Tyson Foods reported Monday that its profits were up 29 percent in the first quarter, breaking company records and besting analysts' estimates, but its top executive confirmed the company's pricing practices were being investigated by the Securities and Exchange Commission.

During his first conference call as company president and CEO, Tom Hayes compared Tyson's quarter to the Super Bowl win by the New England Patriots the evening before.

"We're setting some records here ourselves today," he told analysts on a conference call.

Springdale-based Tyson's top executive also confirmed during a conference call with reporters that the company was served a subpoena in January from the SEC. Tyson and other large chicken companies, including Pilgrim's Pride Corp. and Sanderson Farms Inc., are facing lawsuits contending they colluded to fix chicken prices.

Hayes declined to comment about the particulars of the subpoena but said the food company is cooperating fully with the SEC investigation. Tyson has denied any wrongdoing, and Hayes said the company looks forward to defending itself in court.

Bob Williams, senior vice president and managing director of Little Rock-based Simmons First Investment Group, said Monday that a subpoena in this case isn't particularly damning, noting Tyson Foods has a presumption of innocence in the suit.

"Lots of people get subpoenaed," he noted.

That said, he noted that the world of finance tends to be not that forgiving and holds companies to a different standard.

"When there's blood in the water, the sharks will come to circle," Williams said.

On the conference call with analysts, Hayes called the company's results the best quarter in its history on the strength of its profits in the beef and pork segments.

The company increased its earnings per share guidance for the coming year from $4.90 to $5.05, or about 12 percent higher than 2016. The company said it expects its sales in 2017 to be mostly flat as the company works to increase sales volume across all its operations.

Tyson saw its shares drop throughout the day Monday, closing at $63.13, down $2.26 or 3.4 percent in trading on the New York Stock Exchange. Shares have traded as low as $55.72 and as high as $77.05 over the past year.

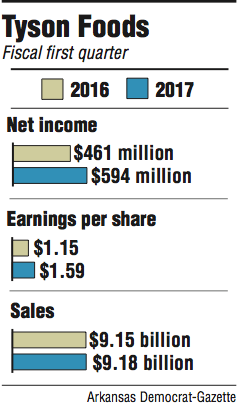

For its first quarter of fiscal 2017, the food company booked profit of $594 million or $1.59 per share for the period ended Dec. 31, compared with $461 million or $1.15 earnings per share for the same quarter a year ago.

An average estimate of 11 analysts pegged Tyson's earnings per share at $1.26 for the period. In 2016, Tyson beat earnings estimates in the first three quarters of 2016 but performed lower than analysts expectations in the fourth quarter.

Tyson reported revenue of $9.18 billion for the quarter, up 2.4 percent when compared with $9.15 billion in the year ago period, besting estimates of 10 analysts predicting average revenue of $9.04 billion.

Hayes, a former Hillshire Foods executive, moved up to the company's top spot at the first of the year. Tyson acquired Hillshire, along with its many well-known brands like Jimmy Dean and Ballpark, in 2014 for $7.7 billion.

In November, Donnie Smith, Tyson's CEO, said he would step down at the end of the year -- the same day the company reported disappointing earnings results for its fourth quarter attributed to higher grain prices and soft demand for chicken. During Smith's tenure as CEO, Tyson shares quadrupled in value. He will remain as a company consultant for three years. Smith had been a Tyson employee for 36 years.

On Monday, Tyson reported operating income for the quarter was $982 million compared with $776 million for the first quarter of 2016. The pork segment's operating margin for the quarter stood at 19.7 percent and beef saw a 8.5 percent operating margin. The chicken and prepared food segment's margins were in typical ranges. Tyson posted a total company operating margin of 10.7 percent.

Williams of Simmons First Investment Group said the strong profits by primarily the beef segment, but also pork segment, helped drive the company's earnings. He said Tyson's overall performance was strong and the first quarter results show the company is continuing to do a good job integrating the various components it acquired after buying Hillshire.

"They knocked the cover off the ball," Williams said.

Total sales for the company's chicken segment were $2.7 billion for the quarter, up from $2.63 billion for the year ago period. In the beef segment total sales were $3.5 billion, down slightly from $3.6 billion for the first quarter of 2016. The pork segment posted sales of $1.25 billion for the first quarter, up a bit from $1.2 billion the year earlier while prepared foods saw sales of $1.89 billion, virtually unchanged from the same quarter in 2016.

Tyson also reported that during the first quarter it repurchased 8.1 million shares valued at $520 million.

A Section on 02/07/2017