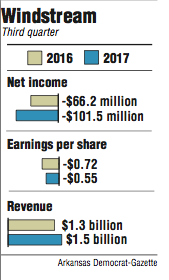

Windstream lost $101.5 million in the third quarter, a 55 percent deepening from a loss of $66.2 million in the same period last year, the Little Rock firm said Thursday.

The company lost 55 cents a share in the quarter, compared with a loss of 72 cents a share a year earlier. The loss was worse than the projection of a loss of 41 cents a share estimated by eight analysts surveyed by Thomson Reuters.

Windstream closed at $2 a share Thursday, up 8 cents, or 4.2 percent, in trading on the Nasdaq exchange.

"Windstream is in a tough business," said Bob Williams, senior vice president and managing director of Simmons First Investment Group Inc. in Little Rock. "And this was definitely a difficult quarter."

During the quarter, Windstream closed on its acquisition of Broadview Networks Holdings Inc. It also closed earlier this year on its purchase of EarthLink, an Internet and network products and services business.

Windstream had a lot of merger and acquisition costs during the third quarter, Williams said.

"But those are one-time costs," Williams said.

Windstream's merger and related costs were more than $33 million.

"Our overall strategy continues to deliver solid results," said Tony Thomas, Windstream's chief executive officer. "We continue to deliver faster broadband speeds to more consumers and small businesses, which led to improved broadband subscriber trends."

Thomas began Thursday's conference call with analysts by noting a lawsuit filed against the company's subsidiary, Windstream Services, which issued 6 3/8 percent senior notes due in 2023.

U.S. Bank, trustee for the debt, filed the lawsuit last month in U.S. District Court of the Southern District of New York.

In September, Aurelius Capital Master Ltd. of New York, which manages a hedge fund, acquired more than 25 percent of Windstream Services' 2023 senior notes. Aurelius sent a notice of default to Windstream Services claiming Windstream Services transferred assets and leased those back in a manner that didn't meet the "sale and leaseback" requirements under the 2023 senior notes.

The hedge fund invested in the debt "for the sole purpose of declaring a default related to the Uniti spinoff transaction that occurred more than 2.5 years ago," Thomas said.

"In response to the alleged default, which we vigorously deny, we initiated a consent process for our bond issues and announced earlier this week that we have successfully obtained consent for our 6.375 percent issue of 2023 notes, which we believe has resolved the allegation of default," Thomas said.

The timeline for the case has not been finalized, Thomas said.

Business on 11/10/2017