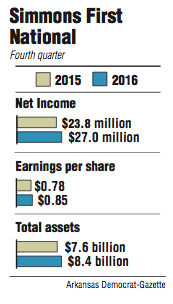

Simmons First National Corp. had a net income of $27 million in the fourth quarter last year, the Pine Bluff-based bank said Wednesday.

That compares with $23.8 million that Simmons earned in the same period of 2015.

Simmons earned 85 cents per share in the quarter compared with 78 cents a share in the fourth quarter of 2015.

Simmons beat average expectations of 83 cents a share by five analysts surveyed by Thomson Reuters.

Shares of Simmons rose 80 cents to close Wednesday at $59.30 in trading on the Nasdaq exchange. The earnings report was released after the market closed Wednesday.

Total loans rose to $5.6 billion in the fourth quarter, an increase of 14.5 percent compared with the same period of 2015. Simmons had deposits of $6.7 billion in the quarter, up almost 11 percent from the fourth quarter of 2015.

For the year, Simmons reported a net income of $96.8 million.

The bank is beginning to leverage its size and integrate more of its services in its newer markets, George Makris Jr., Simmons' chairman and chief executive officer, said in a prepared statement.

Simmons, which has $8.4 billion in assets, announced last month the acquisition of Southwest Bancorp, based in Stillwater, Okla. Southwest has about $2.5 billion in assets and offices in Oklahoma, Texas, Colorado and Kansas.

Simmons will pay about $564 million for the Southwest, 83 percent in Simmons stock and 17 percent in cash.

"Simmons Bank will enter new and very attractive markets as a result of the [Southwest] merger," Makris said.

The bank will add offices in Oklahoma, Texas and Colorado when the Southwest transaction closes.

It was the third acquisition the Pine Bluff bank made in 2016.

When the purchase closes in the fall, Simmons will exceed $10 billion in assets.

The transaction uses a "meaningful portion" of Simmons' excess capital that it has been accumulating, Matt Olney, a banking analyst in Little Rock with Stephens Inc., said in a recent research report.

Olney, who owns no Simmons stock, has a neutral rating on Simmons and has a favorable view of the 6 percent improvement to annual earnings per share Simmons expects from the Southwest purchase.

"But we suspect a portion of this upside could be offset in 2018 [by the impact of increased government regulation] for crossing the $10 billion asset threshold," Olney said.

Simmons has branches in Arkansas, Kansas, Missouri and Tennessee.

A conference call to discuss results of the quarter and year will begin today at 11 a.m.

To access the call, dial (866) 298-7926 and provide the identification code 4645-3886.

Business on 01/19/2017