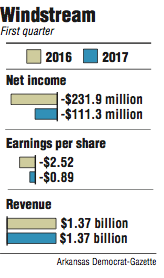

Windstream Holdings lost $111 million in the first quarter compared with a loss of $232 million in the same period last year, the Little Rock telecommunications firm said Thursday.

For the quarter, Windstream lost 89 cents a share compared with a loss of $2.52 in the first quarter last year. The company missed the average estimate of a loss of 28 cents a share from five analyst surveyed by Thomson Reuters.

Windstream shares fell 47 cents to close Thursday at $4.90 in trading on the Nasdaq exchange, hitting a 52-week low of $4.84 a share during the day. The stock is down 33 percent since it closed at $7.33 on Dec. 30.

Windstream said it intends to pay a 60 cent per share annual dividend.

"Our first-quarter results were in line with our expectations, and we are making solid progress on achieving our 2017 goals," Tony Thomas, Windstream's chief executive officer, said in a statement. "The integration with EarthLink is off to an excellent start and our synergy plans remain on track."

Windstream reported revenue of $1.37 billion in the first quarter, basically the same as in the first quarter last year.

In the quarter, Windstream announced fiber expansions in five metropolitan areas -- Little Rock, Cleveland, Dallas, Detroit and St. Louis.

It also announced nine wireless openings in Atlanta; Birmingham, Ala.; Cedar Rapids, Iowa; Columbus, Ohio; Denver; Knoxville, Tenn.; Omaha, Neb.; Richmond, Va.; and Tampa, Fla.

During the quarter, Windstream also closed on its acquisition of EarthLink.

It also said it agreed to buy Broadview Networks Holdings of Rye Brook, N.Y., for $227.5 million.

Broadview is a leading provider of cloud-based communications solutions to small and medium-sized businesses. Windstream expects to realize about $30 million in annual operating savings within two years.

Windstream is battling to diversify beyond its traditional land-line core businesses, said Bob Williams, senior vice president and managing director of Simmons First Investment Group Inc. in Little Rock.

"From that perspective, it appears to have been effective," Williams said.

Windstream is having the most success in markets where it is the new competitor, Williams said.

"Where Windstream has struggled is in markets where it was the traditional existing operator," Williams said.

David Barden, an analyst with Bank of America Merrill Lynch, has a buy rating for Windstream shares.

He bases the rating on a several-step process that would increase the stock price, he wrote in a research brief Thursday.

Also on Thursday, Uniti Group Inc., a Windstream spinoff, reported a loss of $21.8 million, or 14 cents a share, in the first quarter. Revenue was $211.5 million.

Little Rock-based Uniti, a real estate investment trust, was previously known as Communications Sales & Leasing.

Uniti shares fell $1.17 to close Thursday at $25.28 in trading on the Nasdaq exchange.

In April, Uniti agreed to buy Southern Light LLC for $700 million, including $635 million in cash. Southern Light provides data transport services along the Gulf Coast to 12 markets in Alabama, Florida, Georgia, Louisiana and Mississippi.

In February, Uniti agreed to purchase Hunt Telecommunications for $170 million, including $114.5 million in cash. Hunt provides data transport to primary and secondary schools and government agencies in Louisiana.

Business on 05/05/2017