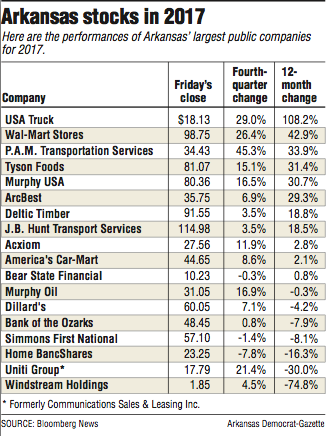

In a year when stock markets nationally had their best returns since 2013 and the Dow Jones industrial average was up 25 percent, the 18 stocks on the Arkansas Index produced eight firms up more than 18 percent.

USA Truck had the best year in 2017 among Arkansas stocks, by far outpacing the state's largest publicly traded companies.

The Van Buren-based trucking firm's stock more than doubled in value for the year, rising 108.2 percent.

The trucker had better-than-expected increasing revenue streams in the second and third quarters of the year, which fueled the stock price and caused investors to respond positively, said Bob Williams, senior vice president and managing director of Simmons First Investment Group Inc. in Little Rock.

"[USA Truck's] share price bottomed in mid-May followed by a strong rally for the rest of the year," Williams said.

Stock analysts still are projecting a net loss for 2017 for USA Truck because of a difficult first half, Williams said. But USA Truck's new management team assured investors that the firm would return to operating profitability, and those assurances proved true in the third quarter, Williams said.

Eleven of the 18 stocks on the Arkansas Index were up in 2017.

Wal-Mart was up 42.9 percent, the second-best return for the year.

Wal-Mart, based in Bentonville, gained acceptance for its strategic moves to reposition itself as a major player in e-commerce, rewarding investors, Williams said.

"In a time when bricks and mortar stores are more like anchors for a retailer, Wal-Mart reported strong sales exceeding expectations in the third quarter," Williams said. "The company outpaced analysts' estimates with better-than-projected sales online and in stores."

P.A.M. Transportation Services' return for the year was a jump of almost 34 percent, the third-best for the year.

P.A.M.'s share price remains strong after a modified auction to buy back its own shares in November, Williams said.

With limited participation, P.A.M. was able to repurchase about 36 percent of its limit, Williams said. Its stock price has remained near the 52-week high but is still well off historic peaks, Williams said.

P.A.M., based in Tontitown, had the best performance in the fourth quarter among the 18 Arkansas stocks with a gain of more than 45 percent.

Windstream of Little Rock lost almost 75 percent of its stock value in 2017, the worst performance among the largest Arkansas public companies. It was also the worst performance by any of the state's largest public companies since 2008.

Traditional landline data and telecommunications providers struggled because of weaker-than-expected growth, and Windstream was no exception, Williams said.

"Hit hard by technology disruption and a high cost of capital, the elimination of the common dividend was announced in August," Williams said. "This occurred despite several years of assurance from prior management that the distribution was safe and would be maintained."

Little Rock-based Uniti Group, a Windstream spinoff, fell 30 percent in 2017, the second-worst performance in the state.

This year, Uniti's debt ratings were downgraded along with a reduction in Windstream's bond rating, Williams said.

"Currently, the vast majority of Uniti's cash flow is derived from Windstream's lease payments," Williams said. "With the two so closely tethered together, investors were reassessing the limited revenue diversity, business and credit risk at Windstream."

Uniti has reiterated a goal of diversifying 50 percent of its revenue mix away from Windstream, Williams said.

The stocks of Arkansas' largest publicly traded banks dropped in 2017.

Conway-based Home BancShares lost 16.3 percent for the year, the third-worst performance of the year, followed by Bank of the Ozarks, which was down 8.1 percent, and Simmons First National, which declined 7.9 percent. Bear State Financial was up almost 1 percent for the year.

The Arkansas banks underperformed banks as a whole this year.

The Dow Jones Bank Index was up about 18 percent for the year, and the Dow Jones Regional Bank Index was up about 9 percent for the year.

There were contributing factors that hurt Arkansas bank stocks this year, said Garland Binns, a Little Rock banking attorney.

During the presidential campaign last year and the first months of President Donald Trump's administration, it was expected that there would be changes made in the banking regulatory environment, Binns said.

"But we haven't seen that," Binns said.

Those banking changes were put behind attempts to remake health care and changes in corporate taxes, Binns said.

"So I think there is an amount of uncertainty among financial institutions as to how this will play out," Binns said. "Obviously it will be sometime next year before we'll know."

Business on 12/30/2017