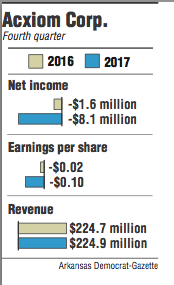

Acxiom Corp. reported an $8.1 million loss for their fourth quarter Tuesday, but executives called 2017 "a milestone year," pointing to improving profit margins that were counterbalanced by the August sale of Acxiom Impact, its email services business.

"Over the past five years Acxiom has undergone a remarkable transformation, and we are a much stronger and better-positioned company today than we were when we began this journey," President and CEO Scott Howe said in an earnings call. "We have rounded the corner."

Acxiom is a Conway-based data broker and distributor that helps marketers more efficiently advertise and target potential customers through digital marketing technology, and data management and collection services.

The loss was five times greater than last year's $1.6 million loss, but revenue stayed flat at around $225 million. In a news release, the company said that "strong growth in connectivity and audience solutions was offset by revenue declines" from the absence of Acxiom Impact.

Howe highlighted that the company grew by about 120 employees in fiscal 2017.

The quarterly loss per share came to 10 cents versus a 2-cent loss last year. When taking into account the one-time expenses, the company pointed out that earnings per share came to 15 cents, which matched the average of analyst expectations.

Acxiom's newest segment grounded in online data services, Connectivity, maintained its steady growth, posting revenue above 40 percent to $44.2 million versus last year. It now comprises about 20 percent of the business. Audience Solutions, which reconciles data points to individuals and sells data sets to marketers, also grew about 8 percent over the quarter, representing about 38 percent of the business.

However, the company's largest segment, Marketing Services, has been shrinking since the end of 2015. This past quarter's revenue dropped by about 17 percent versus last year to $294.3 million. That business provides data management support for individual companies. Howe said "this business has stabilized and is on the right track," but that its progress will hinge on gaining new clients.

For the fiscal year, total revenue was about $880 million, an increase of 4 percent compared to last year. Net income totaled $4.1 million, down 40 percent from last year's $6.7 million.

"Each of our businesses delivered revenue growth and margin improvement, and we made a number of strategic moves to accelerate our vision of powering a world where all marketing is relevant," Howe said.

"We enter fiscal 2018 from a position of strength and industry leadership and remain committed to delivering even more value to our clients and shareholders," he said.

"As a company we delivered on our promises in [fiscal year] '17, and our enthusiasm has never been higher."

The company's shares on the Nasdaq closed at $28.21, down 15 cents.

Business on 05/17/2017