Earnings data from J.B. Hunt Transportation Services show freight volume is rising, but customers aren't necessarily paying more for its logistics services.

"They don't have to pay," said Bob Williams, s̶e̶n̶i̶o̶r̶ vice president and m̶a̶n̶a̶g̶e̶r̶ managing director* of Simmons First Investment Group. "There's enough competition right now, and enough over capacity still available, that it limits the ability to raise prices."

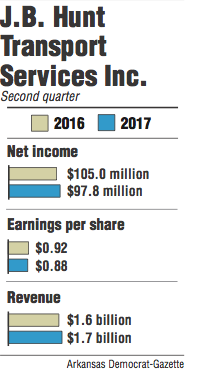

Despite an overall revenue increase this quarter, the company's profit fell by almost 7 percent compared with the second quarter of 2016.

In the Lowell-based company's second quarter earnings release Monday, J.B. Hunt reported $97.8 million in profit, down from $105 million a year ago. Earnings per share were 88 cents this quarter, a drop from the same time last year, when investors made about 92 cents per share.

The results came up short of industry analysts' projections. J.B. Hunt is the first publicly traded truckload company to report this quarter's earnings, which could be a sign for what is to come for others in an industry trying to adapt to changing consumer demands.

"It was a little disappointing," Williams said. "They missed both on the bottom line and on the top line."

Whether customers will pay more for loads is a looming question in the industry.

The revenue per load in the intermodal segment was relatively stagnant from last year. With the exception of the trucking segment, freight volumes are up across the company. The intermodal segment carried about 24,940 more loads this quarter than second quarter 2016, leading to about $1 billion in revenue. That's an increase from $933 million last year.

J.B. Hunt is the nation's largest intermodal service, and the segment is responsible for about $109 million of the company's total profit, dragged down by increased costs in equipment and wages and hiring expenses, the company said.

Revenue from the integrated capacity solutions rose to $222 million from $203 million last year, but changing demands from customers led to about a 102 percent decrease in profit from last year. The number of loads in this segment was 240,069, up from 199,312 last year. But the revenue per load has gone down about $95 per load from last year.

Revenue per truck each week in the dedicated services segment was a little under $100 less this year than last.

The trucking segment offers a positive glimpse into customers' willingness to pay more. The average haul distance here shrank by about 6 percent, but its customers seem to be paying more, as each truck brought in $99 more per week than last year. Still, profit from this segment fell about 37 percent.

"The benefit from higher customer rates per mile was more than offset by increased driver pay and hiring costs, higher independent contractor cost per mile and decreased tractor maintenance costs compared to the second quarter 2016," the company said in its report.

The company is paying more in fuel and fuel taxes this year, at about $79 million, a 9 percent increase from 2016. A notable uptick in insurance claims took about 1.6 percent of the company's revenue, about $27 million. Salaries and wages grew by 9 percent, up to $871 million from $794 million last year. J.B. Hunt added 155 employees to its integrated services division.

Business on 07/18/2017

*CORRECTION: Bob Williams is vice president and managing director of Simmons First Investment Group. His title was incorrect in a previous version of this story.