Wal-Mart Stores Inc. reported increases in sales and traffic in the second quarter, led by the retailer's best grocery performance in five years and a continued surge in its U.S. e-commerce business.

But the company's ongoing efforts to strengthen its digital capabilities and lower prices to compete with online retailers and discounters took a toll on profits in the second quarter of the fiscal year.

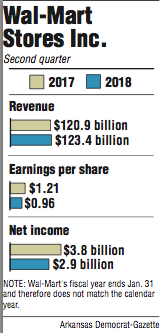

The Bentonville-based retailer's net income fell 23 percent to $2.9 billion, or earnings per share of $0.96, compared with the year-ago quarter. Revenue climbed 2.1 percent to $123.4 billion and beat analyst forecasts of $120.8 billion. Adjusted earnings per share of $1.08 -- which don't account for certain charges in the quarter -- also edged past analyst expectations of $1.07.

Wal-Mart Chief Executive Officer Doug McMillon said in a news release that the sales growth, which was highlighted by the company's grocery performance and a 60 percent increase in U.S. e-commerce sales, was evidence of another "solid quarter."

"Our customers are responding to the improvements in stores and online, and our results reflect this," McMillon said.

Investors weren't as impressed. Wal-Mart's stock dipped as much as 3 percent during trading early Thursday, largely because of the pressure its investments are placing on the bottom line. Wal-Mart also announced lower-than-expected per share guidance of $0.90 to $0.98 for the third quarter.

Shares of Wal-Mart stock closed Thursday at $79.70, down $1.28.

"Expectations were pretty high coming into this quarter," said Brian Yarbrough, a retail analyst with Edward Jones. "Overall the numbers were solid. They're doing everything they need to do. ... It's just, again, down earnings. There's just no earnings [growth]."

Wal-Mart has invested billions of dollars on initiatives intended to fend off competitors and better position itself for the future.

One example: The company is lowering grocery prices to compete with deep discounters like Aldi and Lidl. Wal-Mart also has acquired e-commerce apparel companies like Bonobos to build market share in certain categories like clothing and continues to rapidly expand its online assortment, which now boasts more than 67 million items.

The U.S. team has introduced programs such as a pickup discount and an easy reorder system, which are designed to better integrate its in-store and e-commerce businesses. Wal-Mart's order online, pick up groceries curbside service is expanding to include 1,100 stores by the end of the year, and the company has recently said it is rolling out in-store pickup towers at 100 locations.

While the efforts are important to keep pace with customer expectations in the evolving retail landscape, the growth has come at a cost as operating expenses increase and margins shrink.

"As we're pulling all this together for the customer and ensuring that we meet that need of how they want to shop, it's our job to balance how we do that as a company and where we make our investments, and we've invested in certain parts of the company and we'll continue to do that," said Brett Biggs, chief financial officer. "But we also know shareholders have expectations and we've got to be able to balance that with what we're looking to do in the short to midterm."

Wal-Mart also reported a 1.3 percent decrease in profits during the first quarter. But Biggs said Wal-Mart is "pleased with where we're at" through the first half of the year despite the slide in net income.

The company's U.S. business delivered a 1.8 percent increase in same-store sales, or sales at stores open for at least one year. It marked the 12th straight quarter of same-store sales growth. Traffic also increased 1.3 percent, which was the 11th straight quarter of increases.

Wal-Mart U.S.' net sales increased 3.3 percent during the quarter with grocery purchases playing a key role in the growth. McMillon said in a prerecorded call for investors that food categories delivered the strongest quarterly comparable sales performance in five years under U.S. chief Greg Foran's leadership.

Groceries account for about 56 percent of Wal-Mart's revenue.

"I think it's huge," Stephens Inc. retail analyst Ben Bienvenu said of the performance. "I think it's reflective of their decision to proactively invest in price in a meaningful way.

"They've got better assortment, better quality in stores. I think all those things, coupled with a better associate experience, are driving improved comps in that segment."

E-commerce also contributed to a significant portion of Wal-Mart's U.S. sales during the quarter.

The company doesn't break out sales from its e-commerce platforms, which include Jet.com, Bonobos, ModCloth, Moosejaw, ShoeBuy.com and Hayneedle. But the majority of the Wal-Mart's e-commerce growth during the quarter was through Walmart.com, according to the company.

"We've got good momentum in stores and e-commerce and we will continue to execute our strategy for our customers," Foran said. "Still a lot of work to be done, and I see that as I get around, but I'm happy with the progress as we continue to stick to our plan."

Net sales at Sam's Club, the company's warehouse division, increased 2.3 percent to $14.8 billion in the quarter. Same-store sales -- excluding fuel -- also climbed 1.2 percent, marking the sixth straight quarter of increases. Sam's Club posted a 2.1 percent increase in traffic.

Wal-Mart's international division reported net sales of $28.3 billion in the quarter, a slight decrease from $28.6 billion a year ago. But the company said nine of its 11 international markets reported positive same-store sales, including its Asda operations in the United Kingdom.

"They have definitely turned around a ship that was struggling," Yarbrough said about Wal-Mart. "It's heading in the right direction. I just think it's such a big ship and there's too many pressures on the business that it's really hard to get firing on all cylinders and show earnings growth like they used to do."

Wal-Mart expects its U.S. same-store sales to increase between 1.5 and 2 percent during the third quarter.

In addition to announcing its third-quarter profit expectations, Wal-Mart also adjusted its full-year guidance of $4.30 to $4.40 a share after an earlier estimate of $4.20 to $4.40.

"I would've liked to have seen a stronger [third quarter] guide, but I also think it's prudent not to get expectations too high as we head into the back half [of the year]," Bienvenu said.

Business on 08/18/2017