07 compared to last year.

Strong beef and chicken demand along with low grain costs and the company's "financial fitness plan" were factors in the three months that ended Sept. 30, Tyson President Tom Hayes told analysts Monday.

Tyson's beef sales rose 9.5 percent and operating income more than doubled compared to the same quarter last year. Chicken sales increased to nearly $3 billion this quarter from $2.8 billion the year before.

Roughly 100 consecutive months of growth in the U.S. economy contributed to more people purchasing meat, in turn, profitable sales for Tyson and other companies, said Mervin Jebaraj, assistant director of the Center for Business and Economic Research at the University of Arkansas - Fayetteville.

Quarterly profit at competitor Pilgrim's Pride, Co., nearly doubled, according to the company's report released last week.

"Fiscal 2017 was a year of great change and, despite some challenges, our team remained focused on the long term by keeping consumer relevance, customer growth and shareholder value creation at the forefront," Hayes said in a statement.

This quarter Tyson integrated AdvancePierre further into each business segment and began divesting some acquired non-protein assets.

"We repurchased roughly $650 million in shares before the AdvancePierre acquisition and then redirected cash flow and proceeded to pay down more than $600 million of debt," Hayes said in a statement.

On Sept. 28, two days before the close of fiscal 2017, Tyson Foods also said it would eliminate 450 positions mostly out of its Chicago, Cincinnati and Springdale offices. To counter historically high turnover rates Tyson increased wages at processing plants a year ago which, Hayes told analysts, has been a successful strategy.

Overall Tyson did great this quarter, however, the company's pork division looked seemingly under pressure, said Bob Williams, senior vice president and managing director of Simmons First Investment Group.

Pork sales increased more than 10 percent compared to Tyson's fourth quarter last year. While pork prices rose 11.7 percent this quarter, pork volume declined 1.2 percent year over year.

"Increasing prices did very little to quash demand," Williams said. "From an economic standpoint, you have to control demand with pricing to some extent; otherwise you'll run out of product."

Based on data from the U.S. Department of Agriculture, Tyson Foods estimated that beef, pork, chicken and turkey production will increase 3-4 percent from fiscal 2017 levels, and stronger foreign markets -- like China's -- should absorb some of the difference.

"We're currently expecting adjusted earnings growth of 7-10 percent...per share [next fiscal year]," Hayes said in a statement.

Tyson forecast sales of $41 billion for the year ending September 2018, up from analyst expectations of $40.36 billion, according to Thomson Reuters.

Some analysts were skeptical of the company's bullish projections. During a conference call Monday, some estimated that grain prices could likely rise during the cooler months -- affecting margins across the board -- as chicken prices decline.

Hayes said he felt confident with Tyson's 2018 projections for the first quarter. This year's corn and soybean harvests are estimated to be at or near record levels, according to USDA figures released last week.

Tyson shares rose $1.45, or almost 2 percent, to close Monday at $75.59.

Business on 11/14/2017