Lagging collections of sales and use taxes and corporate income taxes caused Arkansas state government's general revenue in October to drop by $29.4 million from the same month a year ago, to $500.6 million.

The 5.6 percent drop in October's total general-revenue collections also was $30.9 million below forecast, the state Department of Finance and Administration said Thursday in its monthly revenue report. To put the $30.9 million figure in perspective, the state's fickle general-revenue collections last fiscal year fell $55.6 million short of the state's forecast in January and later $51 million short of the forecast in March.

October is the fourth month in fiscal 2018.

The record general-revenue collections for the month of October continues to be the $530 million collected in that month in 2016, said Whitney McLaughlin, a tax analyst for the finance department.

The two largest sources of general revenue are individual income taxes and sales and use taxes.

"The October revenue report shows continued strength in job creation with individual income tax collections exceeding forecast and year-to-date collections surpassing the previous year," Gov. Asa Hutchinson said Thursday in a written statement issued through his spokesman.

"There continues to be irregular fluctuations in the corporate and sales tax collections. We saw the same ups and downs last year, and experience indicates these may even out by the end of the year -- but we will carefully watch these numbers over the next six months," the Republican governor said.

Asked whether he's instructed state agencies to develop contingency plans in case he cuts the forecast and budget again in fiscal 2018, Hutchinson said, "We always urge the agencies to take a conservative approach in spending, but there is no other action required based upon the revenue report."

Finance department Director Larry Walther also said state officials aren't panicking over the revenue drop and aren't considering cutting the forecast and budget again at this point.

In early May, Hutchinson announced a $43 million cut to the general-revenue budget for fiscal 2018, which started July 1.

It was the second fiscal year in a row that saw a cut. In late April, Hutchinson announced a $70 million cut in the fiscal-2017 budget because of lagging sales and corporate income tax collections. But he later restored $60 million of that cut at the end of the fiscal year in June, after tax collections rebounded.

These cuts were the first in the state government budget since January 2010, when Gov. Mike Beebe, a Democrat, announced a $106 million reduction just a few months after another $100 million cut during an economic downturn.

Walther said state officials hope collections rebound in fiscal 2018 and they won't have to cut the forecast for fiscal 2018 and 2019 in early December.

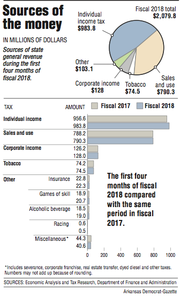

During the first four months of fiscal 2018, total general revenue has increased by $29.7 million, or 1.4 percent, over the same period in fiscal 2017, to $2.079 billion. That's $22.9 million, or 1.1 percent, below the state's forecast.

In fiscal 2018, the state is projected to collect $6.75 billion in total general revenue -- up by $205.1 million over collections in fiscal 2017 -- according to the finance department.

State tax refunds and some special governmental expenditures, such as court-mandated desegregation payments, come off the top of general revenue, leaving a net amount.

In October, the net declined by $24.5 million, or 5.6 percent, from a year ago to $414.5 million. The net revenue fell $38.5 million, or 8.5 percent, below forecast.

During the first four months of fiscal 2018, total net revenue increased by $22.4 million, or 1.3 percent, over the same period last year, to $1.793 billion. That's $36.2 million, or 2 percent, below forecast.

This fiscal year, the general-revenue budget is $5.45 billion, up by $130.1 million over last year's budget, with most of the increase going to the Department of Human Services, according to the finance department.

According to the finance department, October included:

• A $1.7 million, or 0.7 percent, decrease in individual income tax collections from a year ago to $254.4 million. That was $1.1 million, or 0.4 percent, over forecast. October had one less Thursday payday than a year ago, and that's why the state collected less last month compared with a year ago, said John Shelnutt, the state's chief economic forecaster.

The largest category of individual income taxes is withholdings. Withholdings in October were essentially flat at $211.7 million, compared with a year ago, and fell $3.4 million short of forecast.

• A $7.7 million, or 3.9 percent, dip in sales and use tax collections from a year ago to $191 million. That was below forecast by $15.9 million, or 7.7 percent.

In recent months, either the consumer side or business side of sales and use tax collections has been weak and "this month they are both down," said Paul Louthian, a deputy director at the finance department.

Walther said, "We had a cooler than normal August, and so the sales tax [paid by consumers in September] on utilities was down," and that tax was paid to the state in October, Walther said. Shelnutt said these sales taxes declined by about $3 million last month compared with a year ago.

In addition, sales tax collections from manufacturing and information services were down and taxes from motor vehicle sales were virtually flat, Walther said.

"All those things created a problem for October's results," he said.

• A $19.7 million, or 48.1 percent, decrease in corporate income tax collections from a year ago to $21.3 million. That was $17.2 million, or 44.7 percent, below forecast.

Corporate income tax collections tend to be volatile from month to month and "it's hard to pick and to peg," Walther said.

Louthian said the decline in those collections isn't linked at this point to corporations putting off payment of their income taxes in case the federal tax rates are reduced soon by Congress.

"I think you'll see them starting to make plans for that in their current year that they are making estimates," he said.

• A $1.1 million, or 5.4 percent, decrease in tobacco tax collections from a year ago to $18.5 million. These collections fell $0.5 million. or 2.7 percent, below forecast. Monthly changes in tobacco tax collections can be attributed to uneven patterns of stamp sales to wholesale purchasers, according to the finance department.

State Sen. Larry Teague, D-Nashville, said in an interview that he doesn't know what October's revenue drop portends for the future.

"I hope it is just reporting late or something and it will all come back next month," said Teague, a co-chairman of the Legislature's Joint Budget Committee.

"Surely November and December will be solid with Christmas sales starting. Everybody is advertising Black Friday [sales] starting Nov. 1 or whatever, so hopefully that will take care of our issues," he said. "But I don't know what happens."

A Section on 11/03/2017