Weak retail-fuel margins made for a challenging fourth quarter for Murphy USA Inc., but the El Dorado company finished the year strong, Andrew Clyde, its president and chief executive office, said Thursday.

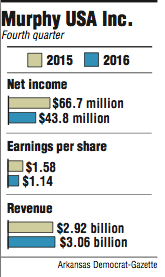

The company reported a fourth-quarter profit of $43.8 million, for a per-share profit of $1.14, surpassing expectations of $1 per share, according to a Zacks Investment Research survey of four analysts. For the fourth quarter of 2015, the company reported a profit of $66.7 million, or a per-share profit of $1.58.

Murphy USA is a retail-fuel and convenience-store firm, with 1,400 stores in 26 states. It separated from Murphy Oil Corp. in 2013 and became its own public company.

For the year, Murphy USA reported a $221.5 million profit, or $5.59 per diluted share, compared with a $176.3 million profit, or $4.02 per share, in 2015. The year-end profit includes a $56 million after-tax gain on the $85 million sale of a Gulf Coast pipeline a year ago.

"When we had this call one year ago, we noted that we would see the impact of several improvement initiatives in 2016 results," Clyde said during a conference call with investors and analysts. "I can proudly say we delivered these benefits to shareholders."

Clyde said new merchandiser contracts brought higher in-store profits and a new labor plan helped reduce per-store operating expenses, making the company "more resilient during times of weakness and more competitive over the long term."

He said operating expenses, excluding credit-card fees, were down 4.1 percent per store, resulting in $4.5 million in savings for the fourth quarter.

Revenue for the quarter totaled $3 billion, compared with $2.9 billion for the same time a year ago. The company reported revenue of $11.5 billion in 2016, compared with $12.6 billion in 2015.

The chain added 37 stores in the fourth quarter, for a total of 67 new ones for the year, Clyde said. Ten others were razed and rebuilt.

Retail-fuel margins in the fourth quarter were the lowest since 2010, Clyde said. For the year, those margins averaged 11.6 cents per gallon, compared with 12.5 cents in 2015.

"Looking at the fuel business, while retail margins were weak, we note that we were able to provide relatively strong margins of 11.6 cents per gallon in an environment where gasoline prices rose about 80 cents per gallon from the low in February 2016," he said. "It's almost a mirror image of [fourth quarter] 2014 when prices declined $1.10 per gallon yet produced outsized margins of almost 25 cents per gallon."

Business on 02/03/2017